- Fed rate cut, FOMC dot-plot, Powell comments will be in focus this week.

- Salesforce is a buy as it holds its annual ‘Dreamforce’ event.

- General Mills is a sell with weak earnings, soft guidance on deck.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro for less than $8 a month!

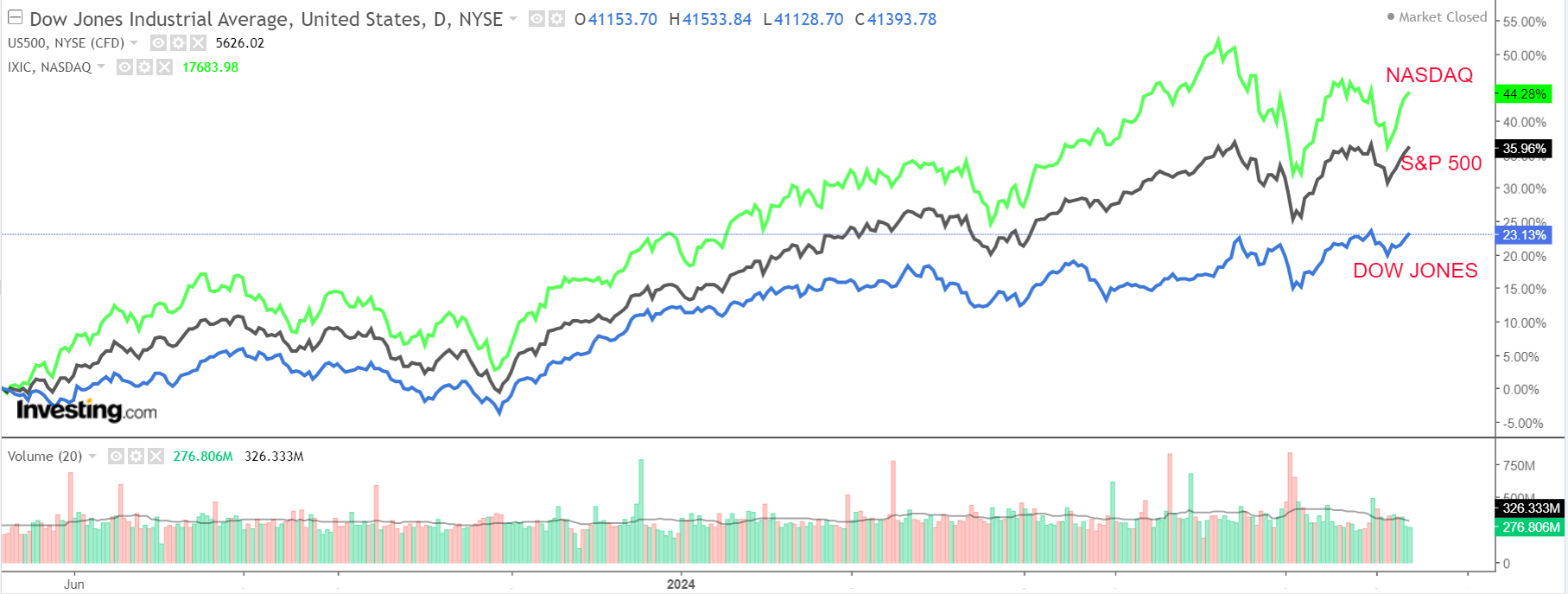

U.S. stocks ended higher on Friday, with the S&P 500 and the Nasdaq Composite posting their best week of 2024 ahead of the upcoming Federal Reserve meeting.

For the week, the benchmark S&P 500 rose 4% while the tech-heavy Nasdaq rallied 6%. The blue-chip Dow Jones Industrial Average climbed 2.6% during the period.

