- The S&P 500 has experienced a strong upward trend with positive weekly performances.

- Meta Platforms demonstrate significant growth potential amid a favorable analyst consensus.

- Concerns arise over the company's reliance on advertising revenue to cover losses in other areas.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

We just concluded the third quarter, which proved to be the best for the S&P 500 since 2020, with 337 of the 500 stocks outperforming the index.

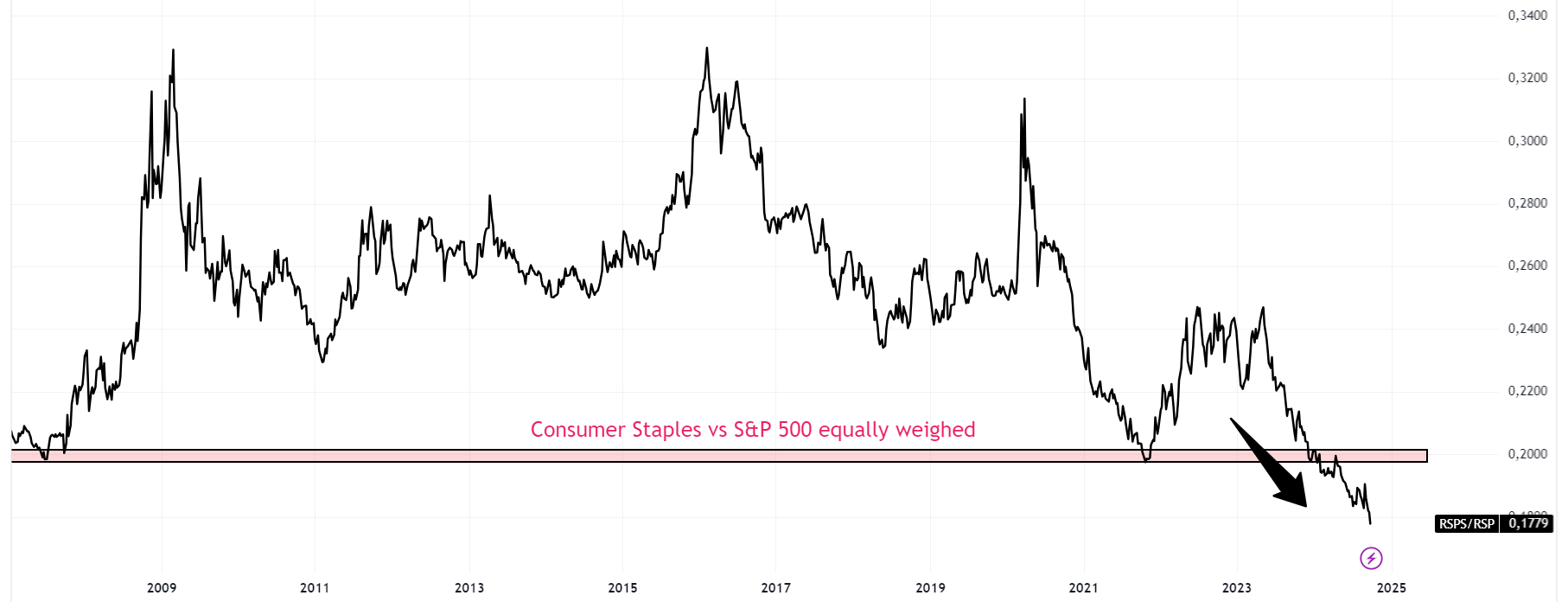

However, it's essential to note that in healthy environments and bullish markets, stocks in the consumer staples sector typically underperform.

With that in mind, let's examine the consumer staples sector on an equally weighted basis.

We can see that the ratio has registered new lows, compared to the equally weighted S&P 500 index. Investors appear to be gravitating toward riskier assets.

Meanwhile, the communications sector (weighted by market capitalization) has reached new three-year highs.

Based on market capitalization, the index is much more technolog- oriented as the top holdings indicate:

1. Meta (NASDAQ:META) +68% YTD

2. Google (NASDAQ:GOOGL) +19% YTD

3. Netflix (NASDAQ:NFLX) +45% YTD

4. Disney (NYSE:DIS) +3.6% YTD

5. T-Mobile (NASDAQ:TMUS) +30% YTD

Let's put them on Pro watchlists by sorting them by analysts' presumed upside.

Source: InvestingPro

Moving to the analysis section, the performance of these five stocks over the last five years and the past year shows strong positive trends.

Source: InvestingPro

When ranking stocks based on their highest increases over the past month and annual growth rates, Meta Platforms emerge at the top.

Meta Platforms: The Best of the Bunch?

Source: InvestingPro

The upward trend of Meta is further supported by its Health Score (financial health), which summarizes thousands of financial data points into a single rating. For this stock, it indicates a "good" financial performance with a score of 4 out of 5.

Source: InvestingPro

Following last week's all-time high for the stock, Zuckerberg has become the second richest person in the world, according to the Bloomberg Billionaires Index, only trailing Elon Musk by about $50 billion.

The pressing question remains: what does the future hold for Meta's stock? The company has garnered favorable analyst consensus, with 80% recommending Buy ratings and target prices above $800.

However, the average target price is closely aligned with the current stock price, prompting some caution.

Analysts Predict Strong Earnings

Source: InvestingPro

An essential metric to consider is Meta's PEG Ratio, which stands at a low 0.23, indicating an undervalued stock relative to its near-term earnings growth.

Additionally, analysts forecast profitability in the current year, suggesting the company will generate more revenue than it incurs in that period.

This is generally considered a positive sign because profitability is a crucial factor in a company's ability to grow or reinvest in its business.

Source: InvestingPro

Meta is expected to release its third-quarter data at the end of the month, with consensus estimates projecting a 17% growth in revenues ($40.1 billion) and profits ($13.5 billion).

For the full year 2024, analysts anticipate revenues of $162 billion (+20%) and profits of $55.3 billion (41%).

Meta Platforms has shown it can continue innovating through artificial intelligence, which has significantly boosted its advertising and profitability—its primary revenue source.

However, this reliance on advertising raises concerns about vulnerability, as it makes the company highly cyclical and exposed to negative impacts during economic downturns.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.