Nvidia, Warner Bros Discovery and CVS Health rise premarket; Toll Brothers falls

- Nonfarm payrolls, PCE inflation data, Powell speech, more earnings in focus

- Shopify is a buy after record-breaking holiday shopping weekend

- Xpeng stock set to struggle amid weak earnings, COVID-related headwinds

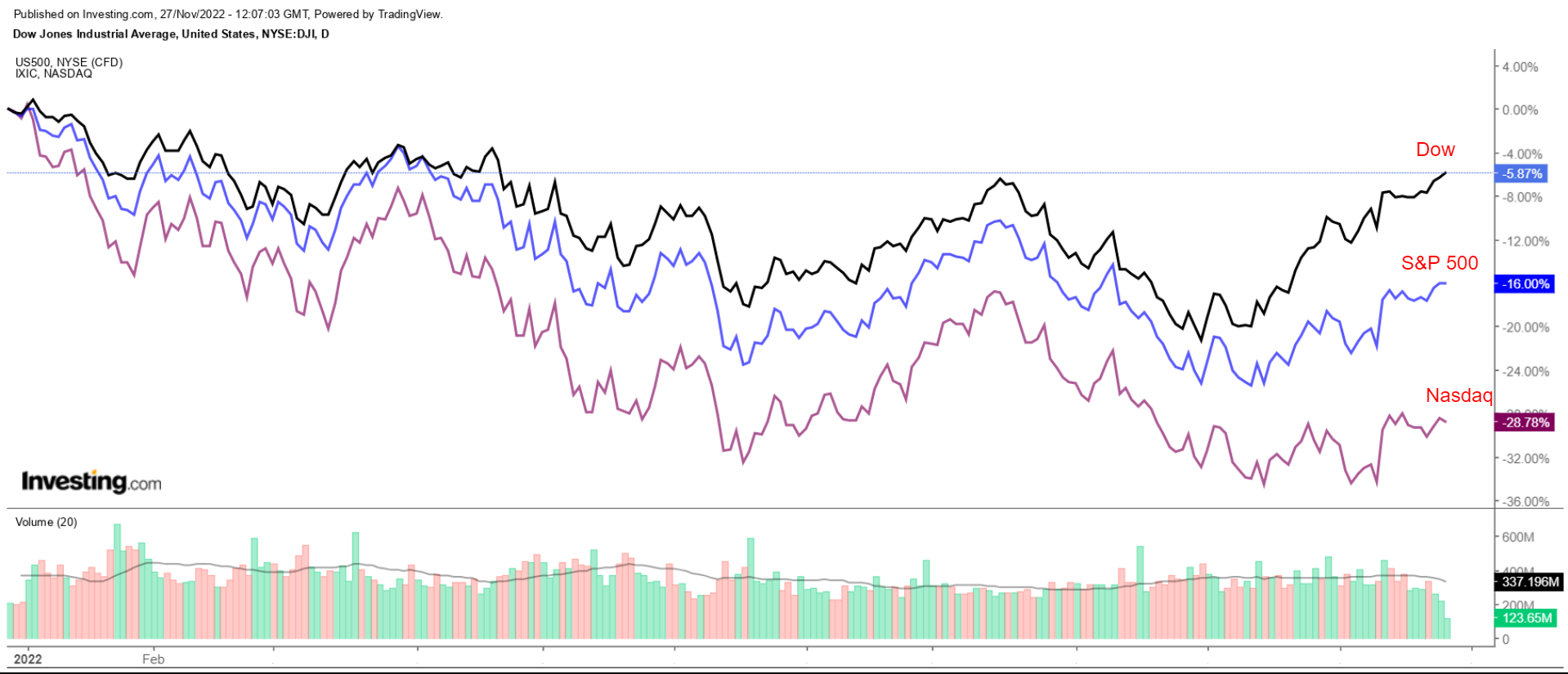

Stocks on Wall Street ended mixed in a holiday-abbreviated trading session on Friday, but the major indices still closed the week higher as investors cheered indications that the Federal Reserve may soon slow the pace of interest rate hikes.