Source: Investing.com

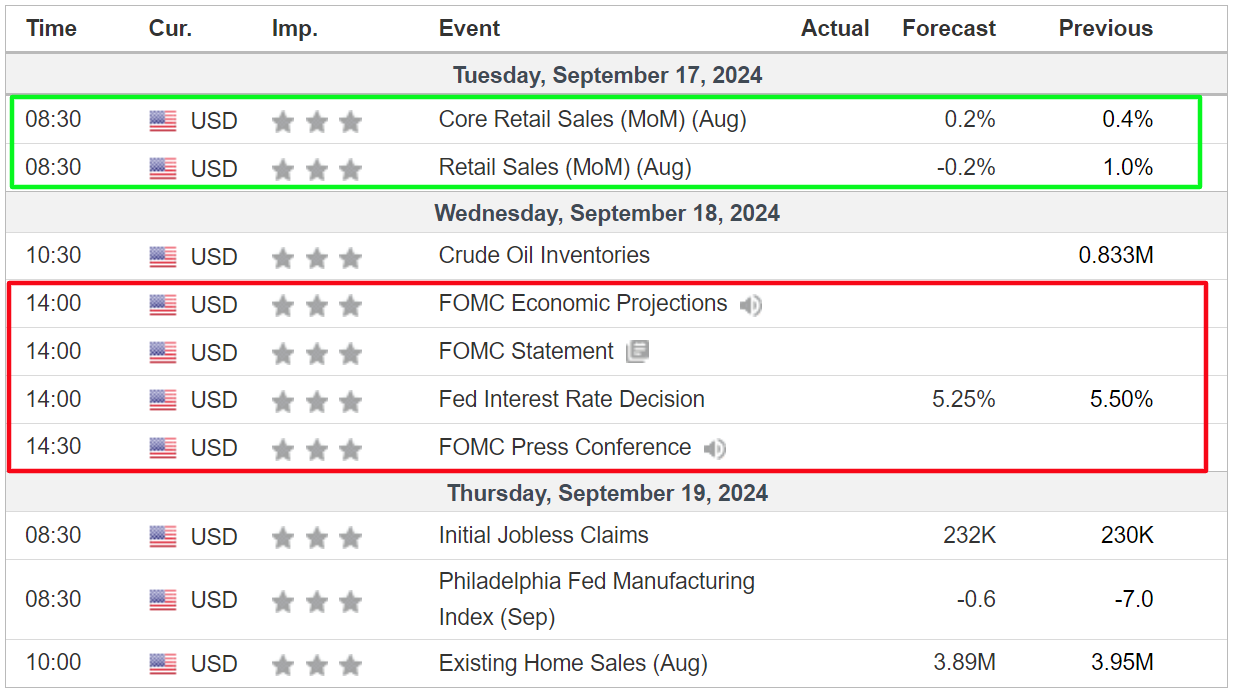

The blockbuster week ahead is expected to be an eventful one filled with several market-moving events, including the Federal Reserve’s latest monetary policy meeting. An official statement is due at 2:00PM ET on Wednesday. Fed chair Jerome Powell will speak at 2:30PM ET.

With a rate cut assured, the key question is the size of the move. At the time of publication, futures trading implied a 50%-50% chance for either a 25-basis point cut or a super-sized 50-bps reduction, according to Investing.com’s Fed Monitor Tool.

Meanwhile, on the economic calendar, most important will be Tuesday’s U.S. retail sales report for August, which will shed further light on the health of the economy.

Source: Investing.com

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including FedEx (NYSE:FDX), Lennar (NYSE:LEN), General Mills (NYSE:GIS), and Darden Restaurants (NYSE:DRI) as Wall Street’s reporting season draws to a close.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, September 16 - Friday, September 20.

Stock to Buy: Salesforce

Salesforce (NYSE:CRM) stands out as a top buy this week, with its highly anticipated 'Dreamforce 2024' event set to be a major catalyst for the stock.

Dreamforce is Salesforce's flagship conference, running from Tuesday through Thursday in San Francisco, and will feature high-profile speakers like Salesforce CEO Marc Benioff, AMD (NASDAQ:AMD) CEO Dr. Lisa Su, and FedEx CEO Raj Subramaniam.

One of the most anticipated sessions will be with Nvidia (NASDAQ:NVDA) CEO Jensen Huang, who will discuss the future of AI along with Benioff on Tuesday at 7:15PM EST / 4:15PM PDT.

Salesforce aims to further win over Wall Street with the introduction of "Agentforce," a new AI-driven product designed to automate routine business tasks and provide intelligent business guidance. These AI agents will integrate Salesforce’s vast customer data with partner data, offering comprehensive solutions to enhance customer relationship management (CRM) experiences.

Given the growing demand for AI solutions in enterprise software, Salesforce’s new products could drive further growth, making it a solid buy heading into the event.

Shares of Salesforce tend to rally during the week of its annual ‘Dreamforce’ event. The enterprise software giant has a history of attracting several analyst upgrades in the wake of its conference presentations.

