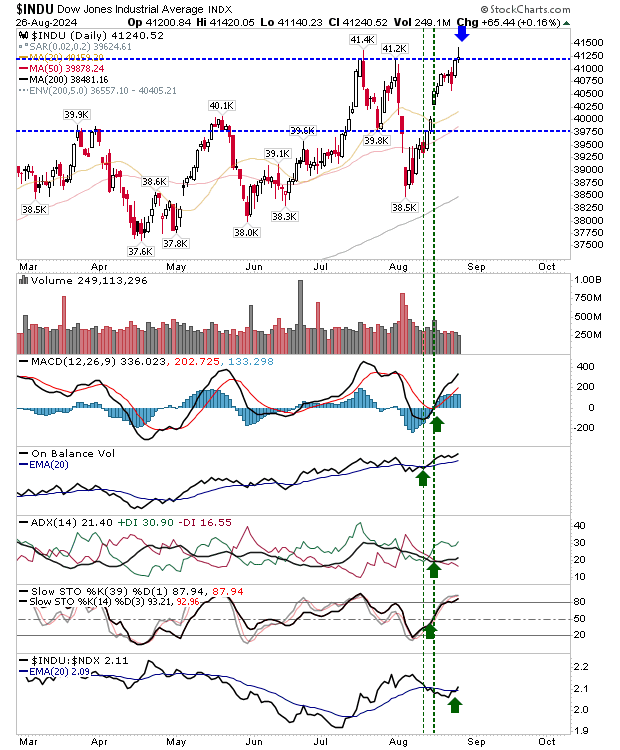

Markets have enjoyed steady gains in recent weeks, with the Dow Jones Industrial Average leading the charge. Earlier yesterday, the index showed signs of a potential breakout, but it pulled back by the close, ending with an inverse hammer at resistance.

As the Dow continues to take the lead, it will be interesting to see how it performs in the coming days.

My expectation is for losses, but technicals are net bullish and haven't really shown a strong bearish divergence to suggest a reversal is coming; a break of yesterday's lows would suggest a double top, and further downside is expected.

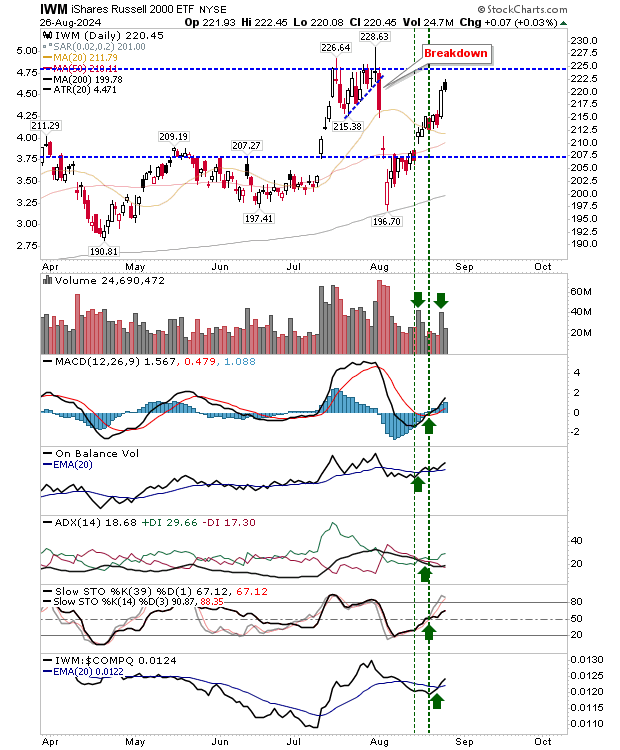

The Russell 2000 ($IWM) is looking more uncertain. Yesterday, it finished with a bearish 'black' candlestick below resistance. Such candles often lead to losses, so I will be keeping a close eye on this.

On the technical front, the MACD histogram is offering a possible bearish divergence with stochastics having crossed the bullish mid-line. Volume is also siding with bulls. For today, I would give the candlestick priority and look for lower prices.

