This article was written exclusively for Investing.com

Very quietly, safe-haven assets have been rallying, and in some cases, to prices not seen in years. The big rally in assets like gold have come despite a massive rally in the equity market. While some investors will think the sudden surge in gold is due to expectations of rapid inflation, it seems more likely that the push into gold has more to do with the safety the precious metal offers.

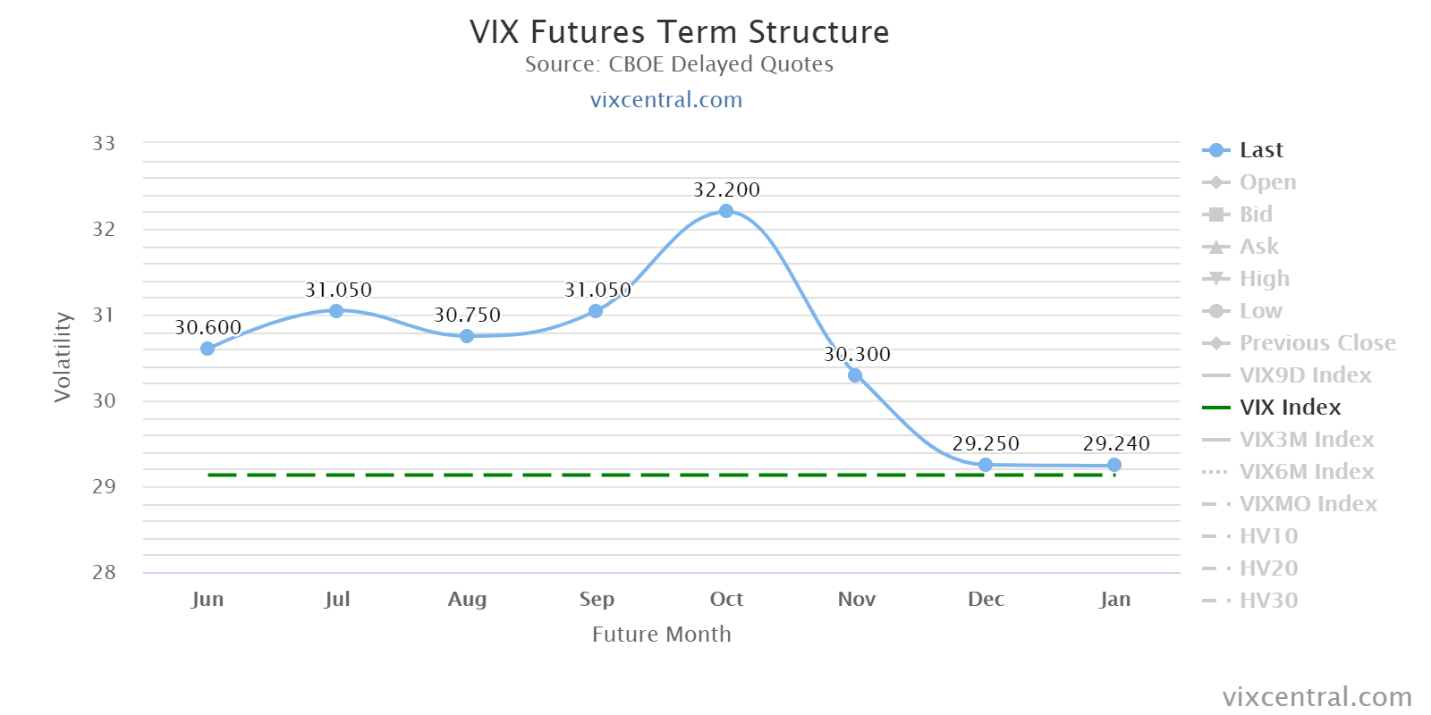

One reason why investors may be in search of safety is that the Volatility Index (VIX) remains at stubbornly elevated levels around 30, a level suggesting equity markets are still volatile. That volatility is expected to stay high based on the VIX term structure, which is currently suggesting that the VIX index will remain high for many months to come.

