This post was written exclusively for Investing.com

The S&P 500 has risen dramatically since its March lows, but cracks are emerging, which suggests that the recent bull run may be at serious risk. There have been some divergences developing over the past few weeks that indicate the recent rally may be a result of only a handful of stocks. If that proves to be the case, then next week's earnings could prove to be vital.

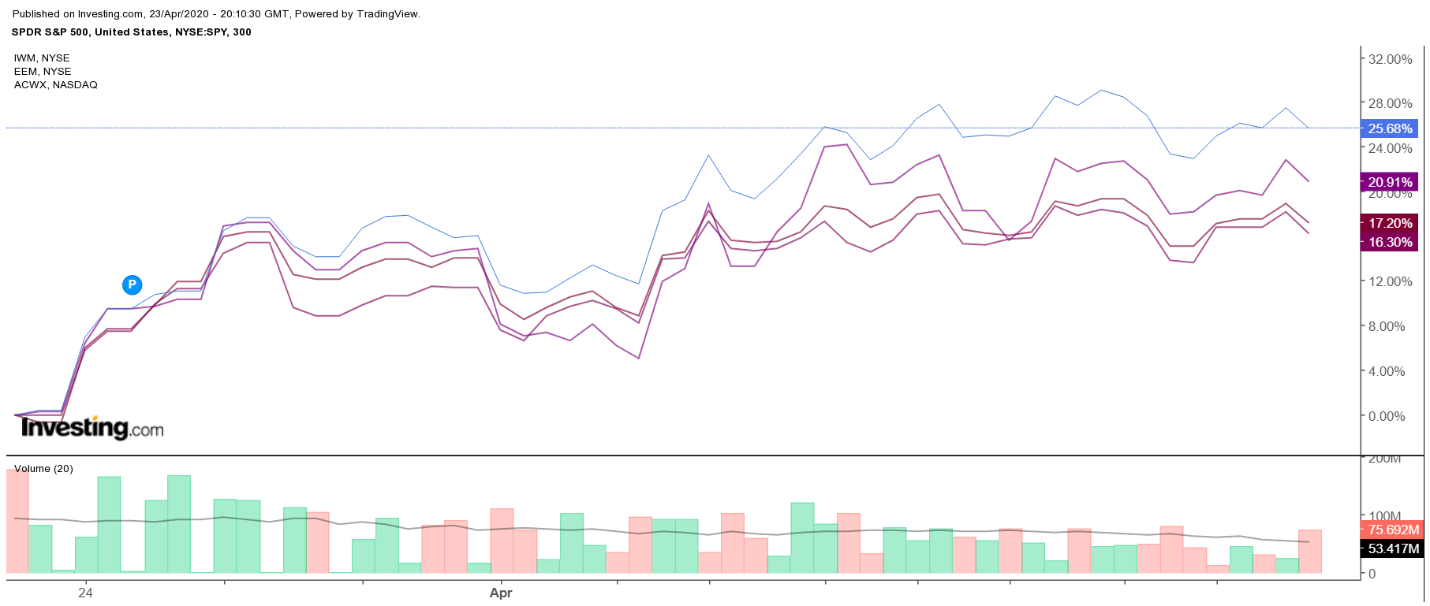

While the S&P 500 ETF (SPY (NYSE:SPY)) rises, the small-cap Russell 2000 ETF (NYSE:IWM) has lagged, as has the Emerging Markets ETF (NYSE:EEM) and the All-World EX-US ETF (NASDAQ:ACWX).

