This article was written exclusively for Investing.com

- Bitcoin and the $40,000 pivot point

- Ethereum is near the $2,900 level

- Closer to the January 2022 lows than the November 2021 highs

- Three bullish factors and three bearish factors

- Tightly coiled springs

One of the issues facing the cryptocurrency asset class is expectations. After rising from five cents in 2010 to nearly $69,000 per token in mid-November 2021, market participants became accustomed to wild price swings and selloffs that provided golden buying opportunities. The asset class was dynamic, creating incredible opportunities for profits. Many market participants who ventured into Bitcoin and Ethereum had no ideological connection to the libertarian means of exchange. Their ideology was profits.

When Bitcoin and Ethereum found bottoms on Jan. 24, 2022, both digital tokens went to sleep. The profit ideologues have departed the asset class, searching for other, more volatile venues, offering better potential for profits. Bitcoin and Ethereum have gone into volatility hibernation, which continues in early May 2022.

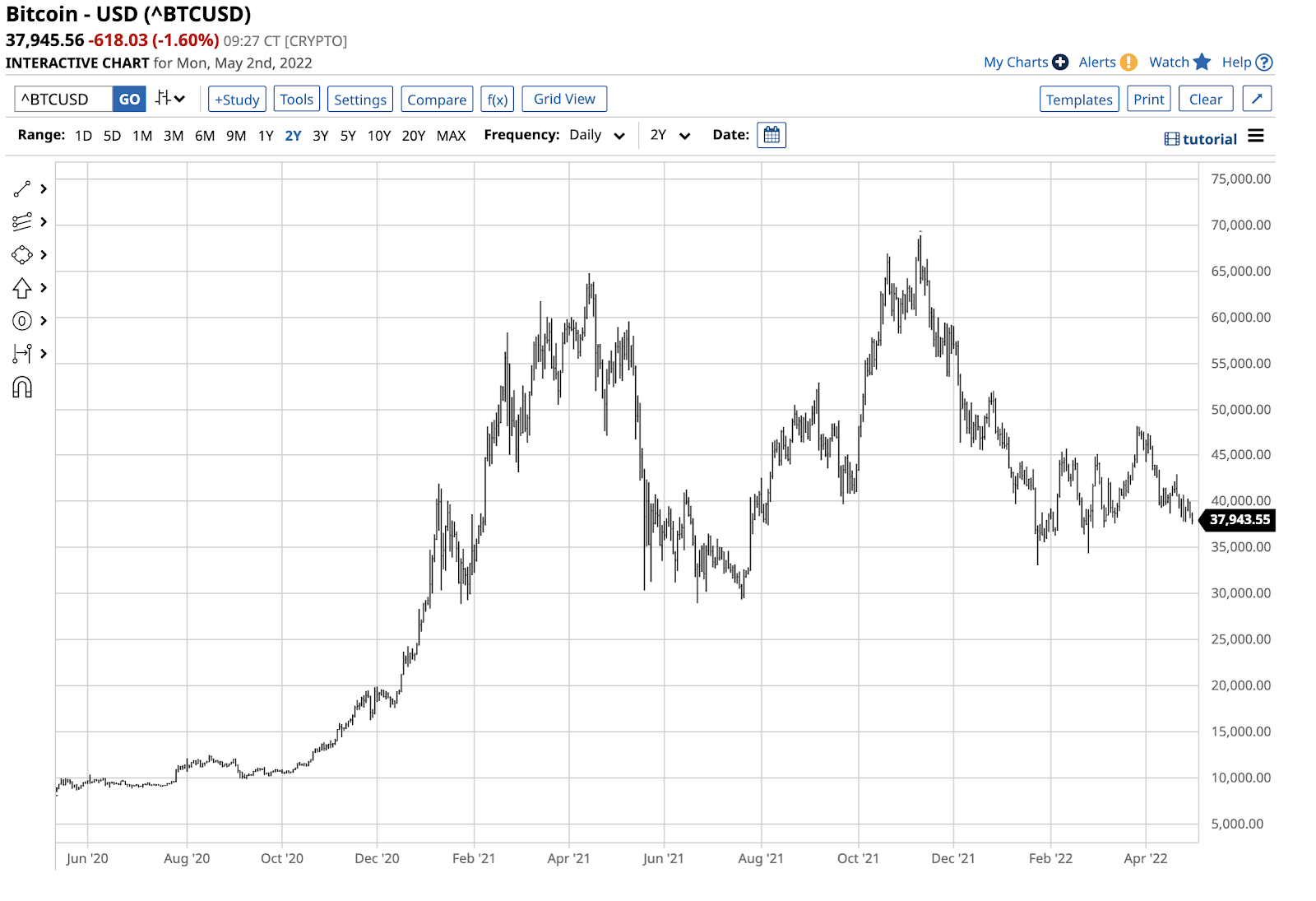

Bitcoin and the $40,000 pivot point

After years of wild volatility in the cryptocurrency arena, the price action in Bitcoin and the other over 19,150 tokens has calmed in 2022.

Source: Barchart

The chart shows that Bitcoin’s 2021 range was from $28,740.04 to $68,906.48 per token, a $40,166.44 trading band. Over the first four months of 2022, the range has been from $33,076.69 to $48,187.21, or $15,110.52. While the 2022 price range for most assets would be volatile, market participants in the crypto arena have come to expect far higher price variance than seen so far this year.

Meanwhile, Bitcoin has made higher lows since June 2021, which is now a bearish pattern for the crypto that continues to consolidate around the $40,000 pivot point, which is the midpoint of the 2022 trading range.

