- U.S. jobs report, Fed rate outlook in focus this week.

- Walmart stock is a buy ahead of investor day event.

- Levi shares are set to struggle on weak profit and sluggish outlook.

Stocks on Wall Street rallied on Friday to end an action-packed week, month, and quarter as fears over a banking crisis ebbed, and signs of cooling inflation boosted hopes the Federal Reserve might soon end its rate-hiking cycle.

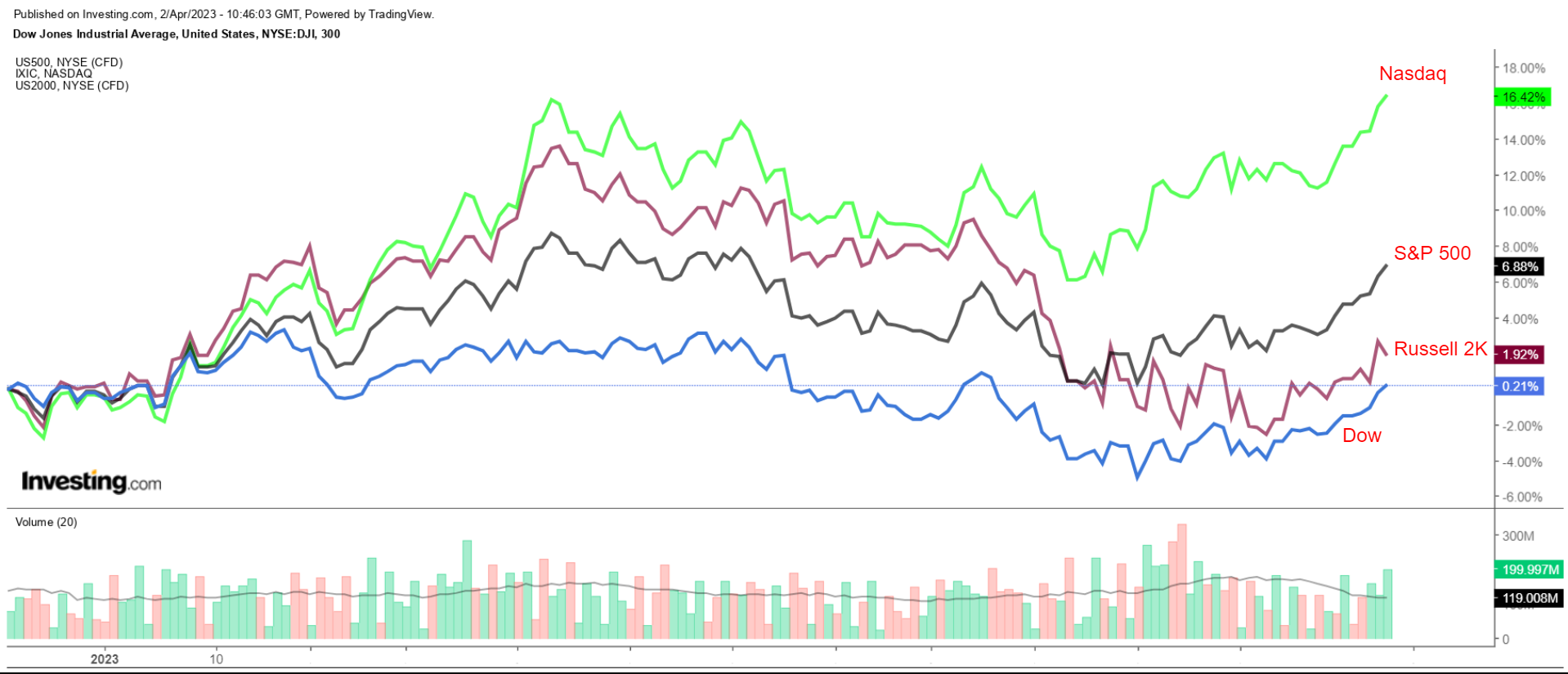

For the week, the blue-chip Dow Jones Industrial Average rose 3.2%, the benchmark S&P 500 climbed 3.5%, while the tech-heavy Nasdaq Composite and the small-cap Russell 2000 advanced 3.4% and 3.9%, respectively.

U.S. stocks also posted strong gains for the month. The Dow tacked on 1.9% in March, the S&P 500 added 3.5%, while the Nasdaq surged 6.7%.

Finally, for the first quarter: the Nasdaq jumped 16.8% to notch its biggest quarterly percentage increase since 2020. The S&P 500 gained 7% in the first three months of 2023, while the Dow inched higher by 0.4%.

