- Shares of artificial intelligence firm C3.ai are down more than 20% in January

- Despite recent overall declines in tech shares, C3.ai has also come under pressure following Q2 FY22 financials

- Long-term investors could consider investing around $22.

Shares of enterprise-level AI software group C3.ai (NYSE:AI) have declined about 83% in the past 52 weeks and about 20.5% since the start of the new year. By comparison, the Dow Jones US Software Index returned about 10.2% in the past 12 months, but declined 15.3% in January.

C3.ai, whose platform enables companies to build AI-powered applications, went public in December 2020, and started trading at $100. In a couple of weeks the stock hit a record high just shy of $185, a level that is now rapidly fading in the rear-view mirror.

AI stock closed at $23.46 on Wednesday. The 52-week range has been $22.56 - 176.94, while the market capitalization stands at $2.3 billion.

Digitalization trends during the pandemic have put machine learning and AI in the spotlight. Recent metrics suggest:

“Global artificial intelligence (AI) software revenue is forecast to reach $62.5 billion in 2022, an increase of 21.3 per cent from 2021.”

As a result, big tech names like Amazon (NASDAQ:AMZN), International Business Machines (NYSE:IBM) and Microsoft (NASDAQ:MSFT) are putting significant resources into the segment.

Meanwhile, smaller names like C3.ai are also developing their own technology and software platforms. Other AI stocks Wall Street watches include Palantir Technologies (NYSE:PLTR), Splunk (NASDAQ:SPLK), Uipath (NYSE:PATH) and Upstart (NASDAQ:UPST).

On Dec. 1, 2021, C3.ai issued second-quarter fiscal 2022 metrics. Revenue was $58.3 million, up 41% year-over-year. Of that amount, subscription revenue was $47.4 million, up 32% YoY. Adjusted net loss per share was 23 cents.

Its most important customer is the oil services group Baker Hughes (NYSE:BKR). In total, C3.ai had 104 customers during the quarter, up 63% from a year ago.

On the results, CEO Thomas M. Siebel said:

“We expanded our important relationship with Baker Hughes extending the contract term, significantly increasing its value, and securing that value as a guaranteed future C3 AI revenue stream.”

Prior to the release of its quarterly results, AI stock was trading around $35. On Jan. 24, it hit a record low of $22.56. Now, C3.ai shares are at $23.46.