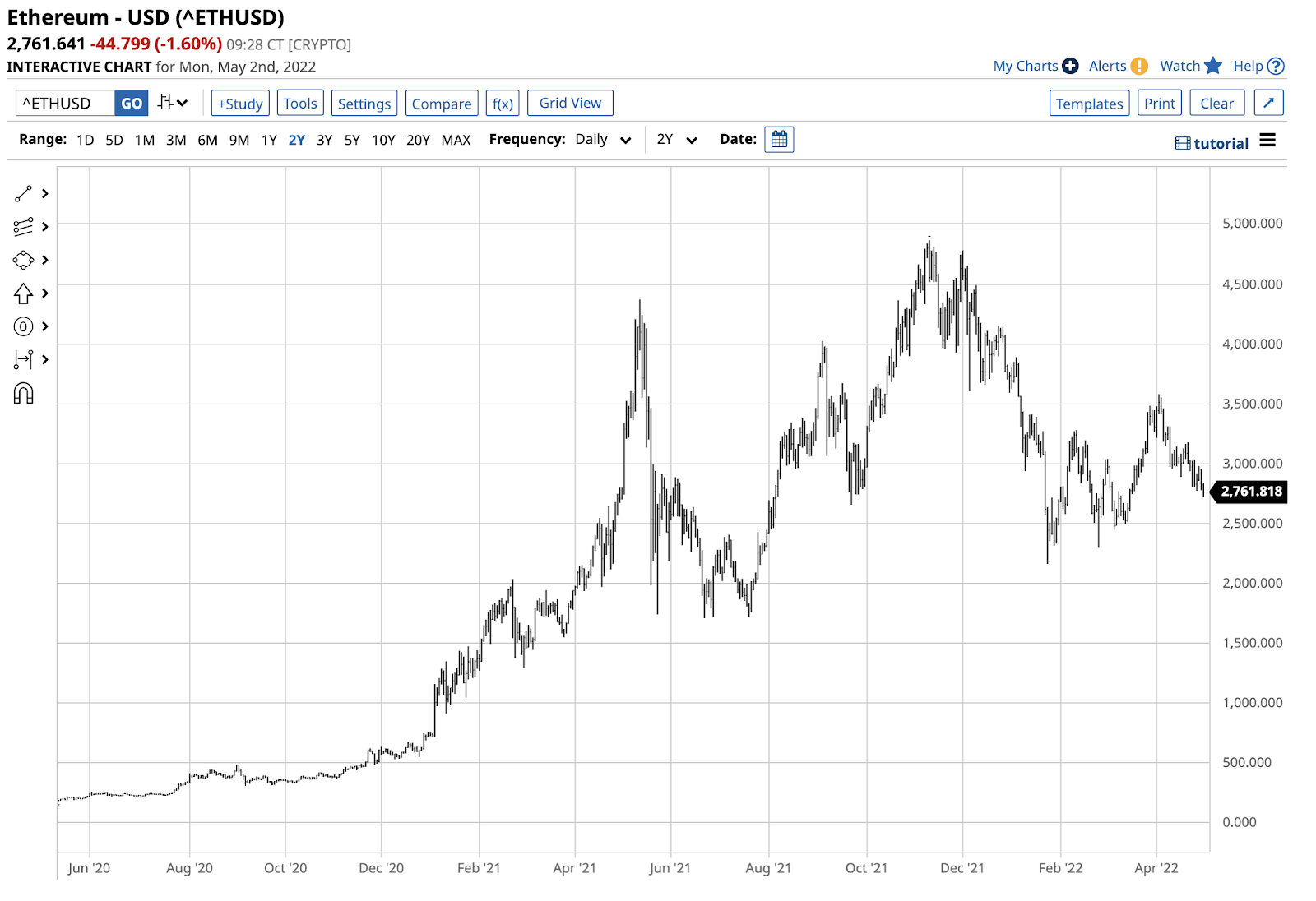

Ethereum is near the $2,900 level

Ethereum, the second-leading crypto, has also settled into a trading range since the end of 2021.

Source: Barchart

In 2021, Ethereum’s price range was from $716.919 to $4,865.426 per token, a $4,248.507. Over the first four months of 2022, it has been between $2,163.316 and $3,888.805 or $1,725.489. At the $2,761 level on May 1, Ethereum was $240 below the $3,000 midpoint, which is the pivot level over the past months.

Meanwhile, like Bitcoin, Ethereum has made higher lows since June 2021.

Closer to the January 2022 lows than the November 2021 highs

At $2,760 for Ethereum and $37,950 for Bitcoin, the prices remain a lot closer to the Jan. 24, 2022 lows, than the Nov. 10, 2021 record highs. Bitcoin, Ethereum, and many other cryptocurrencies have been sleeping in 2022 compared to their activity in previous years.

On May 1, the asset class’s market cap stood at the $1.71 trillion level, well below the 2021 record high. The one consistent bull move in the asset class has been the rising number of tokens coming to market. At the end of 2020, there were 8,153 tokens in cyberspace, and last year ended with 16,238, nearly double the level in a year. On May 1, there were 19,206 tokens, and by the time Investing.com publishes this article, there will be more.

Three bullish factors and three bearish factors

Bullish and bearish factors are pulling cryptocurrencies in opposite directions in 2022.

On the bull side:

- The incredible returns over the past decade continue to attract investors and traders looking for the next Bitcoin that will appreciate from five cents to nearly $69,000 at the high.

- Declining faith in fiat currencies increases the demand for alternatives, and cryptos are filling that void. In 2021, El Salvador made Bitcoin its national currency. Last week, the Central African Republic adopted Bitcoin as an official currency.

