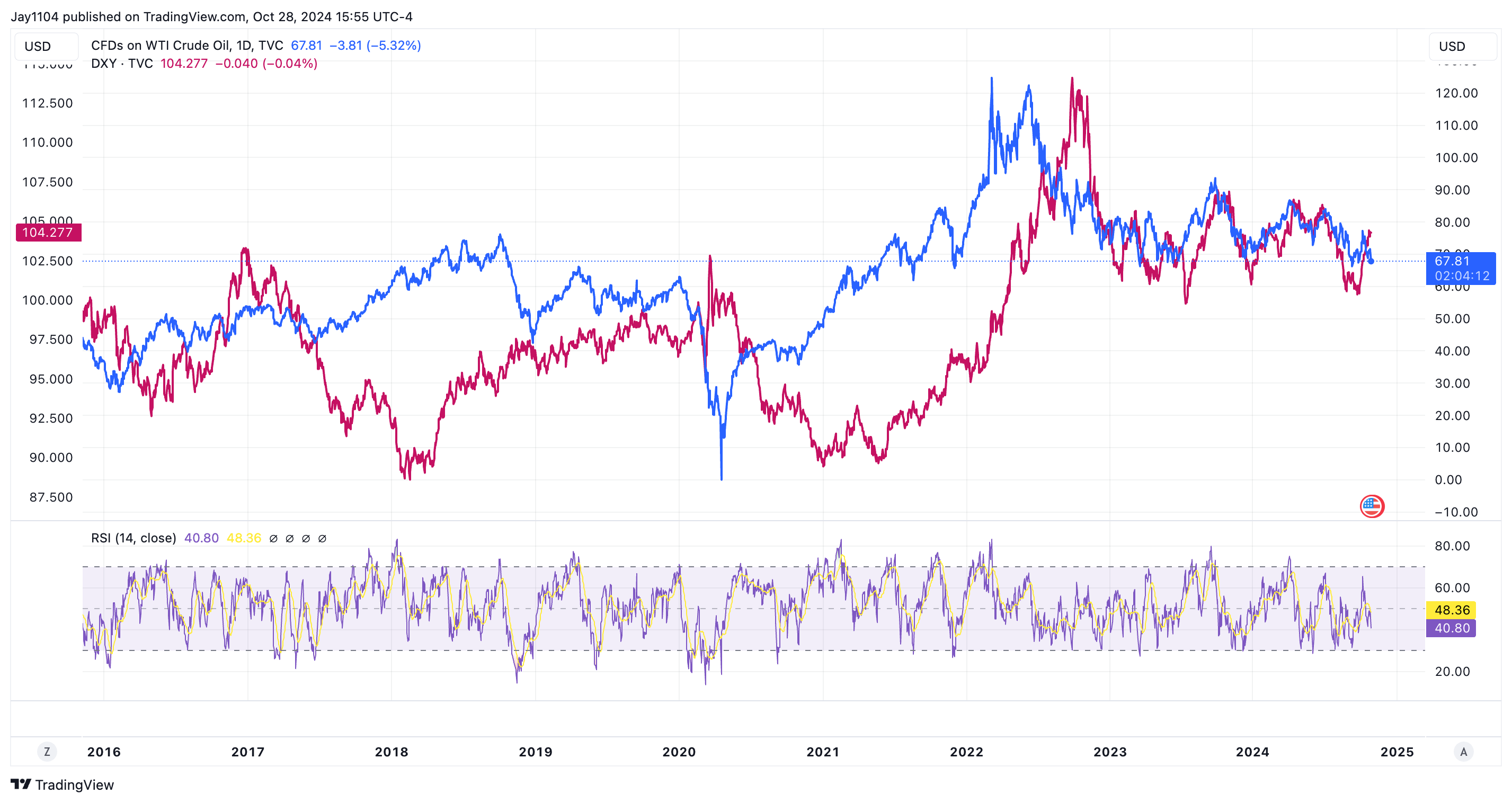

Oil dropped sharply yesterday as Middle East tensions appear to be settling, at least for now.

The biggest question for oil is whether it will break the support level around $66, and if it does, it could drop into the mid-50s. We’re seeing oil prices falling while rates are rising, which seem to be at odds with each other.

In some ways, falling oil prices align perfectly with a stronger dollar, and perhaps we’re seeing a return to the market’s natural order.

Historically, a stronger dollar has pushed oil prices lower. It may be that the market no longer views oil like it did when the inflation was high, with the stronger dollar now driving oil prices rather than oil driving rates and, as a result, the dollar.

