- This article dives into whether AI-powered stock selection strategies can beat human portfolio managers.

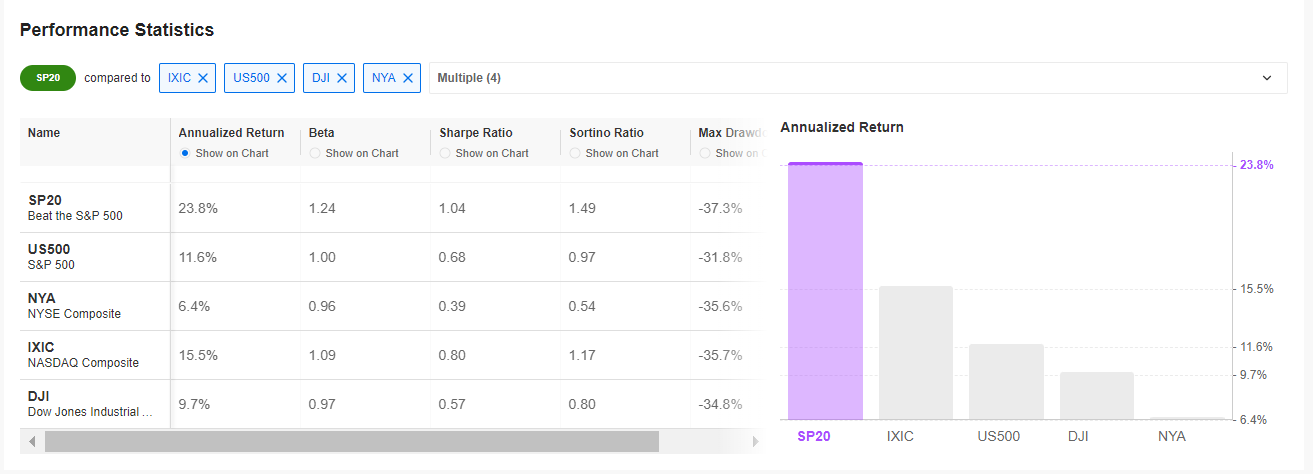

- Focusing on the S&P 500 as the benchmark, we will compare each strategy.

- Historical data analysis shows AI strategies can deliver returns above benchmarks with better risk management.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

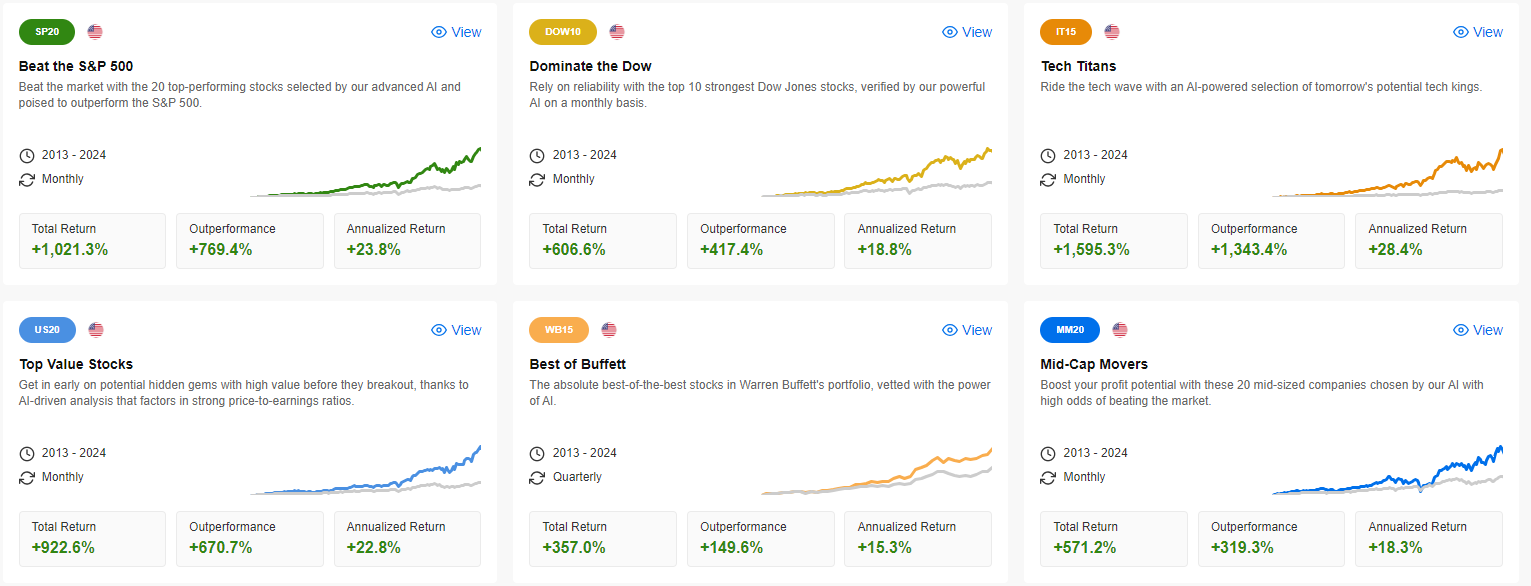

Many investors are curious: can AI outperform human portfolio managers in stock selection? To answer this question, I'll be providing monthly updates on ProPicks strategies, a set of six portfolio strategies with the following characteristics:

- Rotational approach

- Basket of individual stocks

- 20 equally weighted holdings

- Monthly updates on the first of each month

For InvestingPro subscribers, these ProPicks strategies are already accessible within the dedicated section.

