Street Calls of the Week

Stocks endured a rough week, with the S&P 500 down by around 2% and the NASDAQ 100 finishing lower by almost 4%. The move in the small caps also seemed to end now that the gamma squeeze is basically over. This leaves the market in a vulnerable position as we head into the heart of earnings season this week, with Tesla (NASDAQ:TSLA) and Alphabet (NASDAQ:GOOGL) reporting results.

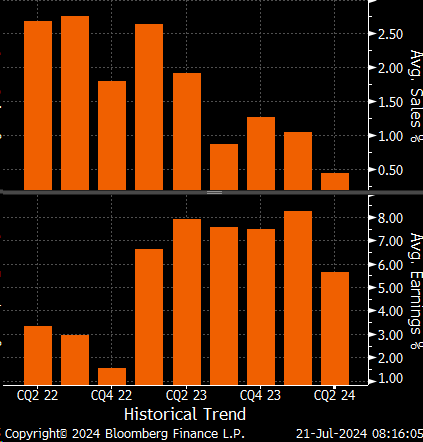

The guidance provided by companies this quarter is critical because estimates for 2024 are heading lower at this point for the S&P 500 and the S&P 493. At the same time, the Mag7 estimates are not rising, which means more stress will be placed on the Mag7 this quarter, giving upbeat guidance.

Also, this quarter’s earnings and sales surprises are running weaker than what we have seen in recent quarters. So far, this quarter’s sales surprises are the weakest in two years, and earnings surprises are the weakest since the first quarter of 2023.

So, there will need to be a big improvement as earnings season goes on. This could help explain some market weakness, especially with stretched valuations.

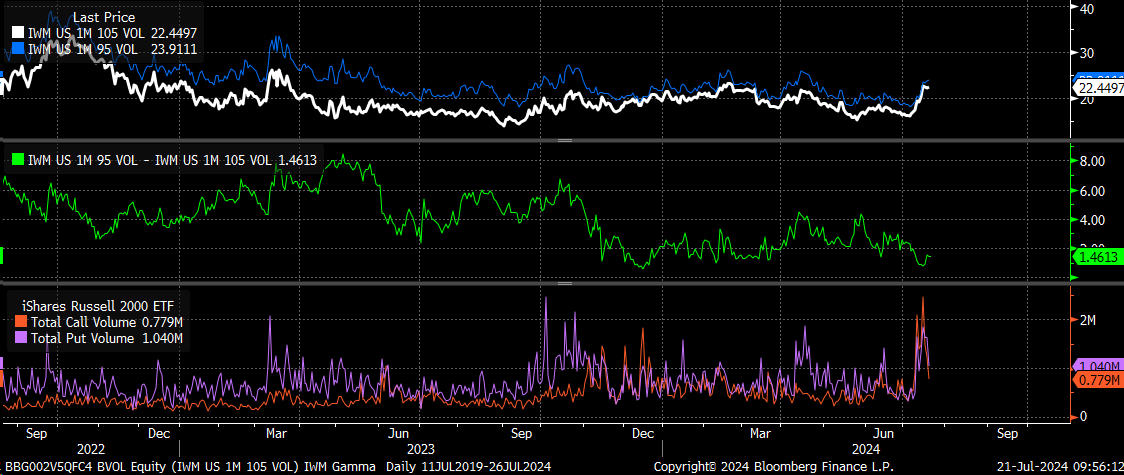

1. Russell 2000's Next Move After Gamma Squeeze Ends

The IWM, Russell 2000 gamma squeeze appears to have ended for now, with call volume crashing on Friday. Additionally, we have seen skew turn higher, indicating that downside IV is now rising faster than upside IV.