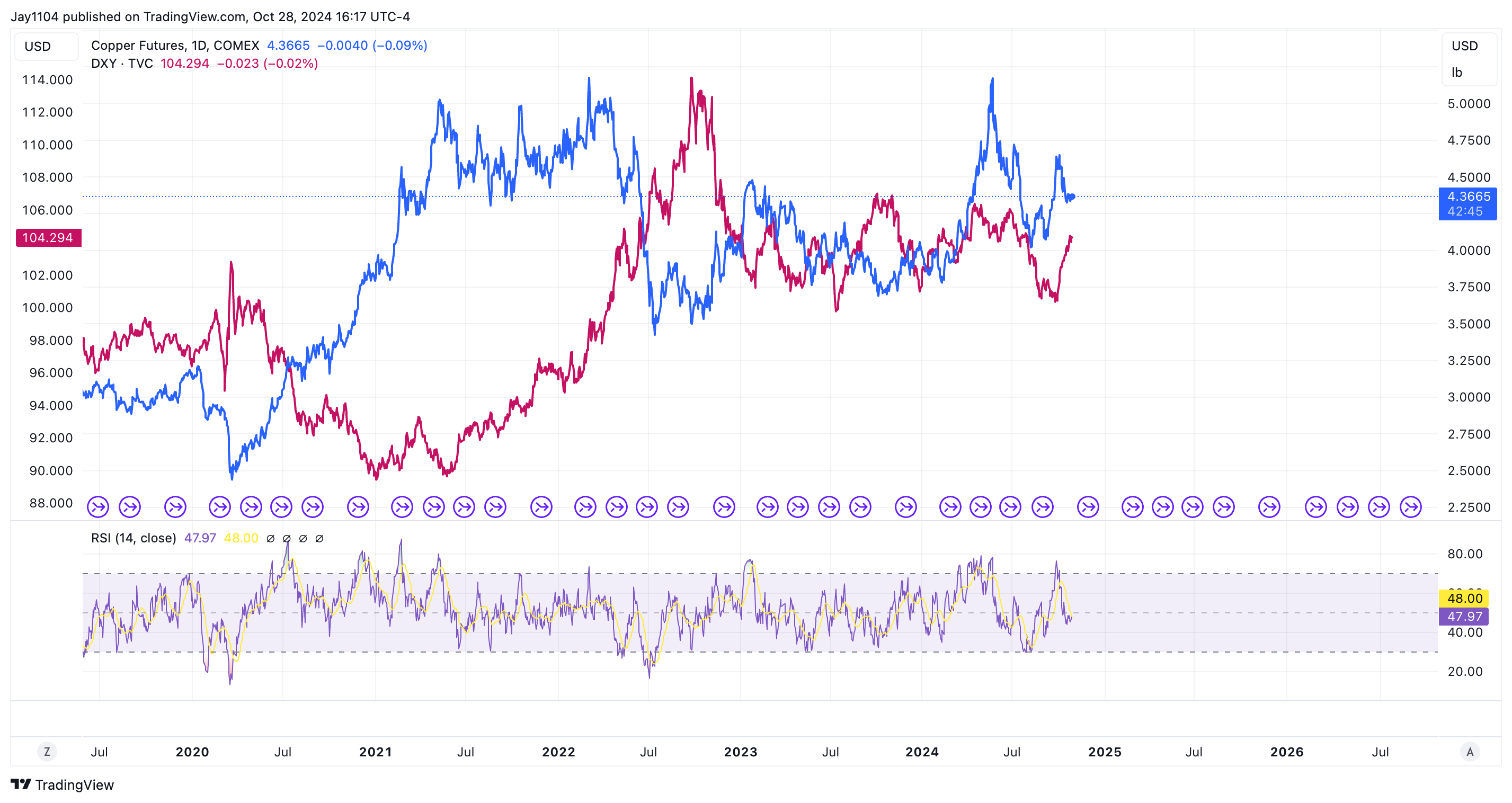

This trend also aligns with declining copper prices.

Another factor is the rise in real yields, with the 10-year real yield moving above 1.98%.

When you factor in rising real yields and a stronger dollar, it suggests to me that oil and commodity prices, in general, are likely to struggle.

Notably, 10-year inflation expectations haven’t fallen—they’ve risen. If oil prices were declining due to growth concerns, breakevens would also be falling. Instead, it seems the market is reverting to more historical correlations.

Another factor is that the term premium for the 10-year nominal rate is rising, reaching 23 basis points—its highest level since last year. Investors are simply demanding a higher interest rate.

