Wall Street's first quarter earnings season started this week, with notable names like JPMorgan Chase (NYSE:JPM) and Delta Air Lines (NYSE:DAL) due to release their latest financials today, and Citigroup (NYSE:C) and UnitedHealth (NYSE:UNH) reporting on Thursday.

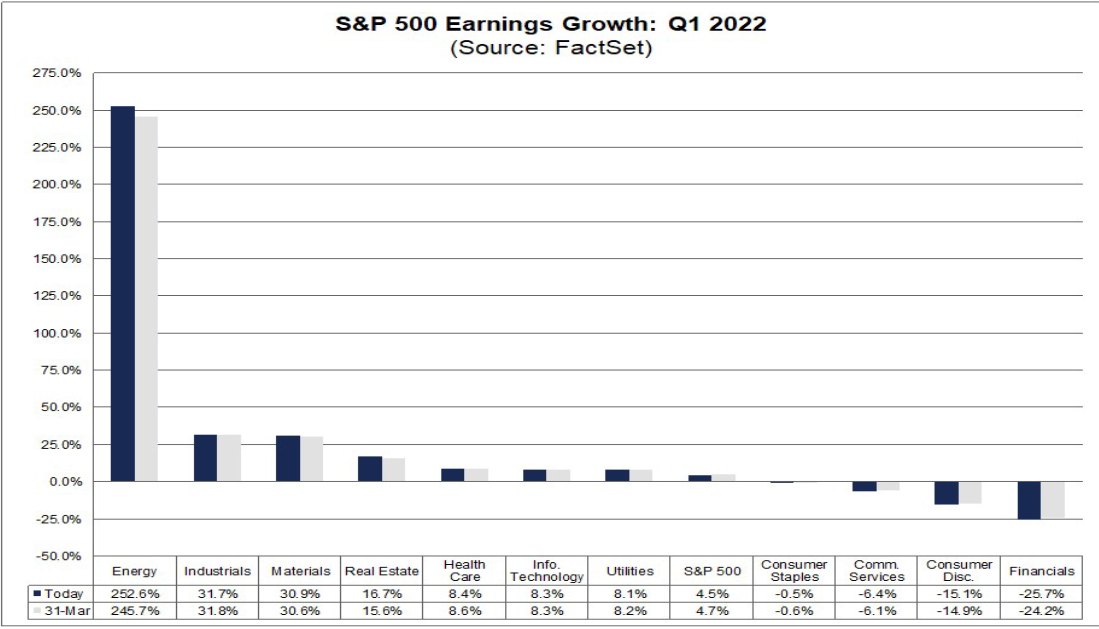

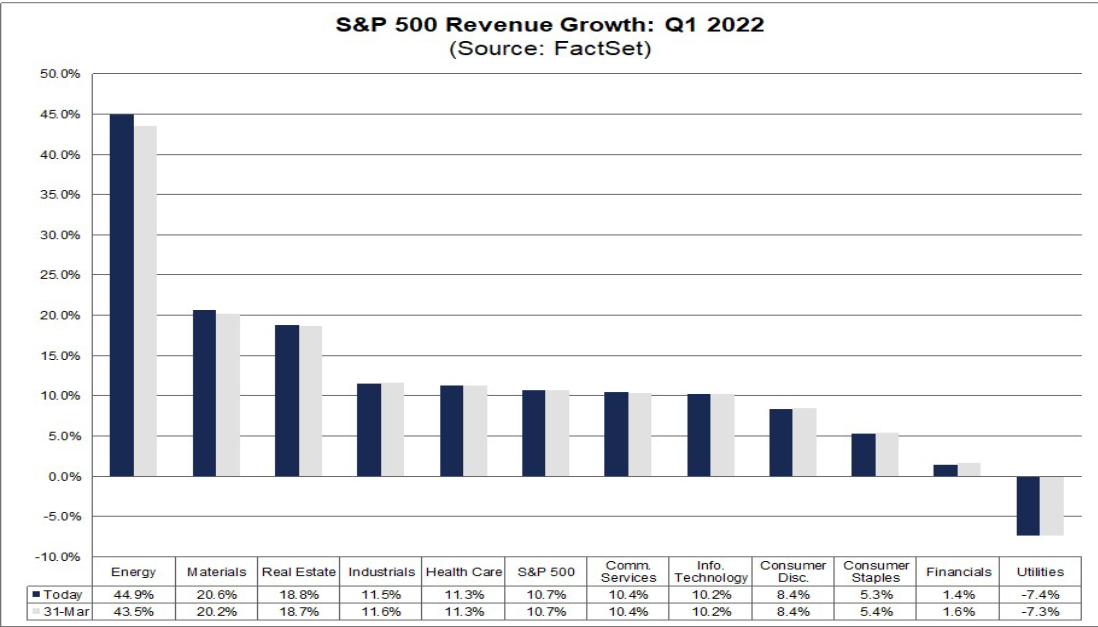

FactSet data shows analysts anticipate Q1 S&P 500 earnings will rise by 4.5% when compared to the same period last year, mainly due to tough year-over-year comparisons and ongoing macroeconomic headwinds, including higher costs, supply chain disruptions, and labor shortages.

If confirmed, Q1 2022 would mark the lowest year-over-year earnings growth rate reported by the index since Q4 2020.

At the sector level, seven of the 11 sectors are projected to report YoY earnings growth, led by the Energy, Industrials, and Materials sectors. On the other hand, four sectors are expected to report a YoY decline in earnings, led by the Financials and Consumer Discretionary sectors.

Revenue expectations are slightly more promising, with sales growth expected to increase 10.7% from the same period a year earlier. If confirmed, it will mark the fifth straight quarter of revenue growth above 10%. However, it will also represent the lowest annualized sales growth rate reported by the index since Q4 2020.

Ten of the 11 sectors are expected to report YoY growth in revenues, led by the Energy, Materials, and Real Estate sectors.

Below we break down two sectors whose financial results are projected to show significant improvement from the year-ago period and one sector whose earnings are expected to take the deepest dive amid the current market conditions.

1. Energy: Surging Oil And Gas Prices Set To Boost Results

- Projected Q1 EPS Growth: +252.6% YoY

- Projected Q1 Revenue Growth: +44.9% YoY

The Energy sector was hit hard by COVID-related shutdowns a year ago, but, is expected to report the biggest YoY gain in earnings of all 11 sectors, with an impressive 252.6% surge in first quarter EPS, according to FactSet.

With higher oil prices benefitting the sector—the average price of WTI crude in Q1 2022 was $95.10 per barrel, 63% above the average price of $58.14 in Q1 2021. Based on FactSet data, the sector is also projected to record the highest YoY increase in revenue of all 11 sectors at 44.9%.