Source: Investing.com

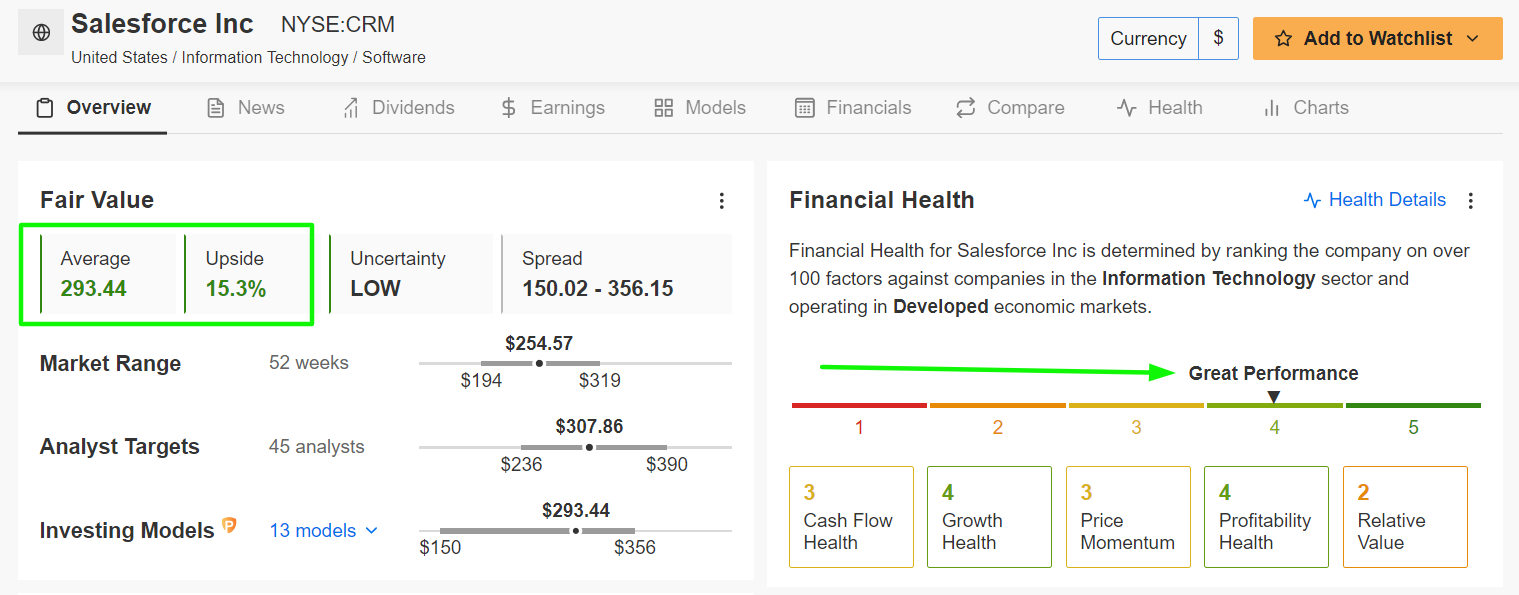

CRM stock ended Friday’s session at $254.57, about 20% below its all-time high of $318.71 reached on March 1. At its current valuation, Salesforce has a market cap of $243.3 billion.

Shares - which are one of the 30 components of the Dow Jones Industrial Average - have lost 3.3% in the year to date, while the Dow has gained 9.8%.

It should be noted that CRM is extremely undervalued as per the AI-powered quantitative models in InvestingPro and could see an increase of 15.3% from Friday’s closing price to its ‘Fair Value’ target of about $293.

Source: InvestingPro

Furthermore, Salesforce boasts an above-average Financial Health Score, supported by its robust profitability outlook, strong sales growth prospects, and reasonable valuation.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now to InvestingPro with an exclusive discount and position your portfolio one step ahead of everyone else!

