- Reports Q2 2022 results on Tuesday, Aug. 2, after the market close

- Revenue Expectation: $6.53 billion; EPS: $1.03

- AMD’s strong outlook and evidence it’s gaining market share fuelling gains in its stock

When Advanced Micro Devices (NASDAQ:AMD) releases its latest quarterly earnings tomorrow, the chip-maker has to show that demand for its products remains strong amid the supply-chain disruptions and inflationary pressures.

Given the current uncertain macro environment, the biggest threat to the California-based chip-maker comes from the increasing possibility of demand destruction if the economy slips into a recession.

The chances of such an outcome increased as the Federal Reserve moved to aggressively hike interest rates this year to tame inflation, which is running at a four-decade high. Intel Corp. (NASDAQ:INTC) last week reported steeply lower second-quarter results and said revenue this year will be as much as $11 billion less than projected.

Similarly, Qualcomm Inc. (NASDAQ:QCOM), the biggest maker of chips that run smartphones, gave a lackluster forecast for the current period, saying that a weakening economy will hurt consumer spending on mobile devices.

So far, AMD management doesn’t see this adverse macro environment slowing demand for its chips. The company, in June, produced a strong sales forecast for the second quarter, indicating that the chip-maker continues to make strides in its most lucrative market: data-center processors.

Source: Investing.com

Investors in the recent market rebound also saw value in the beaten-down AMD stock, which had lost more than half of its value since reaching a record high in November. During the past month, AMD has gained more than 25%, producing returns that are much higher than the benchmark Philadelphia Semiconductor Index.

Market Share Gain

The rebound is supported by AMD’s strong outlook and evidence the company continues to gain market share in the computer processing market. The company is on pace to end 2022 with almost four times as much revenue as in 2019. New products and better execution have helped AMD win over customers who were once skeptical about its capabilities.

In the long run, AMD Chief Executive Officer Lisa Su sees a robust growth scenario in which she expects a 20% compound annual growth rate for the company, helped by AMD’s latest merger deal with the semiconductor company Xilinx.

AMD also expects a gross margin of more than 57%, driven by a mix of new offerings. At the same time, operating expenses are anticipated to be around 23-24%. The chip-maker expects its operating margin to hover around the mid-30% range as the tech giant improves margins and profitability.

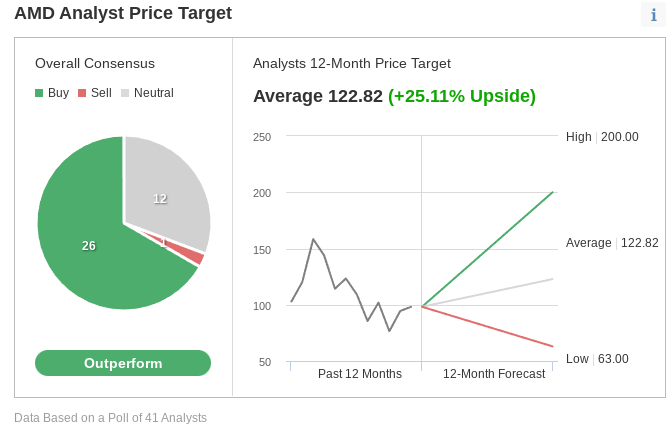

Despite concerns about a potential recession, many analysts continue to remain bullish on AMD stock. In an Investing.com poll of 41 analysts, 26 rate the stock as “outperform,” with their consensus price target implying a 25% price gain.

Source: Investing.com

Though AMD is not immune to macro headwinds, there are enough reasons to believe that it will be able to sustain its fundamental outperformance.

In a note to clients, BMO Capital Markets said the company’s strong execution would lead to share gains against rivals.

According to its note:

“Our view is that we see a path to sustained share gains against Intel ... and we do not need Intel to mis-execute for the thesis to work. Our sense is that with the several key architectural innovations the company has made, along with rolling out a lineup of products that has enabled the company to not only close the gap but get ahead in many cases, AMD’s credibility with customers has continued to climb.”

Bottom Line

Except for macro risks, it seems everything else is going right for AMD. Tomorrow’s earnings are likely to prove that point.

Disclaimer: The writer doesn’t own shares of the companies mentioned in this report.