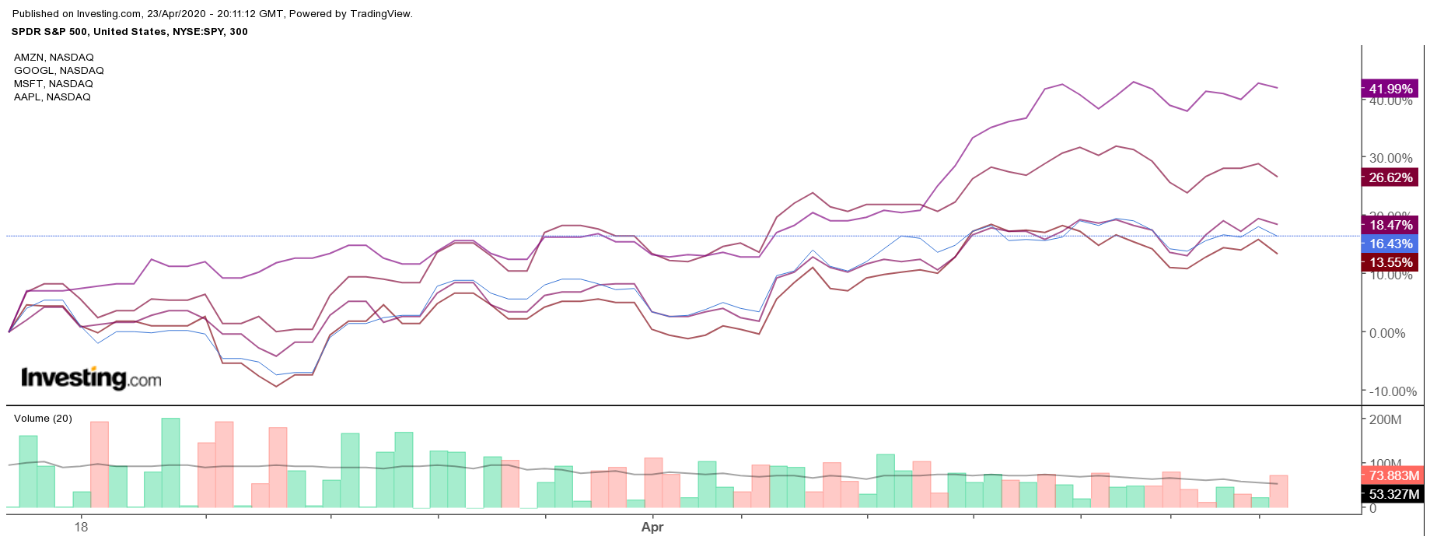

The S&P 500's significant rise seems to be more of a result of companies like Microsoft (NASDAQ:MSFT), Amazon.com (NASDAQ:AMZN), Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOGL) pushing higher. These four companies have a nearly 18% weighting in the S&P 500 SPDR ETF.

Outperforming

Since March 23, the S&P 500 ETF has risen by over 25%, while the Russell 2000 ETF has increased by 20.5%, the Emerging Markets ETF has gained 16.3% and the All-World EX US has advanced by 17.9%. The gains in the S&P 500 seems to be unevenly outperforming the other groups, which suggests that the recent rally is favoring just the largest companies in the equity market.

Leading the Charge

Amazon has been by far the most influential performer since it bottomed on March 16, rising by over 41.9%, while Microsoft has jumped by 26.6% and the S&P 500 has increased by 16.4%. These two stocks have been instrumental in helping the S&P 500 to rebound, and should they falter, it could prove to be a significant drag on the overall market.

Apple and Alphabet have risen by 14% and 17.9% over that same time, respectively. Not necessarily adding to the overall markets rise, but certainly helping to support the rally. The strong performance of these four stocks and their outsize weightings have helped to lift shares disproportionately over other segments of the markets; it would seem.

The critical piece is that each of these four companies reports quarterly results the week of April 27. Alphabet will provide results on April 28, Microsoft, on April 29, and both Apple and Amazon on April 30. It means that next week will likely be a crucial one for the market and likely to set the tone for what could be the next several weeks.

It may also put the market at risk should any of these four companies badly miss results or give a bleak outlook for their current state of the business. It could cause the recent outperformance of the large-cap S&P 500 to retrace much of its recent gains. But because of that outperformance in past weeks, it could lead to a sharper and steeper pullback.

Likewise, positive results, and views of a better economic landscape, could help to push prices even higher. That would result in the gap between the S&P 500 and the other segments widening still further.

The uncertainty and turmoil created by the coronavirus outbreak mean the current situation is replete with multiple risks. These four companies are the largest by market capitalization in the U.S. and have the means to survive the current economic downturn. This is almost certainly one of the main factors driving investors to flock into these four stocks.

But it also means that anything that may go against that belief could send these stocks and the market very quickly in a lower direction.

Disclaimer: Michael Kramer and the clients of Mott Capital own Microsoft, Apple and Alphabet