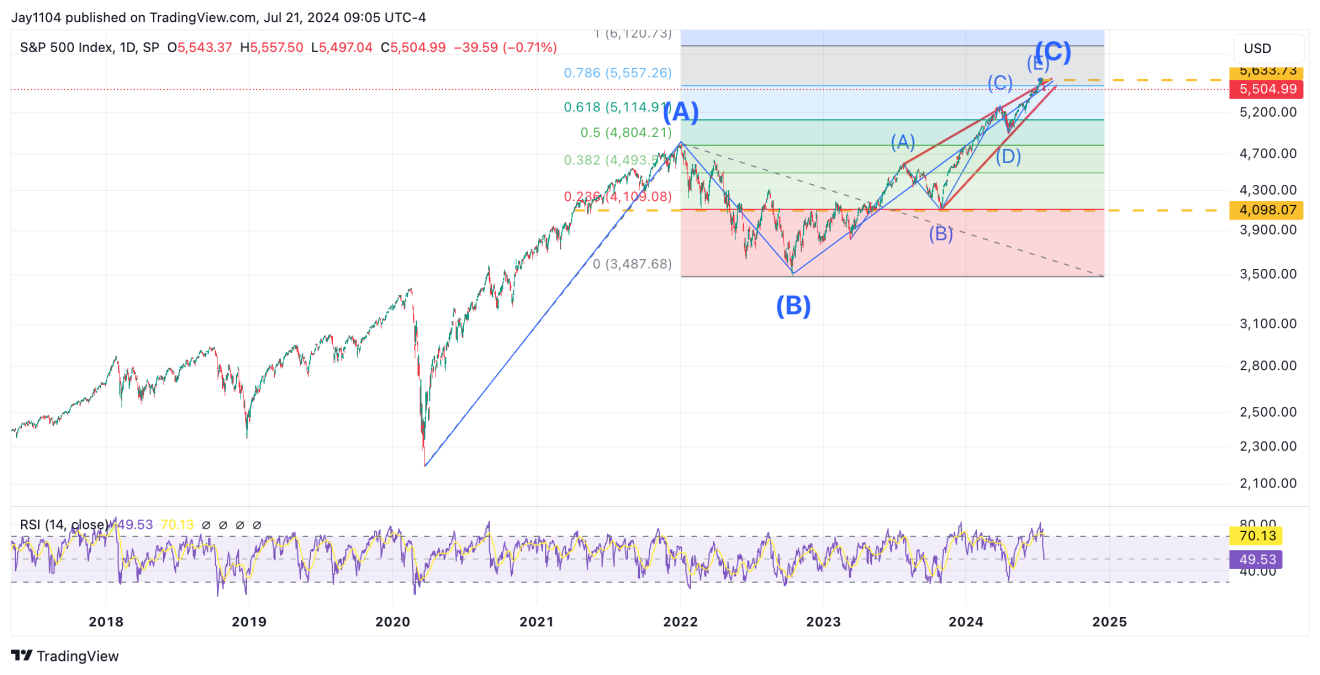

2. S&P 500's Bearish Engulfing Pattern

This week, we saw the S&P 500 put in a bearish engulfing pattern on the weekly chart. Something that doesn’t happen very often on the weekly.

It has happened just eight times since 2020, and 6 of those times saw the S&P 500 lower the following week.

We have also seen the rising wedge pattern on the S&P 500, which completed a throwover this past week by returning to the wedge.

The pattern also has favorable fibs, with wave three slightly bigger than wave 1, while wave 5 equals 61.8% of wave 3.

Additionally, from the 2020 low, wave C equals 78.6% of wave A. This makes this region for the S&P 500 a pretty good spot to see a sizeable correction or move lower when considering the different fib relationships.

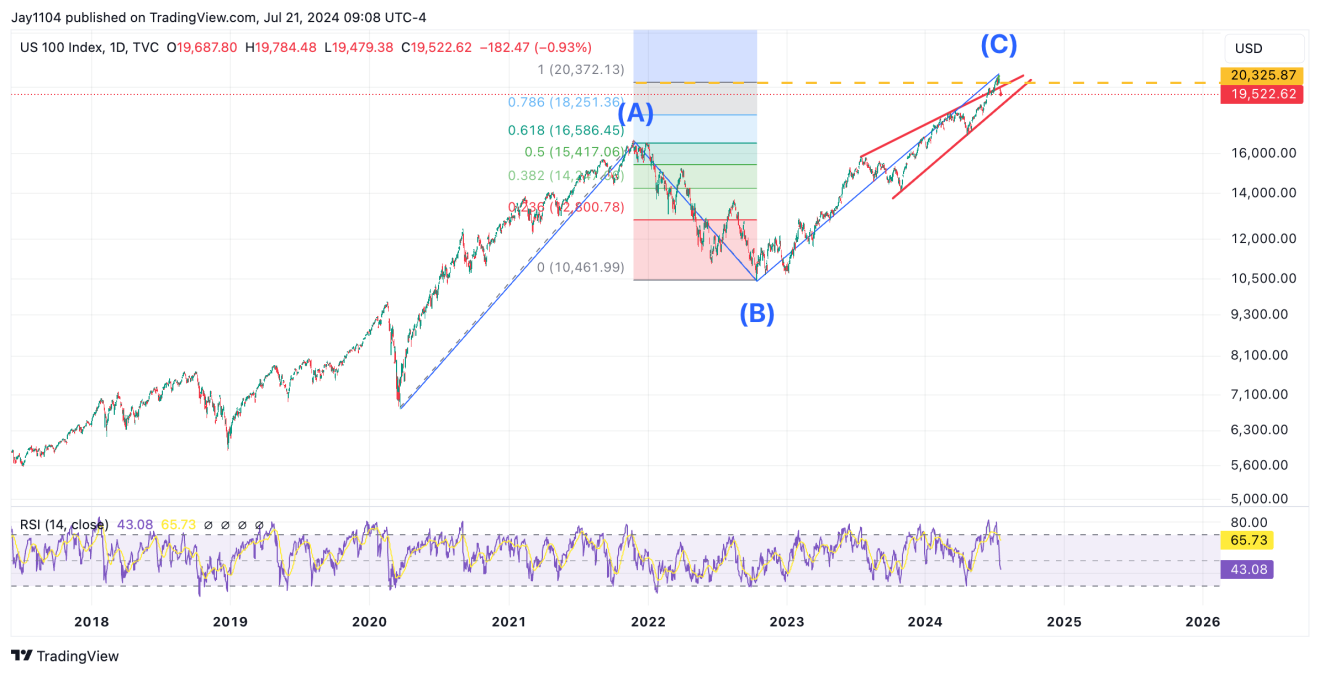

3. Nasdaq 100's ABC Pattern

It is similar on the NASDAQ 100 with a giant ABC pattern off the 2020 lows, a similar rising wedge, with a completed however.

4. Semiconductor Index's Breakdown Below the Broadening Wedge

The SMH also completed its rising broadening wedge pattern and has now fallen out of it. The crazy thing is that it could fall 20% more and only come back to its lows seen in April of this year.

Nvidia (NASDAQ:NVDA) also moved lower this week and is now at a vital spot, with support in this $118 region. A break below $116 likely leads to a further decline to around $110. The setup in Nviidia right now looks similar to it in March and April, with two bearish engulfing patterns, and that double. Nvidia fell 20% during that time in April and May.

5. S&P 500 Equal Weight's 2B Reversal Top

The S&P 500 equal weight put a fairly ugly candle in this week’s weekly chart. After a big move higher, it finished the week lower and closed below March 25 highs as well. It looks like a 2b reversal top, which resulted in the RSP undercutting the $162.84 level.