What To Expect From C3.ai Stock

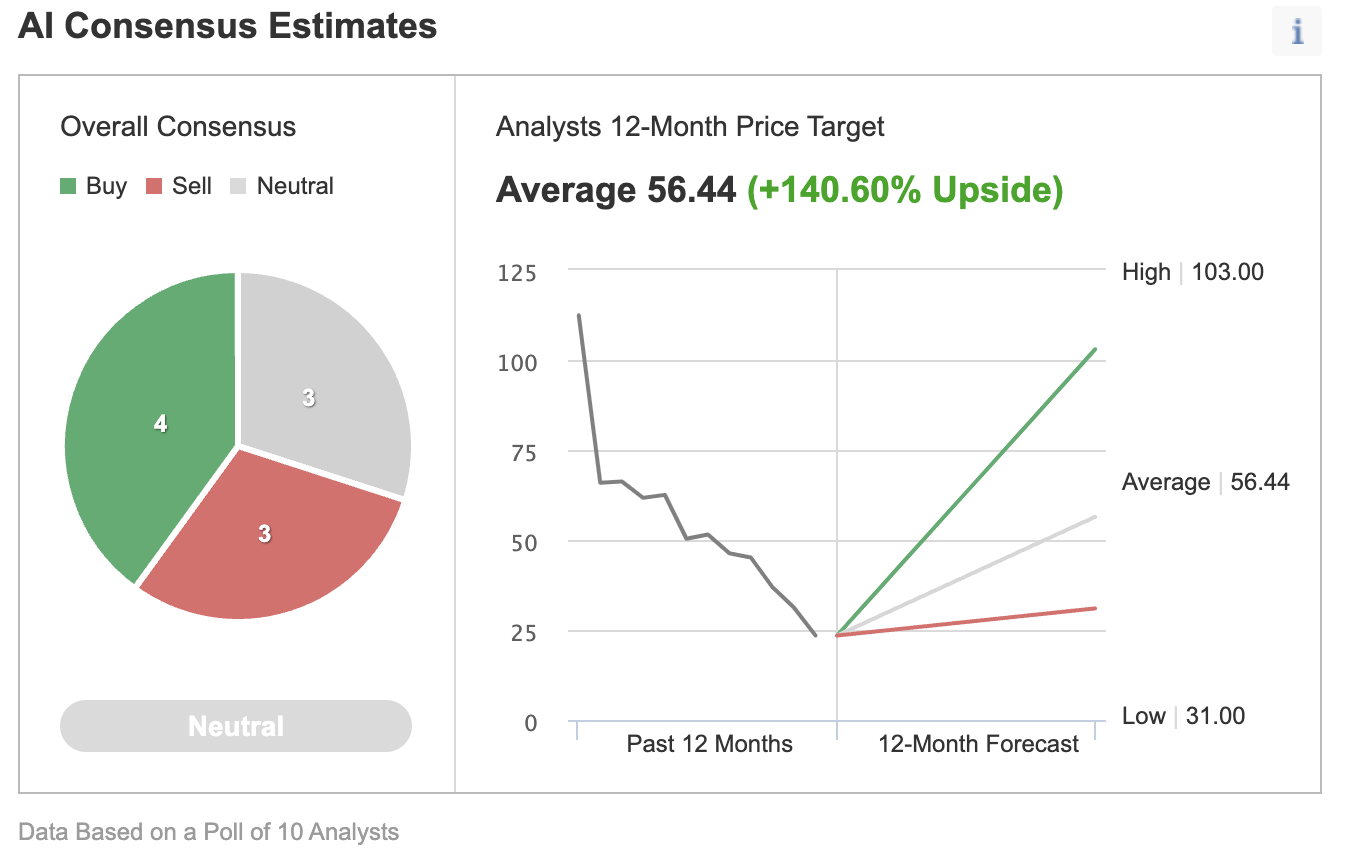

Among 10 analysts polled via Investing.com, AI stock has a “neutral" rating.

Analysts also have a 12-month median price target of $56.44 for the stock, implying an increase of more than 140% from current levels. The 12-month price range currently stands between $31 and $103.

Source: Investing.com

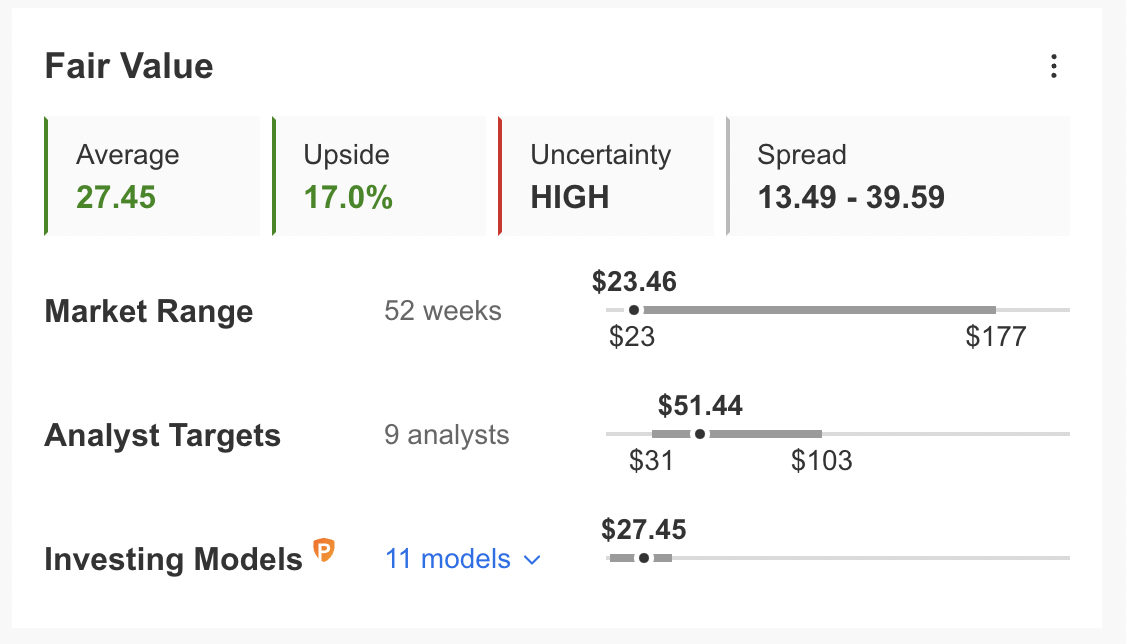

However, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for AI stock via InvestingPro stands at $27.45.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase around 17%.

