- Micron Technology shares have declined over 26.5% since January

- Management expects to deliver robust results in FY22

- Long-term investors could consider buying at current levels

-

If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

Shareholders in the memory-chip and storage solutions heavyweight Micron Technology (NASDAQ:MU) have seen the value of their investment drop close to 21% over the past 52 weeks, and 26.8% year-to-date (YTD). By comparison, the Philadelphia Semiconductor Index is down more than 26.0% YTD, 8.8% lower over the past 12 months.

On Jan. 5, MU shares went over $98, hitting a record high. However, since then, 2022 has not been kind to technology and growth shares, as well as the broader indices. As a result, Micron shares and peer stocks have suffered double-digit losses. The stock's 52-week range has been $65.67-$98.45, while the market capitalization (cap) currently stands at $76.2 billion.

How Recent Metrics Came In

Micron released Q2 2022 figures on Mar. 29. Revenue of $7.786 billion meant an increase of 25% year-over-year (YoY). DRAM sales, which constitute 73% of total top line, grew 29%. Meanwhile, revenue from the NAND segment was up by 19% YoY. Non-GAAP net earnings for the quarter was $2.4 billion, or $2.14 per diluted share, vs.98 cents a year ago.

On the results, CEO Sanjay Mehrotra commented:

“Micron delivered an excellent performance in fiscal Q2 with results above the high end of our guidance. We grew revenue and margins sequentially while driving favorable mix and cost reductions amid ongoing global supply chain challenges… Following a solid first half, we are on track to deliver record revenue and robust profitability in fiscal 2022 and remain well positioned to create significant shareholder value in fiscal 2022 and beyond.”

Next quarter, the chip giant expects to achieve $8.7 billion ± $200 million in revenue in Q3 2022. Diluted EPS is estimated to be around $2.46±$0.10.

Prior to the release of these metrics, Micron stock was around $82. But it ended Apr. 29 at $68.19, meaning a decline of around 17% in a month.

What To Expect From Micron Technology Stock

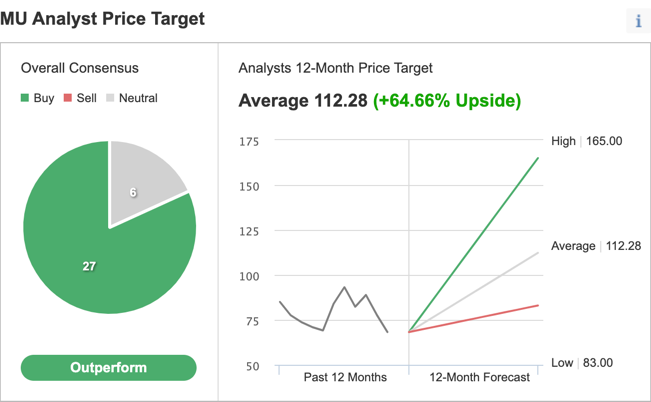

Among 33 analysts polled via Investing.com, MU stock has an "outperform" rating.

Chart: Investing.com

Wall Street also has a 12-month median price target of $112.28 for the stock, implying an increase of almost 65% from current levels. The 12-month price range currently stands between $83 and $165.

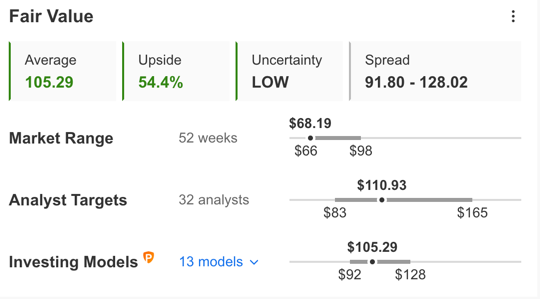

Similarly, according to a number of valuation models such as P/E or P/S multiples or terminal values, the average fair value for MU stock at InvestingPro is $105.29.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase about 55%.

We can also look at MU’s financial health as determined by ranking more than 100 factors against peers in the Information Technology sector.

For instance, in terms of cash flow and profit, it scores 4 out of 5. Its overall score of 4 points means a great performance ranking.

At present, MU’s P/E, P/B and P/S ratios are 8.4x, 1.6x and 2.4x, respectively. Comparable metrics for peers stand at 43.9x, 7.3x and 7.8x, respectively. These numbers show that with the recent decline in price, MU offers good value.

As part of the short-term sentiment analysis, it would be important to look at the implied volatility levels for MU options as well. Implied volatility typically shows traders the market's opinion of potential moves in a security, but it does not forecast the direction of the move.

Micron’s current implied volatility is about 15% higher than the 20-day moving average. In other words, implied volatility is trending higher, while options markets suggest increased choppiness ahead for MU shares.

Readers who watch technical charts may also be interested to know that a number of Micron’s short- and intermediate-term oscillators are oversold. Although they can stay extended for weeks—if not months—the decline in the MU share price could also be coming to a halt.

Our expectation is for Micron Technology stock to build a base between $60 and $70 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding MU Stock To Portfolios

Micron Technology bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $105.29 as indicated by quantitative models.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has MU stock as a holding. Examples include:

- First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL)

- iShares Semiconductor ETF (NASDAQ:SOXX)

- iShares MSCI USA Value Factor ETF (NYSE:VLUE)

- Guru Favorite Stocks ETF (NASDAQ:GFGF)

- Innovator Loup Frontier Tech (NYSE:LOUP)

Finally, investors who expect MU stock to bounce back in the weeks ahead could consider setting up a bull call spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on MU stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bull Call Spread On Micron Technology Stock

Intraday Price At Time Of Writing: $68.19

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e., Micron Technology) and the same expiration date.

The trader wants MU stock to increase in price. In a bull call spread, both the potential profit and the potential loss levels are limited. This MU trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the June 17 expiry 70 strike call for $4.35 and selling the 75 strike call for $2.45.

Buying this call spread costs the investor around $1.90, or $190 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the MU stock price at expiration is below the strike price of the long call (or $70 in our example).

To calculate the maximum potential gain, we can subtract the premium paid from the spread between the two strikes, and multiply the result by 100. In other words: ($5 – $1.90) x 100 = $310.

The trader will realize this maximum profit if the Micron Technology stock price is at or above the strike price of the short call (higher strike) at expiration (or $75 in our example).

Bottom Line

In recent months, Micron Technology stock has come under significant pressure. Yet, the decline has improved the margin of safety for buy-and-hold investors who could consider investing soon. Alternatively, experienced traders could also set up an options trade to benefit from a potential run-up in the price of MU stock.

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »