The dominance of the US stock market over its foreign counterparts has for years been taken as a sign of the new world order for global asset allocation that forever and always favors American shares. But this year offers a compelling counterpoint to reconsider the received wisdom.

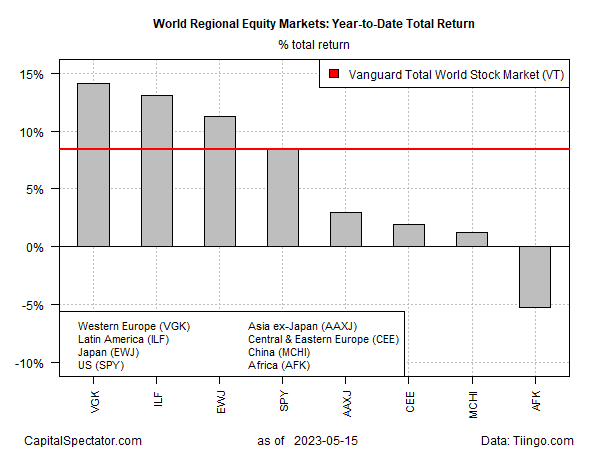

US equities ex-US are outperforming American shares by wide margins year to date, based on a set of ETFs through Monday’s close (May 15). A few months of role reversals are hardly a definitive sign, but the change is no less striking after years of backseat results for non-US markets.

Shares in Europe (VGK), Latin America (ILF), and Japan (EWJ) are well ahead of the US stocks (SPY) so far in 2023. The outperformances are also conspicuous relative to a benchmark of world shares (VT).

There are some laggards in the foreign space, too. Asia ex-Japan (AAXJ), eastern Europe (CEE, a closed-end fund), and China (MCHI) are posting weak results year to date. Africa (AFK) is also suffering, posting a 5%-plus loss so far in 2023.

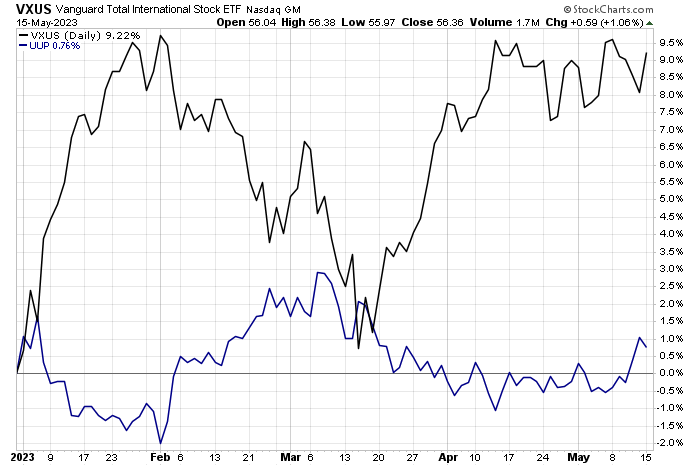

Part of the reason for the rebound in foreign markets over the US is the faltering US dollar. All else equal, when the greenback falls (rises), assets priced in foreign currencies rise (fall) after conversion into US dollars. As the chart below suggests, that factor’s been a tailwind for stocks ex-US this year as the dollar (UUP) has eased/stayed flat and foreign shares have rallied (VXUS).

The question is whether the foreign equities edge will continue. Reasons to be cautious include the view that the relative strength is temporary for some markets due to oversold conditions. Stocks in Europe have rallied in part due to a sigh-of-relief trade. After shares on the Continent took a hit following Russia’s invasion of Ukraine in early 2022, the economic blowback has been less severe (so far) than expected. In turn, the selling was considered overdone, and prices rebounded.

Europe’s bounce-back is arguably complete, but Adam Turnquist, the chief technical strategist at LPL Research, opines,

“Tides Turning Toward International Stocks.” Writing last week he advises that “Investors may want to look for diversification opportunities in developed international markets.” He cites several factors:

The technical backdrop continues to improve for the space, including consistent relative strength over US markets. Weakness in the dollar could provide another tailwind to developed international equities. Their valuations appear cheap, and recession probabilities for the Eurozone and Japan remain well-below recession forecasts for the US. Based on this backdrop, LPL Research recently upgraded developed international equities to overweight and downgraded U.S. equities to neutral.

Aside from the near-term outlook, the larger lesson is that avoiding non-US markets as a general rule is usually a risky bet, if only because the future is forever uncertain. The debate for US-based investors should focus on how much foreign assets to hold, and the answer should almost always be a non-zero number.

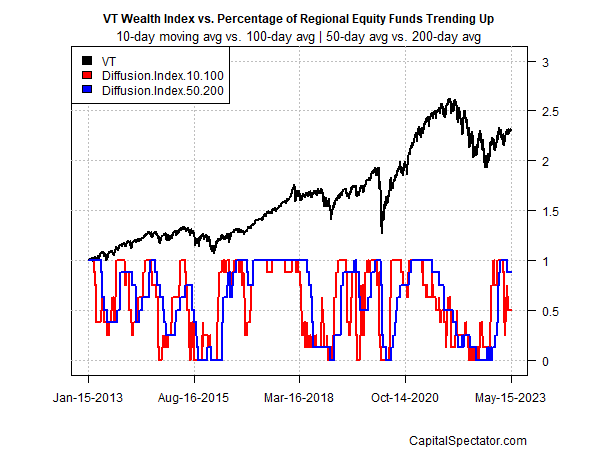

On a more tactical level, watching relative performance offers clues for managing near-term expectations. For example, the recent strong performance of equities ex-US is less surprising when viewed through a momentum lens. The latest pop follows the severe underperformance of non-US shares, an extreme result that laid the groundwork for a robust recovery (see chart below).

The case for ongoing outperformance in the near term is less of a slam-dunk today. However, the case for international diversification still looks compelling, in part as a risk-management tool. US stocks are still a solid investment for the long haul, but not to the exclusion of the rest of the world. America has strengths, but don’t confuse that with a monopoly on value and opportunity.