Investing.com – The battle between Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) for the title of the world's highest market capitalization has been ongoing since early January, when the iPhone maker ceded the crown to the company founded by Bill Gates, only to reclaim it on June 12. A few days later, NVIDIA Corporation (NASDAQ:NVDA) joined the race, and with the help of artificial intelligence, managed to occupy the top spot for market cap worldwide, albeit for a single session.

After all this confusion, order has been restored and as of June 21, the ranking is:

- Microsoft: $3.312 trillion

- Apple: $3.215 trillion

- Nvidia: $3.214 trillion

Despite the absolute gap of almost $100 billion between the first and the third, at the exorbitant levels of these three US tech giants, the difference is actually minimal, to the point that the ranking could change again from one session to the next.

Microsoft among the first to believe in AI

Beyond its historic and updated offering of software and digital services, one of Microsoft's strengths is that it was among the first to believe in the potential of Artificial Intelligence, heavily investing in OpenAI, a company that in the last six months has more than doubled its annualized revenue, rising to $3.4 billion from $1.6 billion at the end of 2023.

Apple continues to update its highs

Apple's growth over the years has been long and relentless, with its stock always overcoming temporary corrections and continuing to hit new all-time highs. The Cupertino company that revolutionized the communication world with the iPhone, has become much more than a smartphone manufacturer over the years and has successfully ridden the wave of artificial intelligence by integrating it seamlessly into its iOS operating system.

Nvidia, the queen of chips

The days when Nvidia was considered only a gaming company are long gone. Its revenues in the first quarter of 2024 rose by 265% compared to the same period last year, and its stock has soared by 170% in the last six months. In the semiconductor market, Nvidia is the absolute queen, and companies, including Microsoft and Apple, compete to secure its essential chips for training the language models that underpin generative artificial intelligence.

The target prices of Microsoft, Apple, and Nvidia

In short, all three companies have what it takes to remain where they are, but which of the three is favored at the moment?

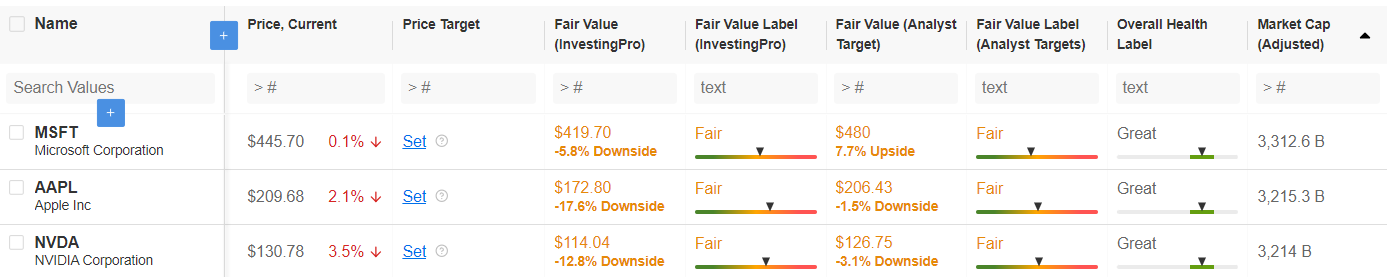

Here is the ranking based on the target price set by analysts:

Source: InvestingPro

Among the three, analysts interviewed by InvestingPro show the most belief in Microsoft's potential. The target price is set at $480 per share, 7.7% higher than the $419.7 closing price on June 20.

In the case of Apple, analysts estimate a target price slightly lower by 1.5% compared to the current value.

Finally, Nvidia could lose the most with a target price of $126.75, 3.1% less than the price on June 20. But it is known that the company led by CEO Jensen Huang is not new to surprising the markets and proving analysts wrong!

InvestingPro users can follow all updates on Nvidia, Microsoft, and Apple in the dedicated section.

If you are not yet subscribed to InvestingPro+, TAKE ADVANTAGE OF OUR DISCOUNT: you can access FAIR VALUE, analysts' TARGET PRICE, and all the financial data of over 180,000 listed companies worldwide by CLICKING HERE. HURRY, THE DISCOUNT WON'T LAST FOREVER!

- CLICK HERE to subscribe to PRO+, our comprehensive subscription, with which you will have access to:

- Advanced stock screener, with which you can find the best stocks based on your expectations

- ProPicks: portfolios of stocks managed by artificial intelligence and capable of beating the market.

- ProTips: easy and immediate information that summarizes thousands of pages of complex financial data in a few words.

- Fair Value and Health Score: 2 synthetic indicators based on financial data that provide an immediate view of the potential and risk of each stock.

- Access to over 1,200 fundamental data points

- 10 years of financial data on over 180,000 companies (practically all the stocks in the world!)

- Data export for offline work

- Stock valuation with over 14 proven financial models

- Fundamental charts

- Useful widgets and dividends to earn through dividends

So, what are you waiting for?!

Act fast and join the investment revolution!

***

Disclaimer: This article is written for informational purposes only; it does not constitute solicitation, offer, advice, consultation, or recommendation for investment, and as such does not intend to encourage the purchase of assets in any way. Please remember that any type of asset is evaluated from multiple viewpoints and is highly risky, therefore, any investment decision and its related risk remain with the investor.