The quarterly gains came despite signs of turmoil in the banking sector following the collapse of two regional lenders and a forced takeover of Credit Suisse (NYSE:CS) which fueled fears about a bigger financial crisis.

The holiday-shortened week ahead will be another eventful one as the market continues to assess the outlook for interest rates, the economy and inflation.

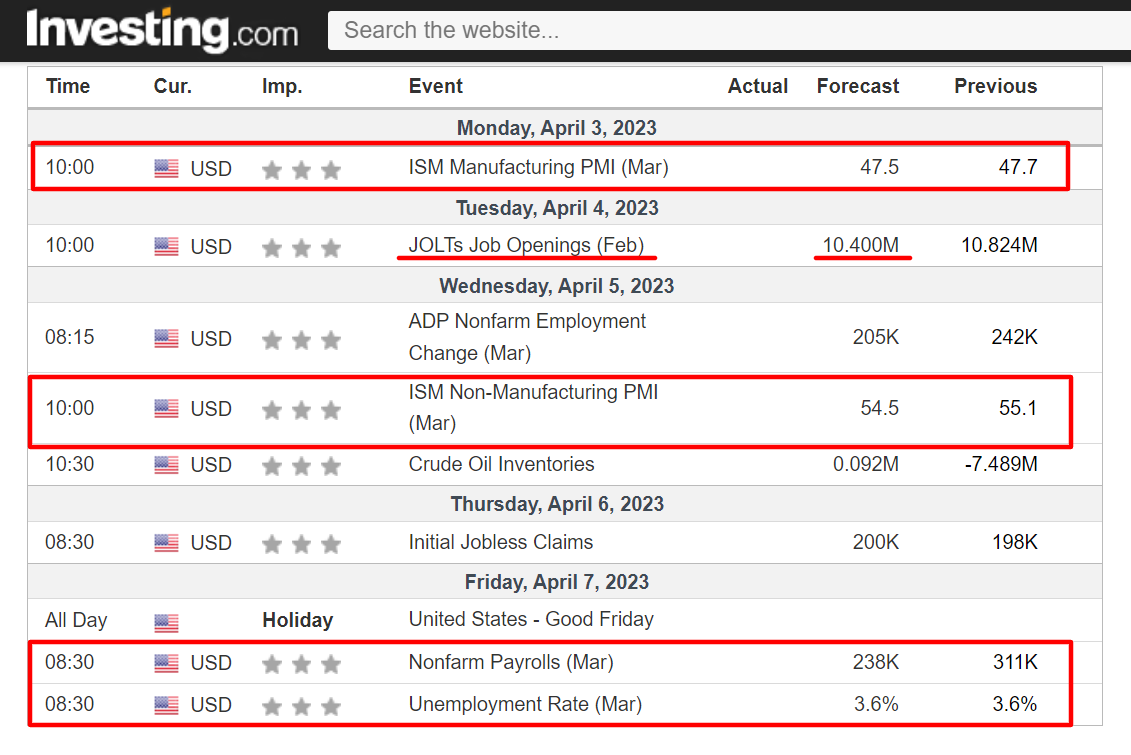

The U.S. jobs report for March will be released on Friday despite the stock market being closed for observance of the Good Friday holiday. As such, there won't be a Wall Street reaction to the labor data until the following Monday.

According to Investing.com, nonfarm payrolls are forecast to rise by 238,000 for the month, following a 311K increase in February and a 517K jump in January. The unemployment rate is seen holding steady at 3.6%.

The Institute for Supply Management's (ISM) manufacturing survey index is scheduled for Monday, followed by the ISM service-sector PMI on Wednesday.