For the week, the blue-chip Dow Jones Industrial Average rose 1.8%, while the benchmark S&P 500 and technology-heavy Nasdaq Composite advanced 1.5% and 0.7% respectively.

The S&P 500 is now up roughly 15% from a mid-October low, however it remains about 16% lower for the year, on course for its biggest annual decline since 2008.

Source: Investing.com

The week after Thanksgiving will be a relatively busy one, filled with economic data, Fed speakers, and more earnings.

On the economic calendar, most important will be Friday’s U.S. employment report for November, which is forecast to show solid job gains but a slowing from October’s growth. The personal consumption expenditures (PCE) price index - which is the Fed’s preferred inflation measure - is also on the agenda.

There’s also a flurry of Fed speakers scheduled, including Fed Chair Jerome Powell, who is scheduled to deliver a speech on the economic outlook at a Brookings Institution event Wednesday.

Elsewhere, the corporate earnings season continues, albeit at a lighter pace. Some of the more notable companies on tap are Salesforce (NYSE:CRM), CrowdStrike (NASDAQ:CRWD), Intuit (NASDAQ:INTU), Marvell (NASDAQ:MRVL), Dollar General (NYSE:DG), Five Below (NASDAQ:FIVE), Kroger (NYSE:KR), and Ulta Beauty (NASDAQ:ULTA).

Regardless of which direction the market goes, below we highlight one stock likely to be in demand in the coming days and another that could see fresh losses.

Remember though, our time frame is just for the week ahead.

Stock To Buy: Shopify

I expect Shopify's (NYSE:SHOP) stock to outperform in the week ahead, with a potential breakout above a key chart level on the horizon, as the e-commerce company is anticipated to be among the big winners from the record-breaking holiday shopping season.

Shopify announced a record-setting Black Friday, with sales of $3.36 billion from the start of the shopping event in New Zealand through the end of the day in California. The tally marked a +17% year-over-year (yoy) increase in sales over Black Friday in 2021, or +19% yoy on a constant-currency basis.

The e-commerce giant noted that at its peak, merchants on Shopify collectively saw sales of $3.5 million per minute at 12:01 PM ET on Black Friday.

“Black Friday and Cyber Monday have grown into a full-on shopping season. The weekend that started it all is still one of the biggest commerce events of the year, and our merchants have broken Black Friday sales records again,” said Harley Finkelstein, president of Shopify.

Indeed, the U.S. holiday shopping season has gotten off to a strong start so far. Shoppers spent a record $9.12 billion in online sales on Black Friday, an increase of 2.3% from a year ago, according to Adobe Analytics. Black Friday shoppers also broke a record for mobile orders, as 48% of online sales were made on smartphones, up from 44% last year.

E-commerce activity is expected to remain robust in the coming days, according to Adobe, as consumers await the year’s biggest online shopping day, Cyber Monday, which is expected to drive $11.2 billion in online spending. If confirmed, that would mark a yoy increase of 5.1%.