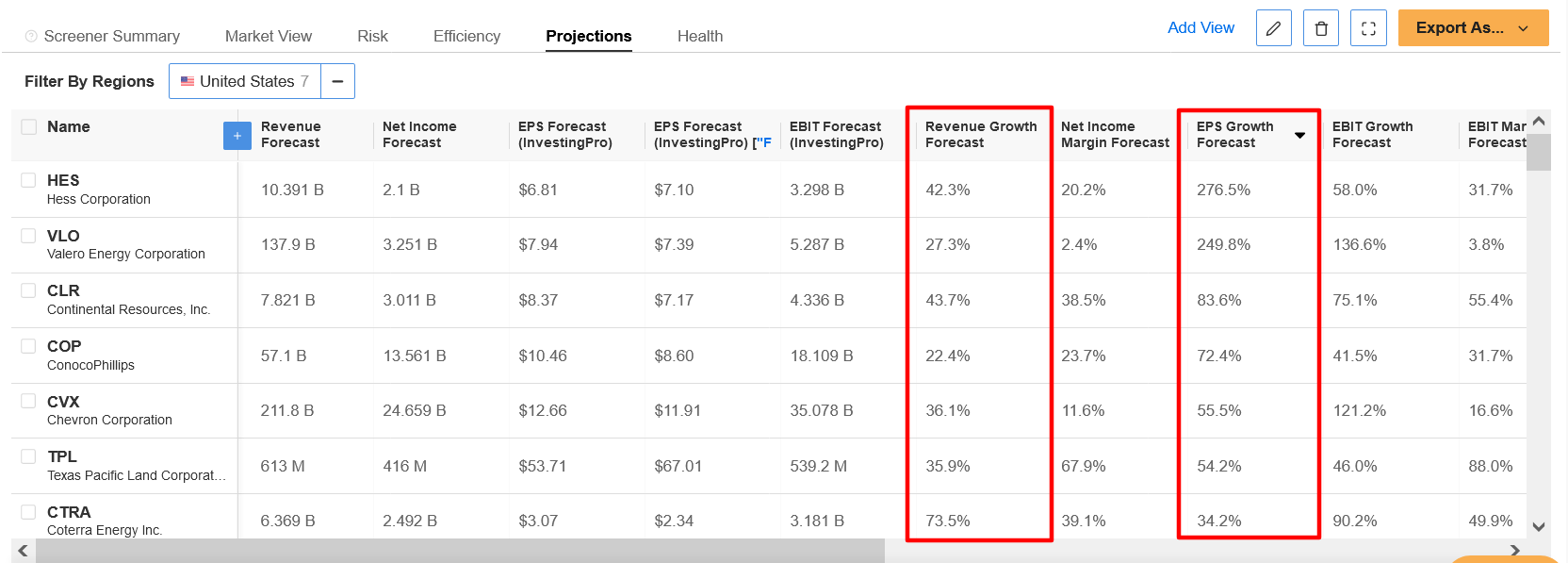

At the company level, ExxonMobil (NYSE:XOM), Chevron (NYSE:CVX), and ConocoPhillips (NYSE:COP) are expected to be the largest contributors to the YoY surge in earnings for the sector, with all three energy behemoths forecast to report double-digit profit and sales growth.

Two other notable names in the group that are set to enjoy significant improvements in their Q1 financial results are Occidental Petroleum (NYSE:OXY), which is projected to post EPS of $1.75, compared to a loss per share of $0.15 in the year-ago period, and Marathon Petroleum (NYSE:MPC), which is anticipated to record a 700% YoY increase in EPS.

According to the InvestingPro+ Energy Stock Screener, a few more prominent names are likely to enjoy robust Q1 profit and sales growth, including Hess (NYSE:HES), Valero Energy (NYSE:VLO), Continental Resources (NYSE:CLR), and Coterra Energy (NYSE:CTRA).

Source: InvestingPro

The Energy Select Sector SPDR® Fund (NYSE:XLE), the ETF which tracks a market-cap-weighted index of U.S. energy companies in the S&P 500, is up 41.3% year-to-date, making it the top performing sector of 2022 by a wide margin. In comparison, the S&P 500 is down by 7.7% over the same timeframe.

In addition to Exxon, Chevron, and ConocoPhillips, some of XLE’s largest holdings include, EOG Resources (NYSE:EOG), Schlumberger (NYSE:SLB), Pioneer Natural Resources (NYSE:PXD), Williams Companies (NYSE:WMB), and Devon Energy (NYSE:DVN).

2. Materials: Metals Rally Set To Power Profit, Sales Growth

- Projected Q1 EPS Growth: +30.9% YoY

- Projected Q1 Revenue Growth: +20.6% YoY

The Materials sector includes companies in the metals and mining, chemicals, construction materials, and containers and packaging industry. Q1 forecasts a print of the third highest YoY earnings jump of all 11 sectors, with EPS anticipated to increase roughly 31% from the turbulent year-ago period, according to FactSet.

Metals, such as gold, copper, nickel, platinum, palladium, and aluminum have seen their stronger prices helping the sector, with expectations for the sector to report the second largest YoY increase in revenue, with sales forecast to grow almost 21%.