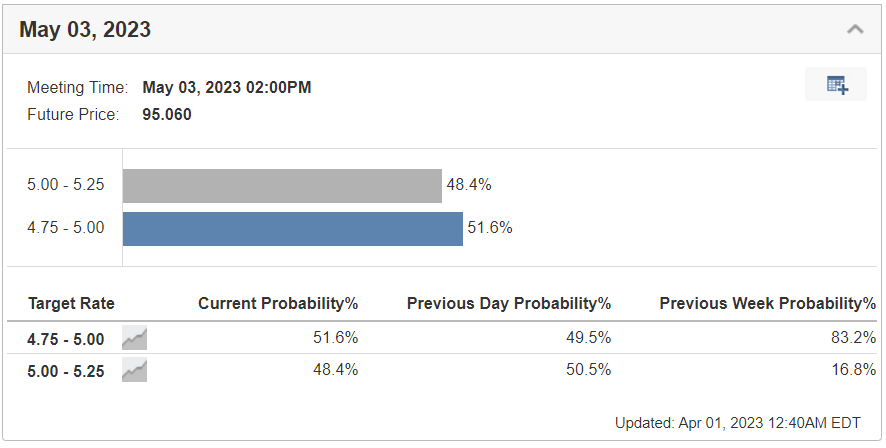

The data will be key in determining the Federal Reserve’s next policy move. Currently, financial markets are pricing in a 52% chance on no action at the next FOMC meeting on May 3 and a 48% chance of a quarter-point increase, according to Investing.com’s Fed Rate Monitor Tool.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see further downside.

Remember though, my timeframe is just for the week ahead, April 3-7.

Stock to Buy: Walmart

After ending the week at a fresh 2023 year high, I expect shares of Walmart (NYSE:WMT) to extend their uptrend in the days ahead - with a potential breakout to a new 52-week peak on the horizon - as the retail giant hosts its highly anticipated "Investment Community Meeting" event.

The two-day annual conference kicks off on Tuesday, April 4 in Florida and will be broadcast live on the Walmart website.

Walmart’s president and chief executive officer Doug McMillon, executive vice president and chief financial officer John David Rainey, and the company's business unit CEOs for Walmart U.S., Walmart International and Sam's Club are all set to deliver presentations on Wednesday, April 5, starting at 8:00AM ET.

The Walmart leadership team is expected to discuss the mega-retailer’s strategic plans and long-term financial growth targets and provide investors with details on new product and service initiatives. The Bentonville, Arkansas-based discount retailer also plans to deliver updated financial guidance for 2023.

The company’s investor day meetings have a history of moving Walmart’s stock, often resulting in sizable single day moves. Shares have rallied in the past when new growth initiatives were announced at the annual event.

WMT stock ended Friday’s session at $147.45, its highest closing price since Dec. 13, 2022. Shares currently stand less than 9% away from a record high of $160.77 reached in April 2022.

At current levels, Walmart has a market cap of $397.5 billion, earning it the status of the world’s most valuable brick-and-mortar retailer and the 13th largest company trading on the U.S. stock exchange, ahead of names like JPMorgan Chase (NYSE:JPM), Procter & Gamble (NYSE:PG), Mastercard (NYSE:MA), and Chevron (NYSE:CVX).

Year-to-date, Walmart’s stock is up 4%, broadly in line with the 4.9% gain recorded by the Retail Select Sector SPDR Fund (XRT), which tracks a broad-based, equal-weighted index of U.S. retail companies in the S&P 500.

The big-box retailer - which operates more than 5,000 stores across the country - has managed to weather the current operating climate better than most of its peers as it benefits from ongoing changes in consumer behavior due to lingering inflationary pressures that is causing disposable income to shrink.

Stock to Sell: Levi Strauss

I believe Levi’s (NYSE:LEVI) stock will suffer a difficult week ahead, as the denimwear company’s latest earnings report will likely reveal a sharp profit slowdown due to the tough economic environment that has weighed on demand for its clothing.

Underscoring several near-term headwinds Levi’s faces amid the current macro backdrop, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the report, with analysts cutting their EPS estimates eight times in the past 90 days, compared to just one upward revision.

Market participants expect a sizable swing in LEVI shares following the update - which is due ahead of Thursday’s opening bell - with a possible implied move of roughly 6% in either direction, according to the options market.

Outsmart the market with InvestingPro:

Consensus expectations call for the jeans manufacturer to post first quarter earnings of $0.33 per share, as per Investing.com, shrinking 28.2% from EPS of $0.46 in the year-ago period. Revenue is seen up about 1.5% year-over-year to $1.61 billion amid the uncertain demand environment.

That leads me to believe that Levi’s management could strike a cautious tone in its guidance for the year ahead to reflect declining operating margins and higher cost pressures as it cuts prices in an ongoing effort to clear unsold inventory from its shelves.

LEVI shares - which have gained roughly 17% since the start of 2023 - ended at $18.23 on Friday. At current levels, the San Francisco-based company has a market cap of about $7 billion.

Despite the strong year-to-date performance, shares have underperformed the broader market over the past 12 months, falling nearly 12% compared to the S&P 500’s 10% decline over the same timeframe.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (NYSE:SPY), and the Invesco QQQ Trust (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.