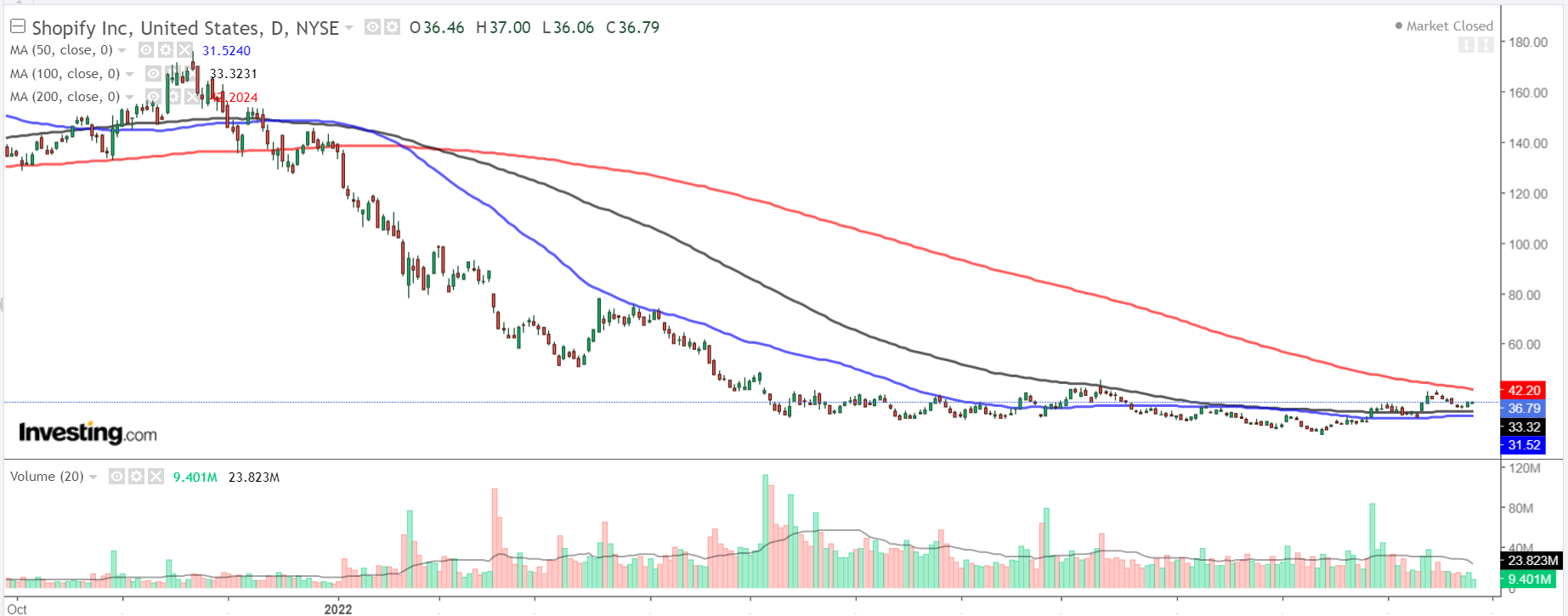

Source: Investing.com

Shopify has seen its stock collapse 73% year to date as the once-high-flying name has fallen out of favor with investors against a difficult macro backdrop of higher interest rates and soaring inflation.

Even as SHOP remains down sharply for the year, shares have rebounded significantly since falling to a recent 52-week low of $23.63 in mid-October, having risen 55.7% over the past six weeks.

From a technical standpoint, Shopify's stock, which has shown indications of bottoming, made a strong push above its 50-day moving average (DMA) at the $30-to-$32 level. It is now knocking on the door of its 200 DMA, a key chart level that hasn't been breached since Dec. 30, 2021.

Source: Investing.com

At current levels, the Ottawa, Canada-based e-commerce specialist - which is still about 80% away from its record peak of $176.29 touched in November 2021 - has a market cap of $46.8 billion.

Stock To Dump: Xpeng

Xpeng (NYSE:XPEV) will suffer a challenging week, in my opinion, with shares likely to fall to a new all-time low, as investors react to a plethora of negative developments plaguing one of China’s largest electric-vehicle (EV) makers.

The Guangzhou, China-based company has seen its stock plunge 86% in 2022 as Beijing’s drastic measures to contain a resurgence in COVID cases have disrupted supply chains and limited output at Xpeng production factories across the country.

XPEV stock ended Friday’s session at $7.07, not far from a recent record low of $6.18 touched on Nov. 2. Shares are roughly 88% away from their November 2020 peak of $74.49, earning the EV maker a valuation of $6.1 billion.