Stock to Sell: General Mills

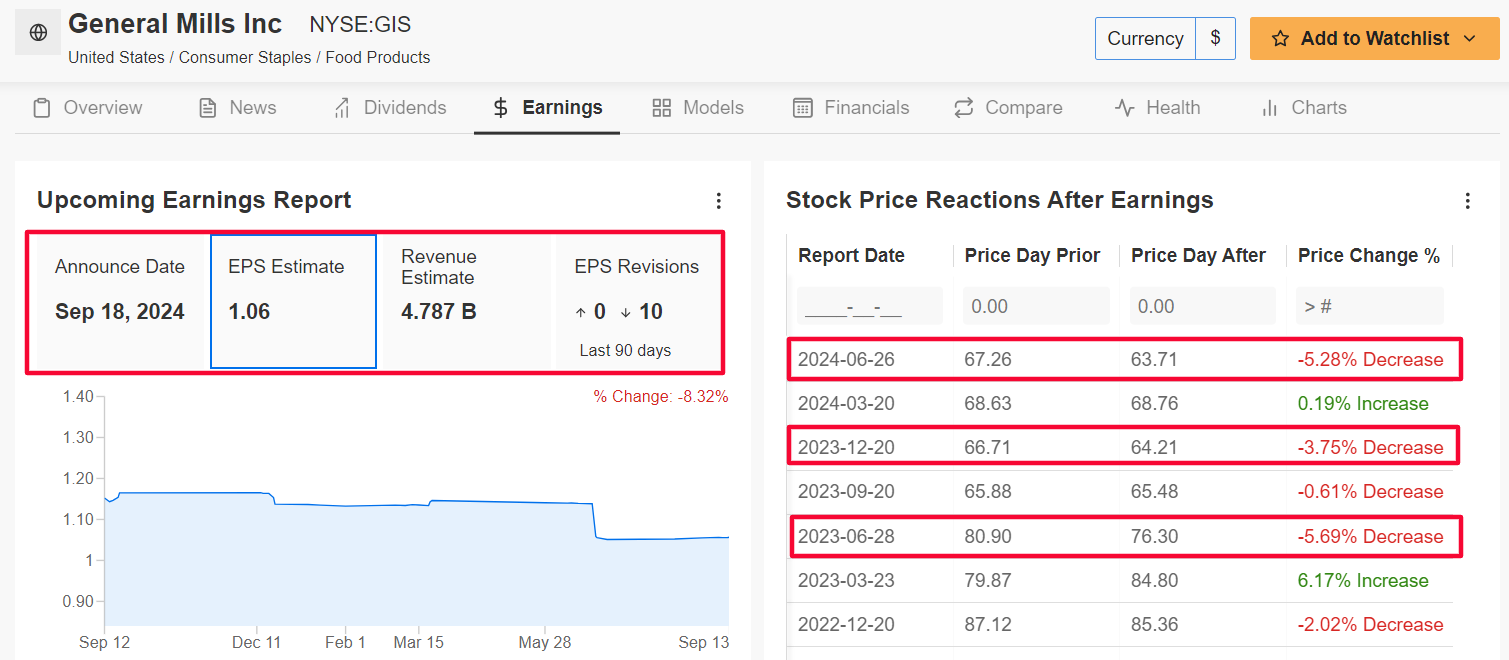

On the flip side, General Mills appears to be a stock to sell this week as it prepares to report its fiscal first-quarter earnings update amid the challenging operating environment.

The food manufacturing giant is facing increasing headwinds that are expected to drag down its results, which are scheduled to be released on Wednesday at 7:00AM ET.

General Mills, known for its household brands like Cheerios, Wheaties, Häagen-Dazs, Pillsbury, Betty Crocker, and Yoplait, is grappling with weakening consumer demand and rising costs in key markets.

Market participants expect a sizable swing in GIS stock after the print drops, according to the options market, with a possible implied move of 4.1% in either direction.

Earnings have been catalysts for outsized swings in shares this year, as per data from InvestingPro, with General Mills’ stock gapping down 5% when the company last reported quarterly numbers in late June.

Source: InvestingPro

As could be expected, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the print. All ten of the analysts covering the company slashed their profit estimates in the past 90 days as Wall Street grows increasingly bearish on the consumer-foods company.

Wall Street sees the Minneapolis-based food conglomerate earning a profit of $1.06 a share in the August quarter, declining 3% from EPS of $1.09 in the year-ago period, due to higher cost pressures and declining operating margins.

Meanwhile, revenue is forecast to inch down 2.5% annually to $4.78 billion, reflecting slowing sales across its core products, including breakfast cereals, snack bars and pet food products in North America, Brazil, and China.

Additionally, soft guidance is expected for the next quarter as the company continues to face margin compression and competitive pressure due to the tough macro climate.

Inflationary pressures have persisted longer than expected, and consumers around the world are pulling back on spending for essentials as prices remain elevated.

Source: Investing.com

GIS stock closed at $73.75 on Friday, valuing the company at $41 billion. Shares are up 13.1% in 2024.

It is worth mentioning that InvestingPro paints a negative picture of General Mills’ stock, citing concerns over declining profit and sales growth prospects.

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and unlock access to several market-beating features, including:

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- AI ProPicks: AI-selected stock winners with proven track record.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.