Stocks had a nice rally to the start day yesterday. The S&P 500 index rallied a bit more than 70 bps, but by the day’s end, all of those gains were gone, with the index finishing lower by around 10 bps. It was a bit worse on the Nasdaq with the index up nearly 1% at the open only to finish down by around 20 bps.

It was one of those days where you wake up and the futures are just jacking higher for seemingly no reason, and you are scratching your head, looking at how Hong Kong was down again, and most of Asia, while the DAX was up, and thinking how this is strange.

The stronger-than-expected GDP revisions certainly added to the futures moving higher as well, but then the realization that the yield curve was steepening, which clearly goes against the equity market going higher, brought the equity market down after peaking in the first 30 minutes of the day, and it was pretty much downhill from there.

The S&P 500 high today could mark the top of the rally completing a wave C of the advance.

One reason why that could be is that the CDX high yield index today fell briefly below 400, but managed to snap back and finish the day higher.

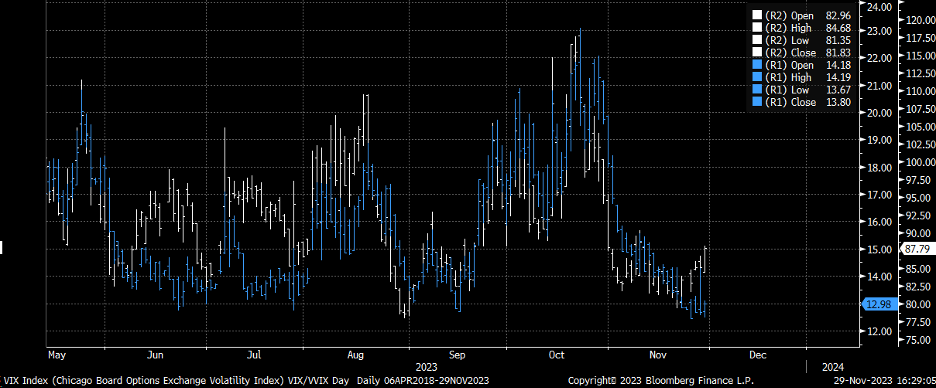

Meanwhile, we also saw the VVIX rise today, and it appears to be diverging higher from the VIX. When the VVIX starts to climb and the VIX isn’t it is time to pay very close attention to the potential for implied volatility to move up.

Today we also saw the DXY trade lower and hit the 61.8% retracement level of its July advance, only to finish the day higher.

Gamma Labs notes that the S&P 500 flips back into negative gamma at 4,520, and if the market goes into negative gamma, we can expect realized volatility in the S&P 500 to begin to rise, which is likely to push implied volatility higher, which will then become a self-reinforcing negative feedback loop, as market makers are forced to sell S&P 500 Futures to hedge.

So it is quite possible that if we start to see the S&P 500 drift just a bit lower from current levels it could result in some of the mechanical forces that we saw when the index bottomed begin to take effect at these higher levels, while the systematic flows that helped to push the indexes second leg higher are waiting to potentially turn sellers if the index dips below 4,400.

So again, everything is lined up at this point, and it is quite possible that we have not only seen the start of a retracement but the potential start of another leg lower.