- Chinese markets have bounced back in May.

- Key indexes like the CSI 300 and Hang Seng have surged recently.

- Is this a temporary rally or the start of a new era for Chinese equities?

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The Chinese economy has defied expectations, surging back to growth in recent months. This newfound optimism has rippled through the stock market, sending key indexes soaring.

China's benchmark Shanghai Shenzhen CSI 300 and the Shanghai Composite are both up over 16% and 18% respectively, clawing back from their lows set earlier this year.

Hong Kong's Hang Seng index hasn't been left behind, climbing an impressive 20.5% in the past three months.

But is this just a temporary blip in the long bear market, or the dawn of a new era for Chinese equities? What should investors who have patiently waited for the bear market's end do now?

Let's delve into that further in the sections ahead.

Growth Engine Restarted: China Pumps Up the Economy

The recent stock market recovery appears tightly linked to a new chapter unfolding in China's economy. After disappointment over sluggish growth projections for 2024, President Xi Jinping is determined to reignite the economic engine – and he's pulling out all the stops.

Following a plan to bolster the real estate sector, a cornerstone of China's past economic boom, Beijing unveiled a record-breaking $47.5 billion mega-fund dedicated to chip development. This represents the largest such investment ever approved by the People's Republic and further strengthens the "Big Fund" initiative launched in 2014 to propel China's dominance in this critical technology sector.

In essence, Beijing is opening its wallet wide open to solidify its economic foundation and compete head-to-head with the United States in the race for technological leadership. The results are already evident - China's first-quarter GDP growth of 5.3% exceeded analysts' predictions of 4.8%.

Abundance of Bargains on the Chinese Stock Market

The wave of liquidity unleashed by China could spill over significantly into the stock market, where several attractive, undervalued companies with long-term potential can be found.

1. Alibaba

One such example is Alibaba (NYSE:BABA), a name that has long piqued investor interest, but whose performance has mirrored the broader market's lackluster showing.

Analyzing Alibaba using InvestingPro reveals an over 8% rally in the past three months. However, analysts suggest this could just be the beginning.

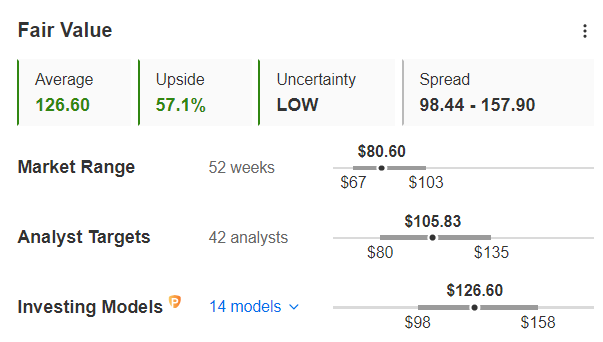

Source: InvestingPro

Based on the Fair Value calculated by InvestingPro based on 14 recognized investment models adapted to Alibaba's characteristics, the stock is undervalued, with a growth potential of more than +57% from $80.60 per share at the May 28 close.

In addition, analysts also agree on the bullish trajectory the stock could follow in the next 12 months, setting BABA's target price above $105.

Source: InvestingPro

2. JD.com

The same holds true for another major stock in the Chinese market, JD.com (NASDAQ:JD).

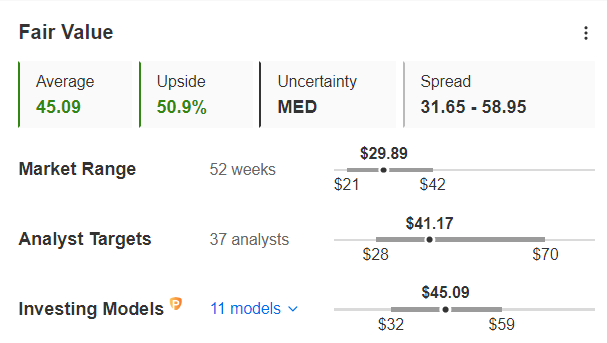

The e-commerce company has a Fair Value of $45.09 per share, which makes the stock markedly undervalued according to InvestingPro's analysis with a potential upside of 50.9%.