- Futures, options, ETFs, ETNs, and pick-and-shovel companies that move higher and lower with cryptocurrency values have shifted them more towards mainstream investment assets.

On the bearish side:

- Custody and security remain significant factors and roadblocks for the asset class as increasing hacking is causing market participants to lose holdings.

- The correction from the November 2021 highs has caused losses for speculators who bought cryptos too late and held on too long. The price action needs to turn bullish for them to return to the asset class.

- Governments continue to hate cryptocurrencies as they threaten their control of the money supply.

These opposing magnetic forces have created a narrower trading range in 2022 than in 2021.

Tightly coiled springs

I view the pattern of higher lows in Bitcoin and Ethereum as a sign that they will break out of the 2022 doldrums. While the technical pattern suggests a substantial move, it could be higher or lower. Meanwhile, the odds favor the upside because of the declining faith in fiat currencies and the benefits of blockchain technology that is the basis for the crypto asset class.

Over the weekend, at the Berkshire Hathaway (NYSE:BRKa) annual event in Omaha, Nebraska, Warren Buffett said he will never buy Bitcoins even at $25 as it “doesn’t produce anything tangible.” He also said he would not pay $25 for all the Bitcoin in the world. Support for the cryptocurrency asset class has increased, but the detractors have not backed down. Last year, Mr. Buffett’s partner, Charlie Munger, called Bitcoin “disgusting and contrary to the interests of civilization.”

The trading patterns in Bitcoin, Ethereum, and many other over 19,200 cryptos are creating tightly coiled springs that will eventually snap higher or lower. My wager remains on the upside as the fintech revolution is financial evolution.