Gold, silver prices pull back from recent gains with nonfarm payrolls on tap

This article was written exclusively for Investing.com

With many cryptos testing their long-term support levels, it is best to be tactically prepared to take advantage of a potential rally as prices continue to coil after the recent troubles. In this article, we will look at the chart of Ethereum and discuss one potential scenario to get on board, if we see the first evidence of a technical bottom.

At the start of today’s European session, Bitcoin was off about 2% and Ether was down nearly 4%, with similar losses observed elsewhere. It must be disheartening for some crypto bulls to see a weaker start as there was finally hope after prices had stabilised somewhat over the past three days.

With sentiment shaken following the recent troubles and inflow of bearish news, crypto investors are badly in need of some fresh catalyst to encourage them to step back in meaningfully. Perhaps something like Elon Musk’s influence to counter other negative forces.

The only source of support that I can think of right now is from 'bargain hunters'—the crypto bulls who perhaps unloaded their positions at much higher levels and want to get back in, and those who are bullish on cryptos but had missed out on the big rally. Some of these people will be keen to take advantage of the downbeat prices, especially once we see signs of a technical bottom.

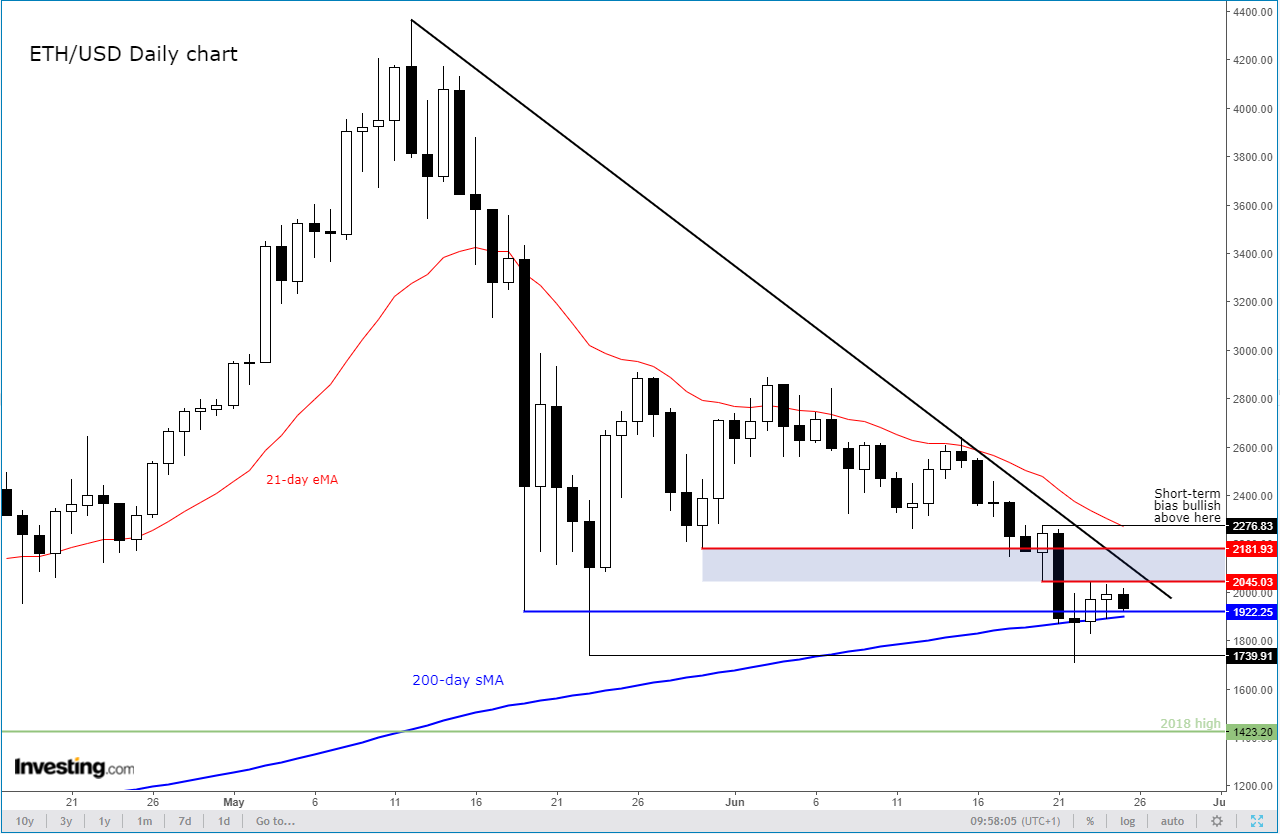

For now, the ETH/USD chart still looks bearish because of the lower highs and lower lows it has been printing, even if the 200-day moving average has provided some mild support this week. But at the time of writing, ETH was testing support around $1920, a level which has held firm on several occasions in recent times. IF ETH finds support from around this level on the intra-day charts, that would be a positive sign. But it will still need to show clear evidence that prices have bottomed out before one can confidently step back in on the long side.

Specifically, I am waiting for a break above $2275, which, if seen, would push prices above the shaded resistance zone, the 21-day exponential moving average and the bearish trend line. Only then would looking for a long trade make sense, as we will have some confirmation to work with. Otherwise, waiting for a deeper pullback and then a confirmation at lower levels is an alternative way of potentially getting long ETH/USD. Remain patient.

So, to summarise, the ETH/USD is still not out of the woods to be actively looking for long trades just yet. But as prices test key support levels, it makes sense to at least prepare yourself tactically to step in on the long side, if the charts provide a confirmation signal that the low might be in.