Source: Investing.com

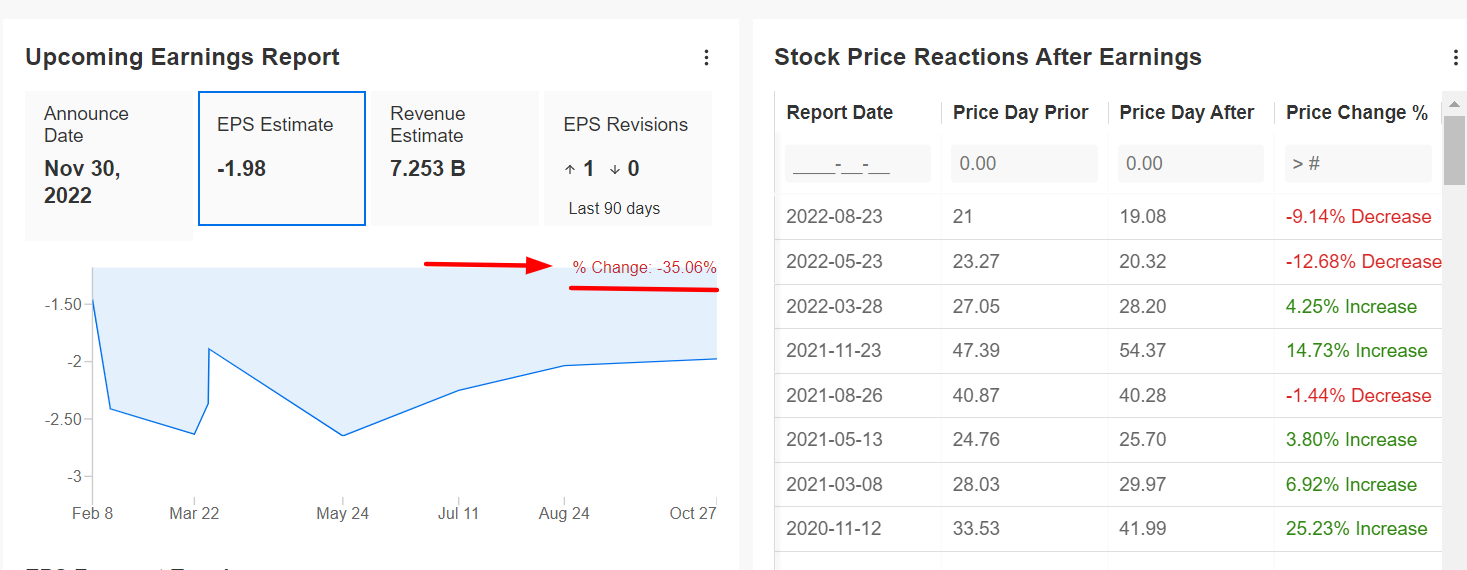

Despite the aggressive reset in its valuation, I believe that XPEV is vulnerable to further losses in the week ahead as it prepares to release its latest financial results before the U.S. market opens on Wednesday, Nov. 30.

Indeed, an InvestingPro+ survey of analyst earnings revisions reveals growing pessimism ahead of Xpeng's report, with analysts slashing this quarter’s estimates by 35.1% in the past 90 days.

Consensus estimates call for Xpeng to announce a loss per share of -¥1.98 (-$0.28) for the third quarter, worsening from a loss of -¥1.89 (-$0.26) in the year-ago period, amid the negative impact of China’s strict "zero-COVID" policy.

Revenue is expected to have risen 26.7% year over year to ¥7.25 billion ($1.01 billion), according to InvestingPro+.

Source: InvestingPro+

As per moves in the options market, traders are pricing in a significant swing of 11.6% in either direction for XPEV stock following the earnings update.

In my view, the weak results will likely lead Xpeng’s management to cut its Q4 guidance and delivery outlook to reflect higher cost pressures and declining operating margins amid intensifying competition from the likes of Nio (NYSE:NIO), Li Auto Inc (NASDAQ:LI), and BYD Co Ltd-H (OTC:BYDDF), as well as lingering COVID-related macroeconomic headwinds.

Disclosure: At the time of writing, Jesse is long on the Dow Jones Industrial Average, S&P 500, and Nasdaq 100 via the SPDR Dow ETF (NYSE:DIA), SPDR S&P 500 ETF (NYSE:SPY), and QQQ (NASDAQ:QQQ).

He is also long on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV).

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »