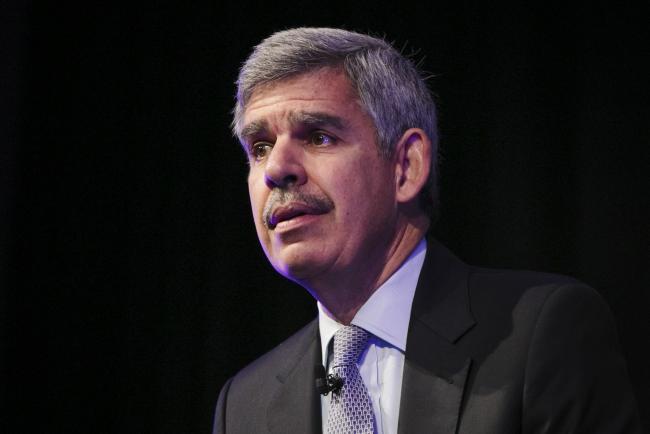

(Bloomberg) -- Mohamed El-Erian sees the rollercoaster ride in financial markets, with Friday’s surprisingly strong US jobs report producing the latest drop, as another lesson for Chairman Jerome Powell and his Federal Reserve colleagues.

“Once again, Fed communication has contributed to undue volatility in markets,” the Gramercy Funds chairman and Bloomberg Opinion columnist said on Bloomberg Television’s The Open. “While Chair Powell went out of his way to be balanced” in remarks earlier this week, “he did not push back in any way against what already was a significant rally in markets. While he said other things, including warning about inflation, he didn’t realize where the technicals of this marketplace were. He didn’t realize the behavioral aspects. And that’s why you got this overreaction.”

Rick Rieder, chief investment officer for global fixed income at BlackRock (NYSE:BLK) Financial Management Inc., also said on the BTV program that markets “got a little overzealous.” He advises investors “get comfortable” in parts of the credit market with highly rated securities of relatively short maturity yielding 5% to 6%, but to “be careful as you go down the credit stack, down the capital stack into equity.”

Stocks fell on Friday and two-year US Treasury yields -- which are more sensitive to imminent Fed rate moves -- rose to near 4.4% on the view that the Fed will keep tightening even if that means a recession down the road.

Swap traders increased their wagers on where the Fed rate will top out next year by more than 10 basis points to 4.97%. That’s from a current benchmark between 3.75% and 4%.

El-Erian said he expects the central bank “will guide us to above 5%” on its so-called terminal rate. “This is really tricky,” he added, “the Fed has to be very careful about what it communicates” to reduce volatility as it walks the line between arresting the fastest inflation in decades and keeping the economy from contracting.

Rieder agreed that “they need to get to about 5-ish,” adding “Rate volatility is the big dynamic. If that stabilizes, I don’t think it means big rallies in rates at all. It means more stability after what has been an incredibly tumultuous year.”

©2022 Bloomberg L.P.