A perfect storm may be brewing for the bond market as a combination of factors drives yields higher.

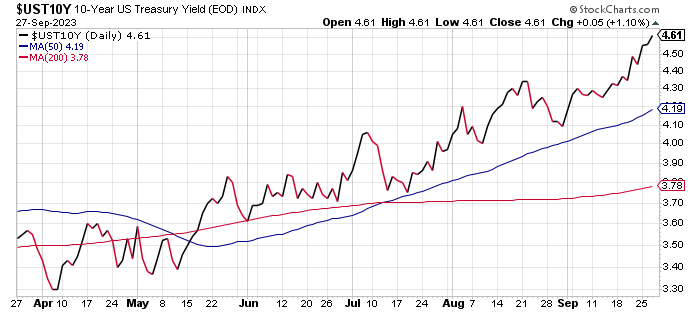

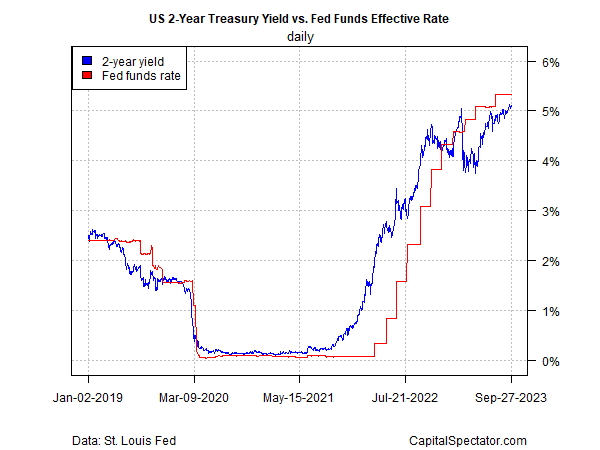

Exhibit A is the benchmark 10-year Treasury yield, which rose again in yesterday’s trading to 4.61% (Sep. 27), the highest since 2007. Several other maturities on the yield curve are also trending higher, including the policy-sensitive 2-year rate, which ticked up to 5.10%, just below its previous peak set in 2006.

There are several factors lifting yields. Until there’s a material shift in one or more of the catalysts, it’s possible (likely?) that yields will continue to trend up. In turn, monitoring the factors that are lifting yields is crucial for managing expectations in the bond market. With that in mind, here’s a brief summary of four key reasons behind the selloff in Treasuries.

1. Higher Inflation Premium

Mike Cudzil, portfolio manager at Pimco, said:

“Markets are trying to understand how low inflation can get if you have a 3.5% unemployment rate, a resilient economy, and interest-rate-sensitive sectors—including housing and autos, which did slow last year but now have started to perform pretty well again despite the rates,”

He tells Morningstar:

“There has been a rise in inflation expectations in the market, and that corresponds to a Fed that is no longer actively fighting inflation but letting higher but stable rates do the work,” says Briggs. “Inflation is coming down but is still above target, so it’s reasonable for investors to require a bit more risk premium in inflation.”

Next month’s initial estimate of US gross domestic product from the government is expected to top 3%, according to the median nowcast of several sources compiled by CapitalSpectator.com. If correct, economic output will accelerate by a meaningful degree compared with the 2%-plus pace in Q2. To the extent that a resilient economy is keeping upward pressure on yields, it’s not obvious that relief in the form of a sharply softer economy is imminent.

2. Hawkish Fed Policy

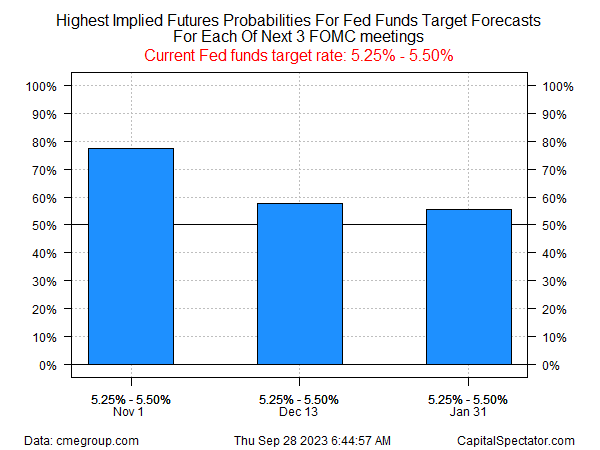

Debate rages on whether the Federal Reserve will continue to lift its target interest rate, but there’s general agreement that rate cuts are unlikely for the near-term horizon.

Fed funds futures are currently pricing in moderately high odds that the central bank will leave its target rate unchanged at a 5.25%-to-5.50% range at the next FOMC meeting on Nov. 1. Confidence is low about what happens at the two subsequent policy meetings, but sentiment is leaning towards a view that rates will stay unchanged.

In turn, the Fed is in the position that simply leaving its policy stance intact amounts to a passive tightening. Notably, the policy-sensitive 2-year yield looks set to close the gap vs. the Fed funds rate as the market recognizes that higher-for-longer may prevail for the central bank’s policy rate in the foreseeable future.

A key variable on this front is how inflation fares in the months ahead. Although pricing pressure has declined sharply since last year’s peak, there are concerns that inflation is settling at a roughly 3% level, which is above the Fed’s 2% target.

Minneapolis Federal Reserve President Neel Kashkari estimates a 40% probability that interest rates will continue to rise to tame inflation. In an essay published earlier this week, he wrote that a “high-pressure equilibrium” is settling over the US economy that will keep inflation well above the Fed’s 2% inflation target.

“The case supporting this scenario is that most of the disinflationary gains we have observed to date have been due to supply-side factors, such as workers reentering the labor force and supply chains resolving, rather than monetary policy restraining demand,” Kashkari advises. He adds: “These dynamics raise the question, How tight is policy right now? If policy were truly tight, would we observe such robust activity?”

3. Rising Energy Prices

Although central banks tend to focus on core inflation, which strips out energy and food, headline prices are still a factor in markets. On that score, the recent rebound in crude oil threatens to halt and possibly reverse the disinflation trend for headline inflation measures.

No wonder, then, that yesterday’s rise in oil futures to the highest level of the year has analysts considering the possibility that inflation may be tougher to tame in the months ahead.

For example, the Financial Times reports:

“Blerina Uruçi, chief US economist at T Rowe Price, said she was worried about higher energy prices leading to higher costs elsewhere. The autoworker's strike could also push up vehicle prices, given the already-stretched supply. “Small shocks to the economy can really bring inflation back up again,” she said. “And as a central banker, you’re going to be worried that if you keep getting these upside shocks, what is that going to do to inflation expectations?”

4. Treasury Debt Issuance

The growing US budget deficit, along with the threat of a government shutdown starting on Oct. 1, is fueling concerns that the rising Treasury debt sales will be a factor weighing on prices and driving yields higher. Minds became focused on this factor when the Treasury Dept., on July 31, announced that it expects to borrow $1.007 trillion in the third quarter, sharply above the May estimate by $274 billion and the highest ever for a third quarter.

The Q3 bond sales “was a lot more than what people thought,” Mark Lindbloom, portfolio manager at Western Asset Management, tells Morningstar. “Somebody’s going to buy them—it will get done—but the question is at what price.”