Corporate earnings, new virus cases and vaccine hopes dominated the headlines today. However, that will change tomorrow with a long list of market-moving economic reports on the calendar. In fact, nearly all of this week’s most important event risks will happen over the next 24 hours. We start with Australian employment and Chinese Q2 GDP, which will be followed by UK labor data, the European Central Bank’s monetary policy announcement and, lastly, U.S. retail sales. EUR/USD climbed to a four-month high ahead of the rate decision but ended the day closer to its lows. The greenback sold off against all of the major currencies except for the Swiss Franc, which squeezed lower after consolidating for most of the week. It is unusual to see the Swiss Franc and Japanese Yen diverge, but concerns about upcoming data could be contributing to USD/JPY’s weakness.

U.S. retail sales growth is expected to slow dramatically after rising 17.7% in the month of June. Spending should be stronger as reopenings continued in June, but Johnson Redbook reported weaker consumption. July data will be worse, but June data should be better. The Philadelphia Fed manufacturing index should also increase after today’s larger than expected rise in the Empire State survey especially after industrial production rose more than expected. Stronger data should help USD/JPY rally, but there’s significant technical resistance between 107.40 and 108.00. The Federal Reserve released its Beige Book report and increased activity was reported in almost all districts, but there are places like St. Louis that reported a slightly more pessimistic outlook.

Good numbers are also expected from China, with GDP expected to recover in the second quarter. China went into lockdown mode in the first quarter and the shutdown in economic activity caused growth to contract by 6.8%. However, restrictions were loosened in Q2, which should lead to a meaningful recovery in growth. Retail sales are also expected to rebound. The Australian dollar rose to a one-month high today, but economists are looking for only modest labor market recovery in June. Jobs are expected to rise by 100,000, but according to the PMIs, further job losses were reported in the manufacturing and service sectors. The New Zealand dollar finally rallied after seeing very little gain over the past four days. First quarter CPI numbers are due for release this evening and while commodity prices increased, food prices fell in Q1.

The Canadian dollar traded sharply higher after the Bank of Canada left interest rates unchanged. The central bank said the economy is picking up notably as lockdown measures relaxed. It sees GDP contracting 43% in Q2 but expanding 31% in Q3 with the economy reaching pre-COVID levels in 2022. However, Governor Tiff Macklem made it clear that rates will remain where they are for a very long time. It will be a long climb back to recovery (especially with the U.S.’s current troubles) and the central bank wants to see evidence that the recovery is self-sustaining. As such, it’ll ignore any temporary rise in inflation. Given the uncertainty in the U.S., the BoC’s dovish outlook is not a surprise, but the loonie’s gains is a sign that investors were relieved by the central bank’s slightly more positive assessment of the economy.

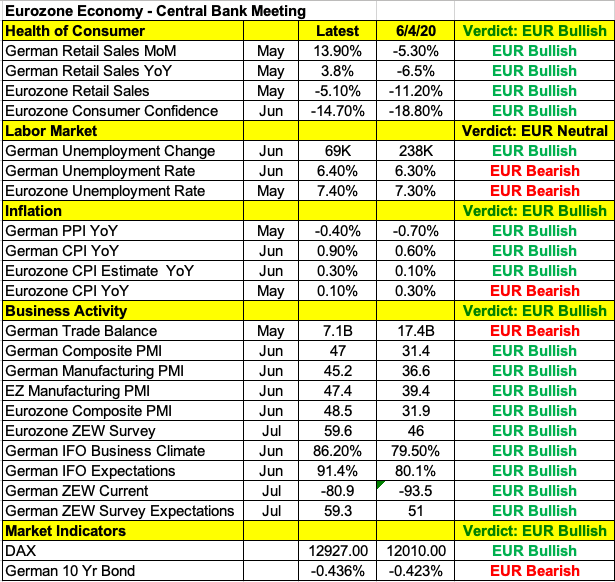

The European Central Bank is also expected to keep monetary policy unchanged on Thursday. When it last met in June, the ECB increased their Pandemic Emergency Purchase Program by EU600 billion and extended the duration of its purchases to at least June 2021. This larger-than-expected move was aimed at sheltering the economy from a deeper contraction. Taking a look at the table below, its efforts have been successful. A lot of these improvements stem from the success of European nations in controlling COVID-19 and the reopenings that followed. The ECB will be pleased with these results but concerned about what’s happening abroad. Cautious optimism combined with stronger data should help the euro hold onto its gains.