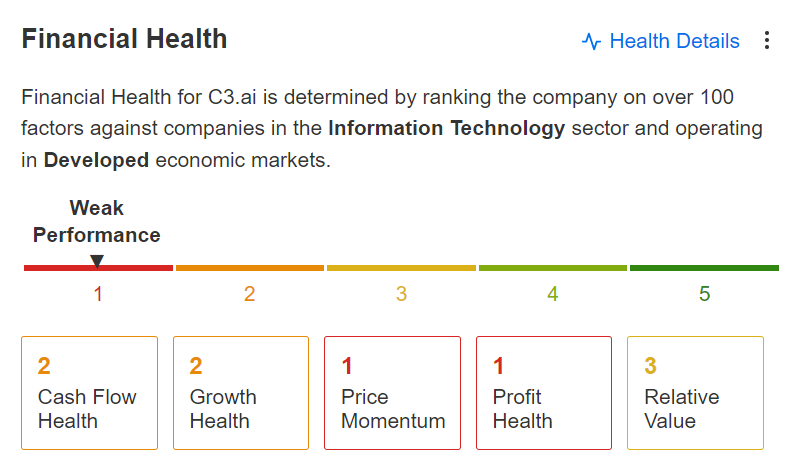

We can also look at C3.ai’s financial health as determined by ranking more than 100 factors against peers in the information technology sector.

Source: InvestingPro

In terms of cash flow and growth, it scores 2 out of 5. However, its overall score of 1 points to a weak performance ranking.

At present, AI stock’s P/B and P/S ratios are 2.5x and 11.9x. In comparison, those metrics for its peers stand at 8.2x and 11.5x. Put another way, despite the recent correction in prices of many tech shares, the industry does not yet offer great value.

Still, according to the Brookings Institution, more than 40 countries now have AI strategic plans. Therefore, the AI segment will likely be on Wall Street’s radar in the coming quarters. We expect many investors to take advantage of the significant declines in shares like C3.ai.

Adding AI Stock To Portfolios

C3.ai bulls who are not concerned about short-term volatility could consider buying into the declines. Their target price would be $27.45, which is the fair value indicated by InvestingPro.

Alternatively, investors could consider buying an exchange traded fund (ETF) that has AI stock as a holding. Examples would include:

- ProShares S&P Kensho Smart Factories ETF (NYSE:MAKX)

- Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ)

- Robo Global® Artificial Intelligence ETF (NYSE:THNQ)

- iShares Morningstar Small-Cap Growth ETF (NYSE:ISCG)

Finally, investors who believe the decline in C3.ai stock will come to an end soon might consider selling a cash-secured put option in AI stock—a strategy we regularly cover. As it involves options, this set-up is not appropriate for all investors.

Cash-Secured Put Selling

Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own AI shares for less than their current market price at $23.46.

This strategy may be appropriate when investors are slightly bullish or neutral on C3.ai stock at this time. Selling cash-secured put options on AI would generate income as the seller receives a premium.

For instance, if investors sold the $22.50 strike put that expires on Apr. 14, they could collect about $2.65 in premiums. Therefore, the maximum return for the seller on the day of expiry would be $265, excluding trading commissions and costs, if the option expires worthless.

If the put option is in the money (meaning AI stock is lower than the strike price of $22.50) any time before or at expiration on April 14, this put option can be assigned.

The put seller would then be obligated to buy 100 shares of C3.ai stock at the put option strike price of $22.50 for a total of $2,250 per contract. In that case, the trader ends up owning AI stock for $22.50 per share.

If the put seller gets assigned AI shares, the maximum risk is similar to that of stock ownership (in other words, the stock could theoretically fall to zero) but is partially offset by the premium received ($265 for 100 shares).

The break-even point for our example is the strike price ($22.50) less the option premium received ($2.65), i.e., $19.85. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on any choppiness in C3.ai stock in the coming weeks, especially around the earnings release.

Investors who end up owning AI shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.

Bottom Line

Shares of the enterprise AI software company C3.ai are well off record highs of almost $185 seen in December 2020. Wall Street has been concerned about the company's lack of a clear path to profitability as well as the overreliance on Baker Hughes, its biggest customer.

As most tech shares get ready to end a month to forget, AI stock now offers better value for long-term investors. Therefore, interested readers with a two- to three-year time horizon could consider buying the dip in C3.ai stock.