- Bitcoin has gained more than 15% over the last 2 weeks.

- Growing risk-on sentiment can continue to boost the crypto.

- 65k level remains a key local resistance.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

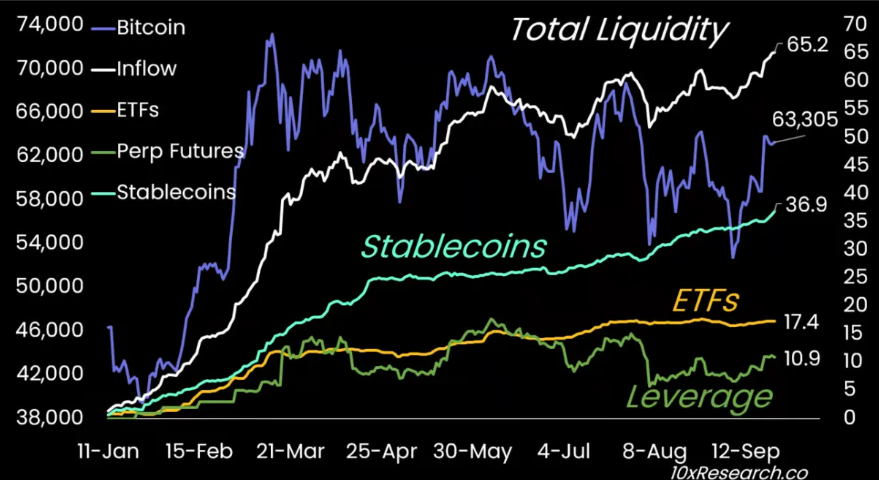

After a sluggish start to the year, Bitcoin has surged more than 15% in the past two weeks, approaching the key local resistance at $65k.

Earlier in the year, analysts were optimistic, predicting that the crypto would hit $100k, fueled by the launch of Bitcoin ETFs.

However, a broad correction over recent months has kept prices in a downward channel. Despite this, the long-term trend remains intact, favoring demand both technically and fundamentally.

Historically, Bitcoin tends to rally 150-160 days after a halving, and we're now in that window. The latest price action aligns perfectly with this pattern.

Investors Focus on China and the Fed

After the Fed's first jumbo cut, Investors are now increasingly optimistic about yet another 50 bp cut, a move that could lift various asset classes, including metals, stocks, and digital currencies like Bitcoin.

Meanwhile, China’s central bank is loosening its monetary policy to boost economic growth, cutting the reserve requirement ratio by 50 basis points to inject $142 billion into the economy.

These macroeconomic shifts create an ideal environment for risk assets, including Bitcoin, to thrive.

SEC Approves Bitcoin ETF Options

This week, the SEC approved options for Bitcoin ETFs, a significant move that could boost Bitcoin’s liquidity and increase its appeal to institutional investors.

BlackRock (NYSE:BLK), a global leader in asset management, spearheaded the application. With increased liquidity and growing confidence in Bitcoin, this approval could pave the way for more cryptocurrency investment opportunities in the future.

Bitcoin: Technical View

Bitcoin’s recent rally has pushed it towards the $64,000-$65,000 resistance zone, where a local deceleration is forming.

If the crypto can break through this level, the next target lies near the all-time highs of $73k-$74k. However, a pullback below $60k could lead to consolidation, with a risk of retesting the $50k area.

Bitcoin’s price action is at a pivotal moment - investors are watching closely for the next breakout or correction.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.