Similarly, the 37 analysts surveyed expect the stock to make a big jump over the next 12 months, from $29.89 on May 28 to $41.17.

Source: InvestingPro

How to Find Undervalued Stocks

Don't be fooled by short rallies – just like one swallow doesn't guarantee summer, a brief upswing doesn't confirm a bull market. But as the two examples we explored show, uncovering investment opportunities doesn't require extensive digging.

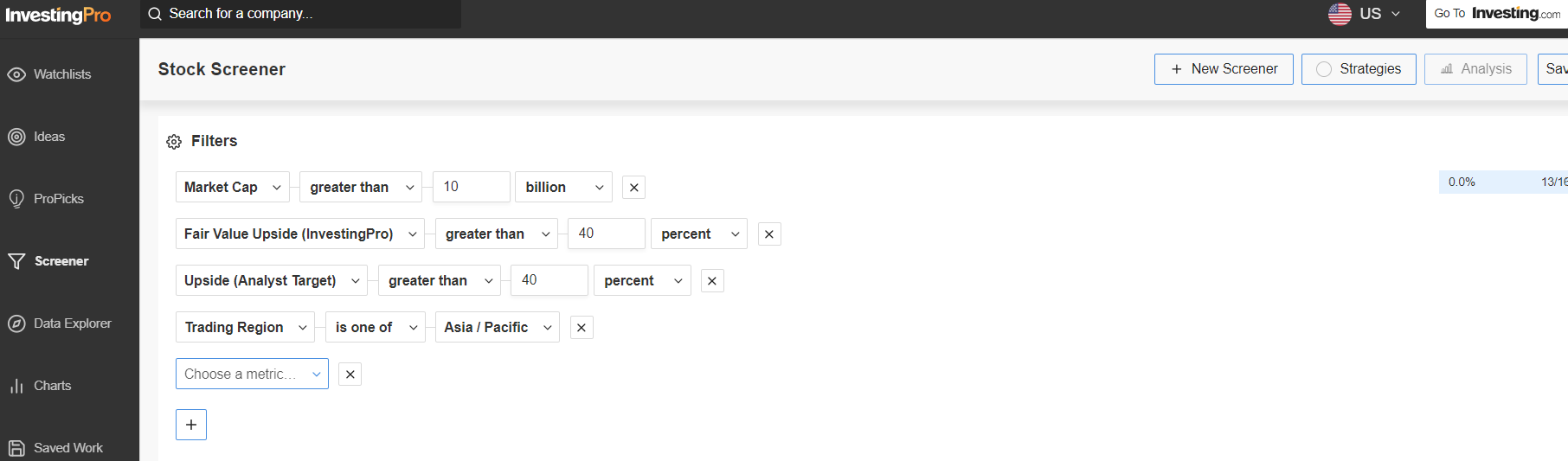

The key lies in having the right tools, and InvestingPro's stock screener fits the bill perfectly. If you're a subscriber, you can replicate the search in the image below. Using filters like Fair Value and Target Price uplift, you can easily pinpoint the most undervalued stocks in the Chinese market.

Source: InvestingPro

No InvestingPro+ subscription? No worries! Subscribing today grants you access to FAIR VALUE and comprehensive financial data for over 180,000 publicly traded companies worldwide.

China's New Era: Time to Buy or Beware?

The old adage "sell in May and go away" might not hold true for Chinese markets this year. Investors who follow this traditional advice could miss out on potential gains as China enters a new economic phase.

Instead, consider strategically restructuring your portfolio to identify companies positioned to benefit from Beijing's recent expansionary policies.

While challenges like an aging population and slowing productivity remain, the overall sentiment seems positive. China may be poised for a return to growth, perhaps at a slower pace than before, but potentially on a more sustainable and stable foundation.

Just today, the International Monetary Fund (IMF) revised its growth estimates for China upwards by 0.4 percentage points for both 2024 and 2025.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.