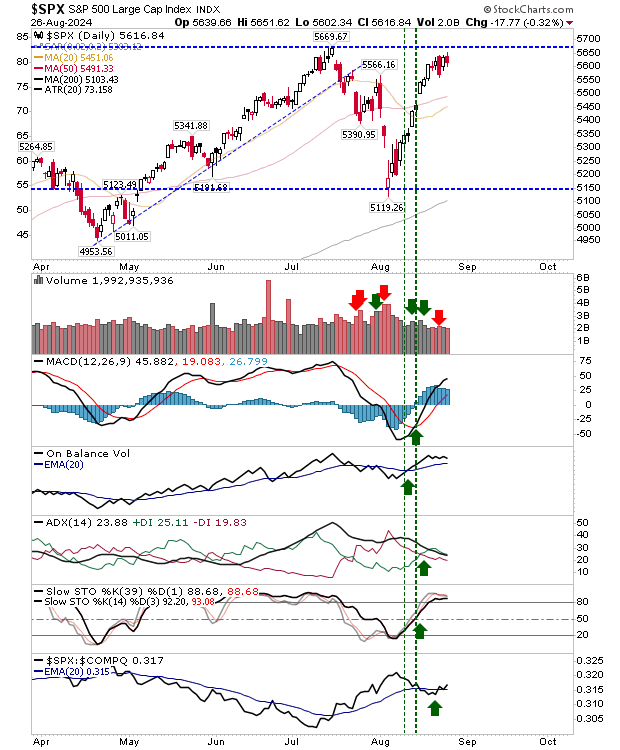

The S&P 500 is knocking around just below breakout resistance. Unlike the Russell 2000, the recent volume has been tepid, but with prices holding gains without the price extension seen in the Russell 2000, suggests the index could hang on.

If the Dow Jones can hold its breakout, then the S&P 500 could offer itself as the "value" play.

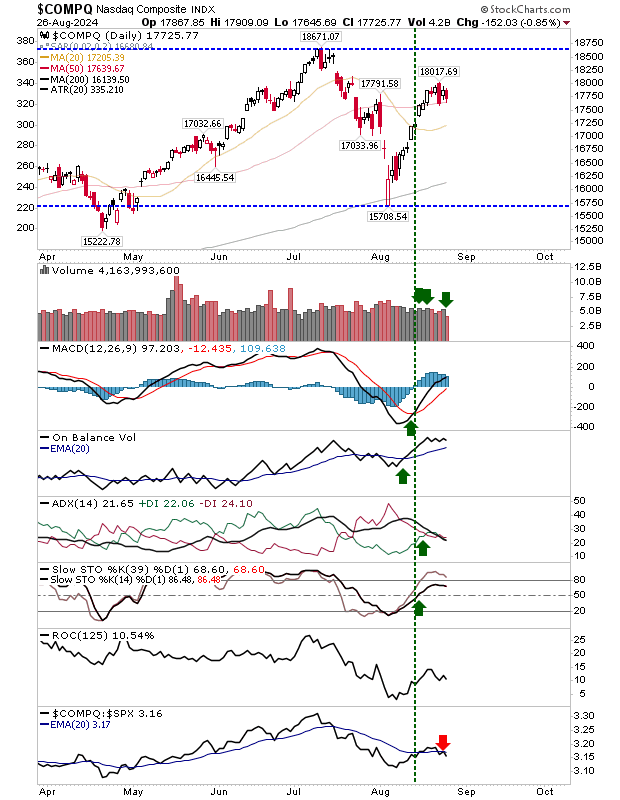

The Nasdaq is in a similar situation to the S&P 500 with a tight period of trading that gives the edge to bulls, particularly with the index resting on 50-day MA support.

Traders could benefit from buying without changing the larger picture; is the July peak a "top", or just a swing high in a larger bullish trend? It will likely take a few more days before we know for certain.

So, for today, look for a lead in the Dow Industrials. Consumer confidence data might be the catalyst to get things moving. If it looks like the Dow is to hold yesterday's lows, then the S&P 500 or Nasdaq might offer more breathing space for a long trade.