Not surprisingly, three of the four industries in the sector are anticipated to enjoy double-digit Q1 EPS and revenue growth, with the Metals & Mining group set to see profit and sales spike 69% and 35%, respectively from the year-ago period.

In contrast, the Materials Select Sector SPDR® Fund (NYSE:XLB), which tracks a market-cap-weighted index of U.S. basic materials companies in the S&P 500, is down 2.8% in 2022.

XLB’s ten largest stock holdings include Linde (NYSE:LIN), Freeport-McMoRan Copper & Gold (NYSE:FCX), Newmont Mining (NYSE:NEM), Sherwin-Williams (NYSE:SHW), Air Products & Chemicals (NYSE:APD), Ecolab (NYSE:ECL), Dow (NYSE:DOW), Corteva (NYSE:CTVA), Nucor (NYSE:NUE), and DuPont de Nemours (NYSE:DD).

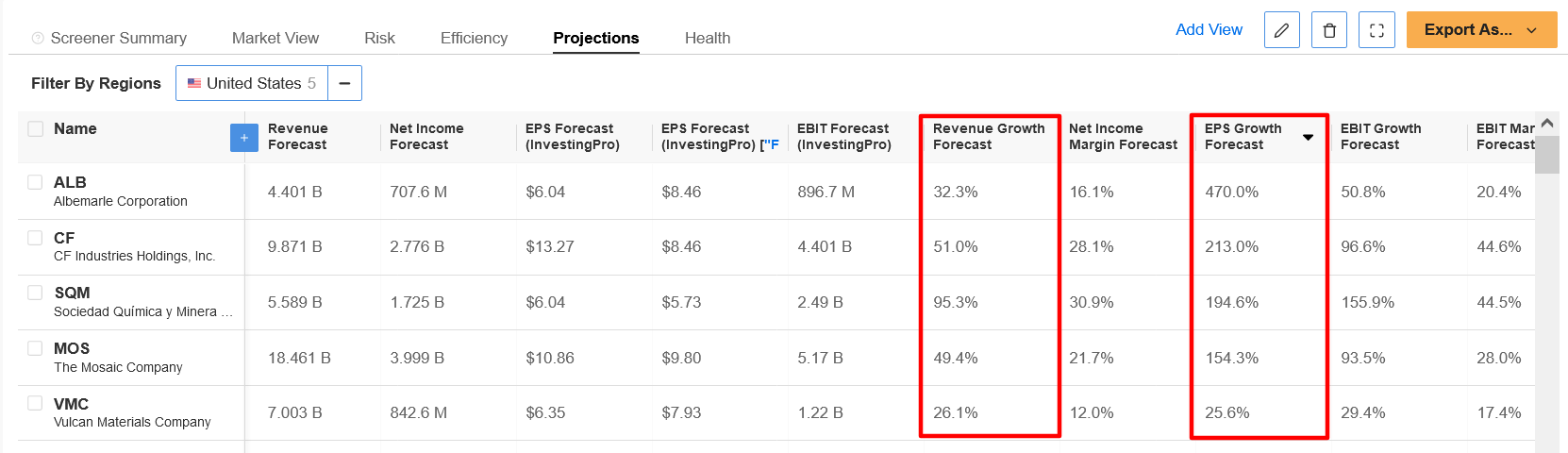

According to the Pro+ Materials Stock Screener, several companies from the group stand out for their potential to record impressive results.

The first is specialty-chemicals manufacturer Albemarle (NYSE:ALB), which is expected to report earnings growth of 470% from the year-ago period. The second is CF Industries (NYSE:CF), which is predicted to post Q1 EPS of $4.26, improving substantially from EPS of just $0.67 in the same period a year earlier.

Mosaic (NYSE:MOS) and Vulcan Materials (NYSE:VMC) are two more to watch as both companies have seen their business thrive amid the current inflationary environment.

Source: InvestingPro

3. Financials: Banks Expected To Lead YoY Decline

- Projected Q1 EPS Growth: -25.7% YoY

- Projected Q1 Revenue Growth: +1.4% YoY

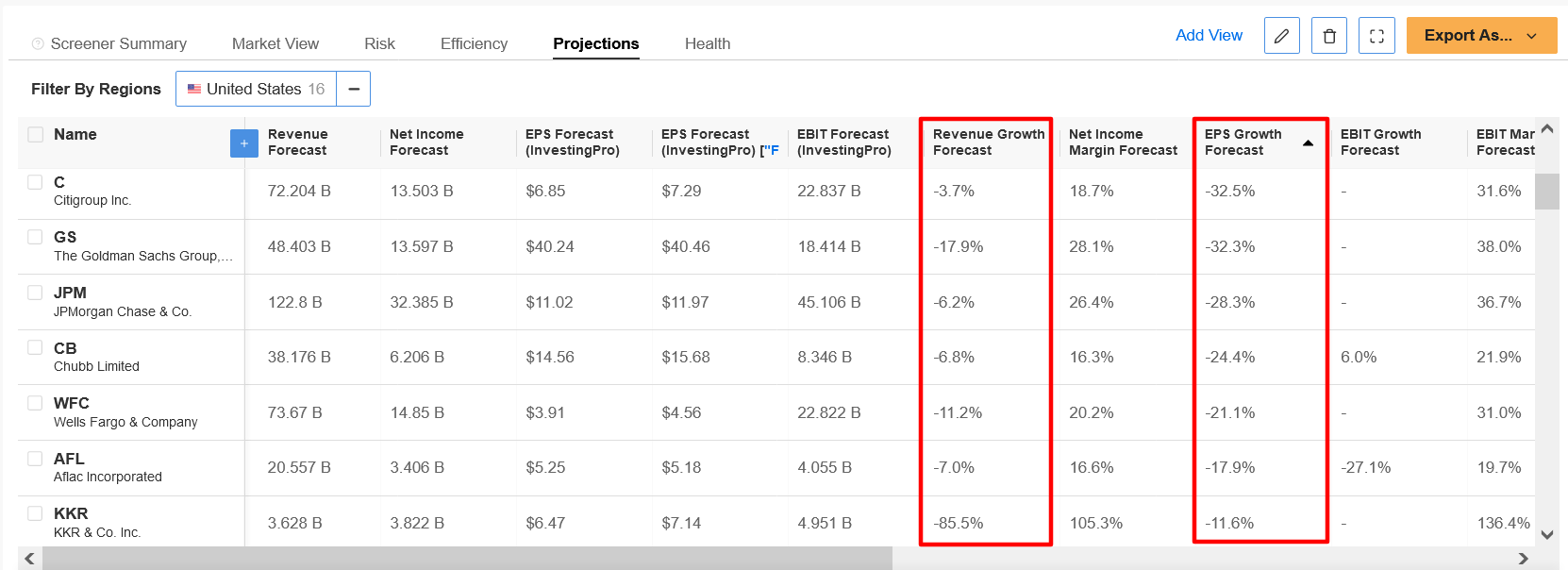

The projected winner of the largest YoY earnings slump prize this quarter is expected to go to the Financials sector, with EPS for the group set to drop 25.7% from a year earlier, per FactSet. The group is also anticipated to report the second smallest YoY increase in revenue, with a gain anticipated to be just 1.4%.

Amid higher provisions for loan losses, a slowdown in equity trading, and reduced M&A activity, all five of the industries in the sector are expected to suffer a decline in profit of more than 10%, led by banks (-36%), Consumer Finance (-26%), Capital Markets (-19%), and Insurance (-10%).

At the company level, Citigroup, Goldman Sachs (NYSE:GS), JPMorgan Chase, and Wells Fargo (NYSE:WFC) are projected to be the biggest contributors to the YoY decrease in earnings for the sector, with all four banking giants expected to post a drop in profit and sales growth.

