Investing.com-- The balance of risks towards Chinese stocks still remained positive, Gavekal Research said in a note, even as a Donald Trump presidency and middling stimulus measures made for more headwinds.

Gavekal noted that Trump’s election victory, which heralds more tariffs, as well as disappointing fiscal measures from the National People’s Congress, should have battered local stocks.

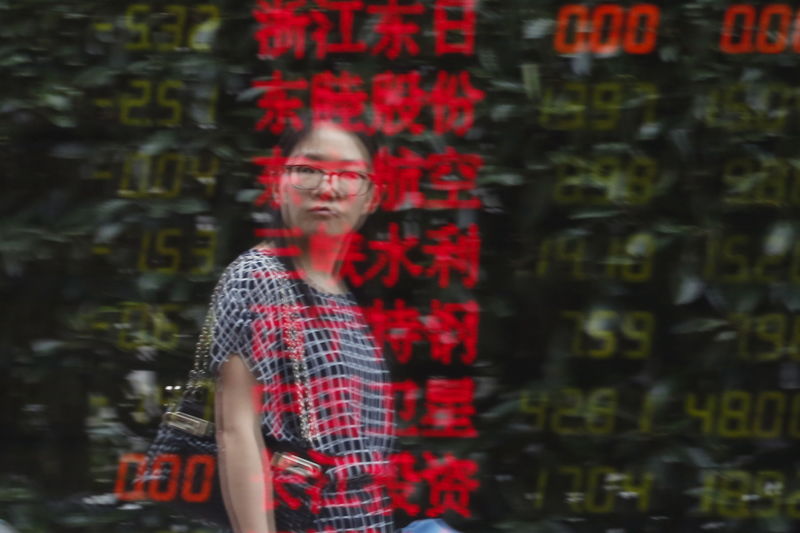

But the Shanghai Shenzhen CSI 300 and the Shanghai Composite logged limited losses over the past week, even briefly gaining. Gavekal said this indicated some resilience in local risk appetite.

“This blithe response by local investors to what could have been a major disappointment suggests that the Chinese equity bull market has plenty of support and further room to run,” Gavekal Research wrote in a note.

The brokerage noted that the biggest risk to China’s stock rally this year was the prospect of higher tariffs under a Trump presidency, the chances of which had doubled after his election victory. Trump has vowed to impose an at least 60% tariff on all Chinese imports, which bodes poorly for the country. Gavekal said the new round of tariffs would be far more painful for China than those imposed during Trump’s first term.

But the balance of risks still remained “decently positive” for Chinese stocks, Gavekal said, stating that the country was in the early stages of a stimulus cycle. Recent government measures to directly support equity prices also bode well for local markets.

China’s bluechip CSI 300 index is trading up nearly 21% so far in 2024, with a bulk of these gains coming in late-September after Beijing announced its most aggressive stimulus measures in recent years.

Commodities less positive from China perspective

Gavekal Research noted that while Chinese equities remained resilient, the same could not be said for commodity prices, specifically that they would likely not benefit all that much from Chinese stimulus measures.

The brokerage noted that China’s recent stock rally had not been accompanied by a run-up in commodity prices, especially those of iron ore and copper.

“The fundamental problem for investors looking to play the stimulus through commodities is that China’s policy package is not designed for a maximal—or so far, even moderate—boost to short-term materials demand,” Gavekal Research wrote in a note.

The brokerage said that China’s recent round of stimulus was aimed more at improving local liquidity, stabilizing property markets and addressing local government debt. The measures did not appear to be aimed at increasing infrastructure and property development, which has fueled Chinese commodity demand in the past.