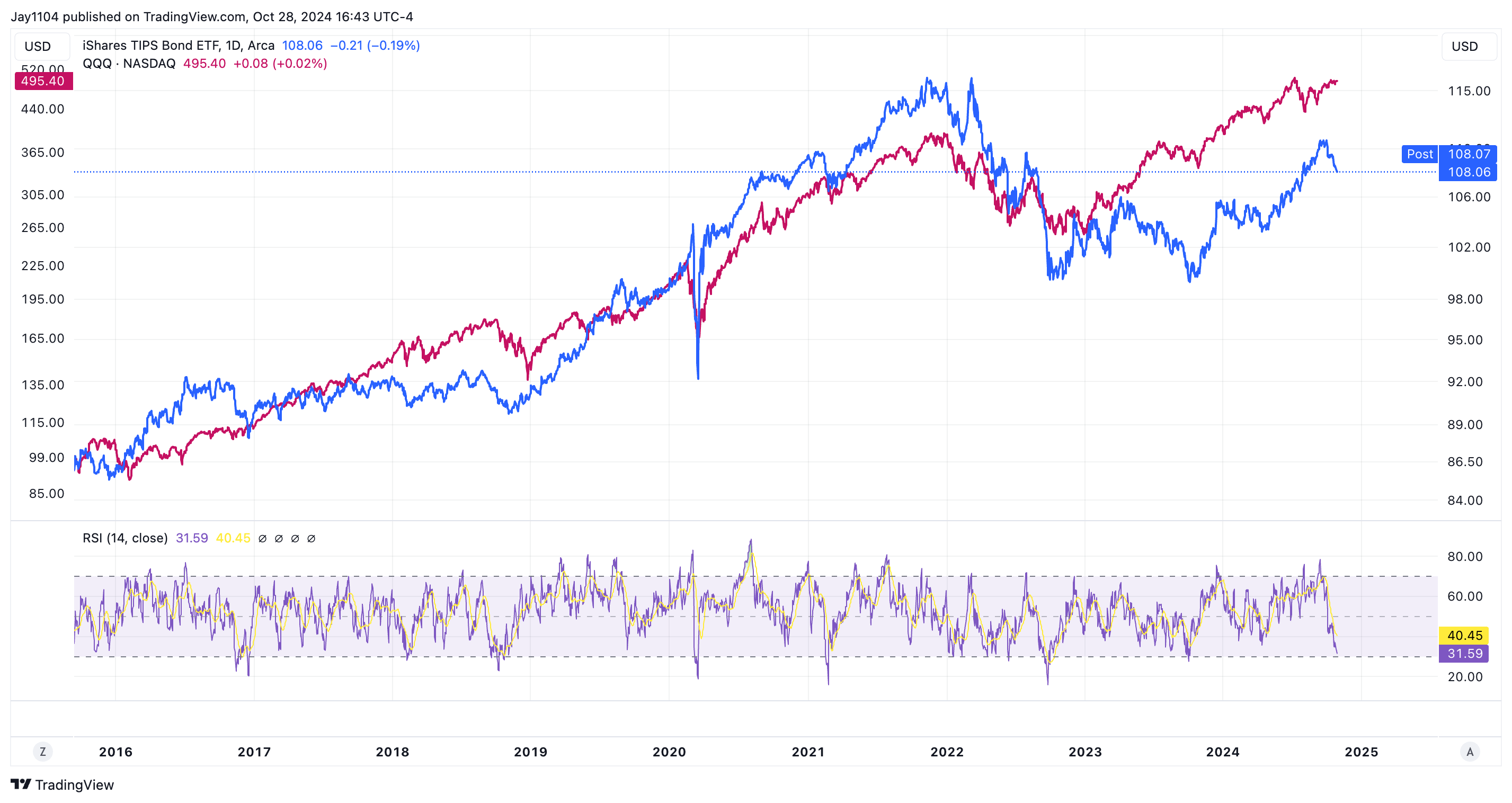

The remaining question is what will happen to the stock market, as the typical correlation between stocks and real rates has shifted. Historically, when the TIP ETF fell, the QQQ ETF followed.

However, this correlation changed around SVB’s collapse in March 2023. This shift is likely the biggest question of all. Clearly, real rates are rising, and stocks are not falling, at least not yet.

S&P 500 Rally Pauses - What's Next?

Yesterday was one of those days where, if you weren’t paying close attention, it didn’t seem like you missed much. S&P 500 futures gapped higher, and that was essentially it. traded sideways for the rest of the session.

Maybe it was a reaction to lower oil prices, but it felt like another one of those mysterious futures rallies that don’t always make sense.

Despite the quiet day on the surface, the breadth in the Bloomberg 500 was fairly positive, with more than 350 stocks moving higher and about 150 declining.

It was the same story in the NASDAQ, except that the NASDAQ futures saw a much bigger rally, nearly all of which were given back by the end of the session.

So far, the technical patterns for S&P 500 futures haven’t changed; they continue moving sideways over time, shifting from one side of the rising wedge to the other.