According to the InvestingPro+ Financial Stock Screener, two other notable names in the group that are poised to report weak Q1 financial results are Prudential Financial (NYSE:PRU), which is projected to post EPS of $2.73, down 33.5% from EPS of $4.11 in the year-ago period, and Allstate (NYSE:ALL), which is anticipated to report a 54% YoY decline in EPS.

Source: InvestingPro

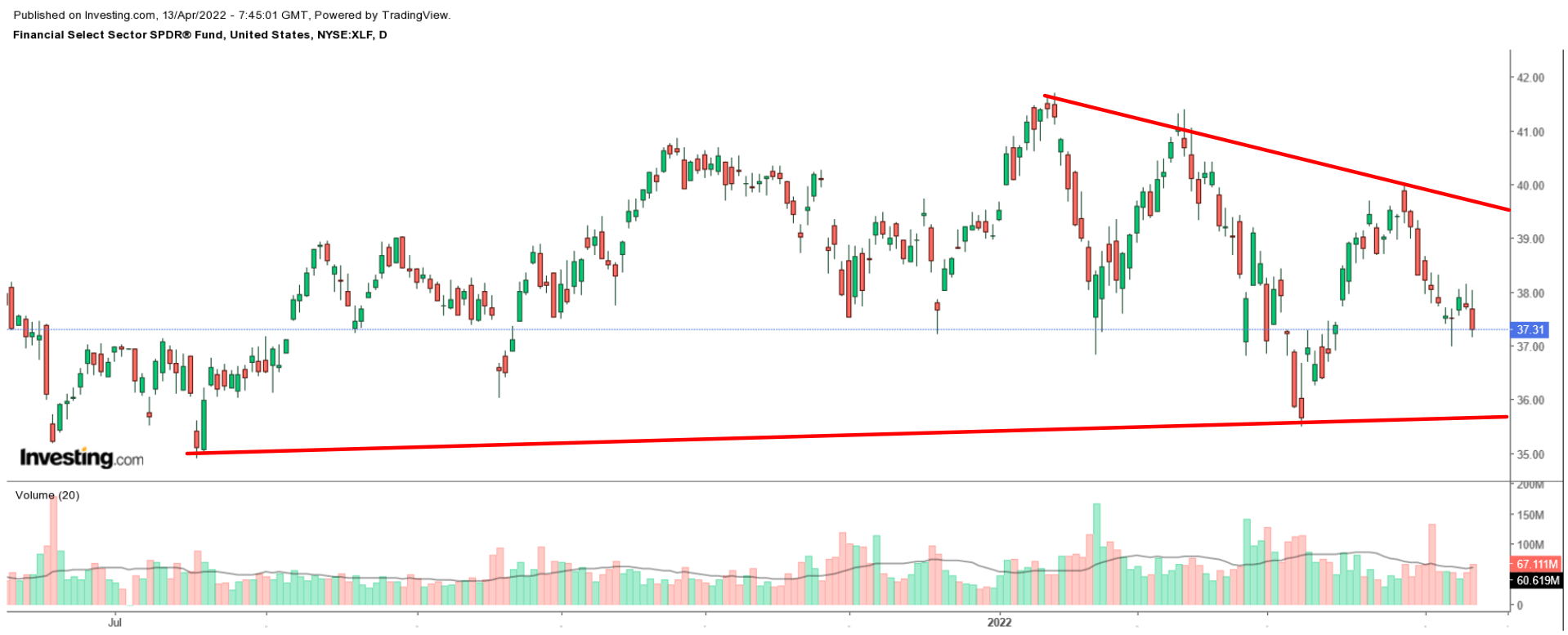

The Financial Select Sector SPDR® Fund (NYSE:XLF) tracks a market-cap-weighted index of financial sector stocks drawn from the S&P 500, and it is down roughly 4.5% since the start of the year.

XLF’s top ten holdings include Berkshire Hathaway (NYSE:BRKa), JPM, Bank of America (NYSE:BAC), Wells Fargo, Morgan Stanley (NYSE:MS), Charles Schwab (NYSE:SCHW), American Express (NYSE:AXP), Citi, Goldman, and BlackRock (NYSE:BLK).