Source: InvestingPro

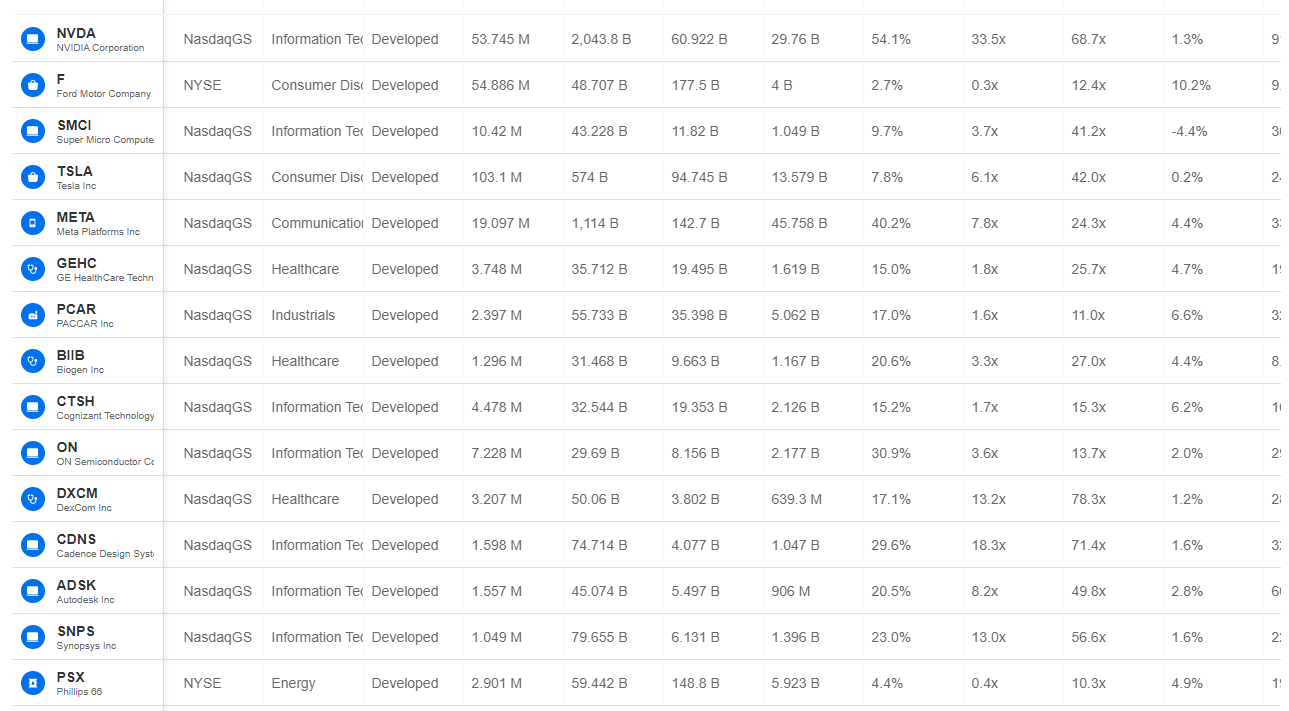

Focusing on the S&P 500 index as our benchmark strategy, the index update occurred yesterday. Among the top 3 stocks in the new basket are well-known companies like:

To access the complete list of stocks in the May portfolios, you can take advantage of the special discount code below:

Get over 40% off your annual Investing Pro+ subscription by using code "proit2024" right now!

Source: InvestingPro

AI favored the tech sector, allocating 10 out of 20 stocks to it. However, it also diversified across healthcare (3 out of 20), industrials (2 out of 20), and sprinkled investments in energy, financials, and consumer discretionary sectors.

Over a decade of historical data analysis shows the strategy performing as expected: delivering returns exceeding the benchmark while maintaining comparable risk levels (excellent Sortino and Sharpe ratios).

Source: InvestingPro

So Can You Trust AI to Deliver Better Returns?

Wise investors can consider incorporating a mechanical approach within their equity portfolio to potentially limit emotional decision-making and the lack of a well-defined strategy.

Here are some specific ways to achieve this:

- Implement a systematic strategy that automates portfolio construction and rebalancing based on predefined rules.

- Utilize a rules-based approach to stock selection, potentially using technical indicators or quantitative analysis.

Additionally, consider adding the newly selected stocks to a watchlist on the first day of each month when portfolio holdings are typically updated. This allows for consistent monitoring of these stocks.

Source: InvestingPro

Starting today, I'll be providing monthly updates on the performance of various investment strategies, with a focus on the Benchmark S&P 500. Additionally, I'll be tracking five other rotational strategies:

- Best of Buffett

- Tech Titans

- Dominate the Dow

- Midcap movers

- Top value stocks

Through these updates, we'll explore the intriguing question: can AI outperform human investors in the market? I welcome your feedback and comments as we embark on this journey together.

***

Take advantage of the opportunity to get the annual Investing Pro+ plan at a special discount. Use code proit2024 and get over 40% off your 1-year subscription!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.