Given the inverse relationship between the VIX and the equity market, it likely means stocks will be in for a wild ride over that same period.

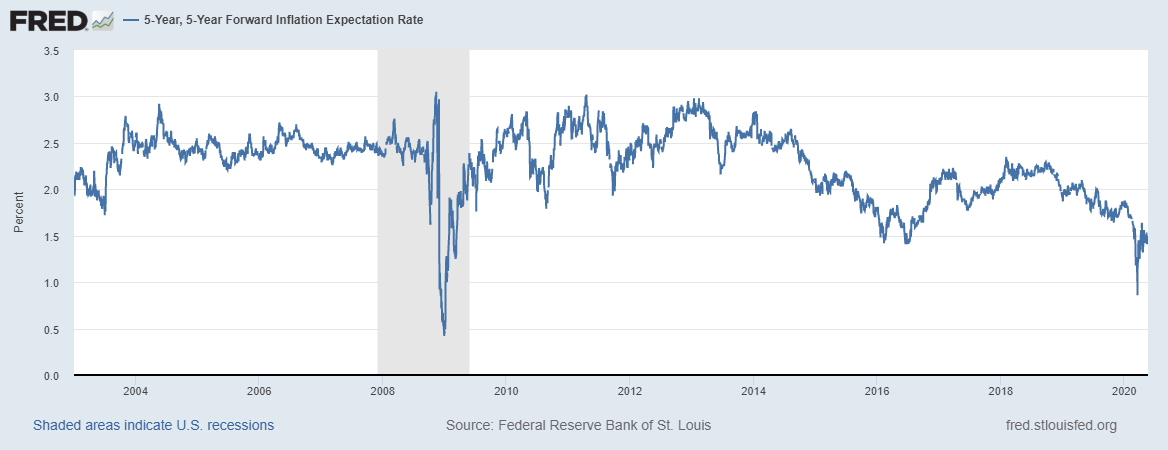

Inflation Expectations Are Low

Believe it or not, gold prices have reached levels last seen in the year 2012. The recent surge in gold started in March, as equity prices and risk assets were tanking. But gold’s strong move higher has continued despite the massive rebound in equity prices since the March lows. The move appears to have more to do with investors seeking safety rather than rising inflation rates from the Fed’s massive quantitative easing measures.

Looking at inflation gauges, such as 5-year-5-year forward inflation expectations, they're at some of their lowest levels since 2003, with only the period during 2008 and 2009 providing lower expectations.

Additionally, the U.S. dollar has been remarkably stable if not stronger during the whole pandemic period, also signaling that inflationary pressures are not likely to be a factor in the near-term. It leaves the current move higher in gold, at the hands of those looking for a safe haven to park their money, potentially a sign investors fear more stock market volatility.

The VIX Index Remains High

Based on the term-structure of the VIX, it seems to confirm the notion that volatility is likely to stay elevated for the foreseeable future. According to data from VIX Central, the VIX index is currently expected to remain above 30 until November. That would take us right into the U.S. presidential election, after which the VIX is expected to fall to around 29 through the new year.

Sharp Drawdowns to Come?

These expectations would suggest that the equity market could easily see some very sharp drawdowns over that period. It seems to indicate that despite the massive rebound in equity prices and risk assets, all may not be smooth sailing. The rising costs of gold and expectations for an elevated VIX index seem to indicate that investors are still expecting volatility to remain very high in the equity market and that we may not see those volatility levels settle down until some time in 2021. The fear of these severe drawdowns may very well be the underlying reason why investors have been flocking into assets like gold.

It may very well be the case that as long as the coronavirus pandemic remains, investors could stay fearful and ready to scramble at the first sign infection rates are beginning to rise or the economic recovery is stalling. Until a time comes that the virus is only a distant memory, we can expect volatility to remain high, and for investors to continue to pile money into safe-haven assets.