(Bloomberg) -- Sight deposits at the Swiss National Bank posted their biggest increase since 2017 last week, suggesting it sold the franc to contain a rally against the euro.

Economists watch the data carefully for clues on whether the SNB has been active on foreign-exchange markets, and according to Credit Suisse (SIX:CSGN) Group’s Maxime Botteron, the jump points to interventions.

The amount of cash commercial banks park with the central bank hit 581.2 billion francs ($581 billion) in the week ending July 26, data published on Monday showed. That’s the biggest absolute increase in just over two years.

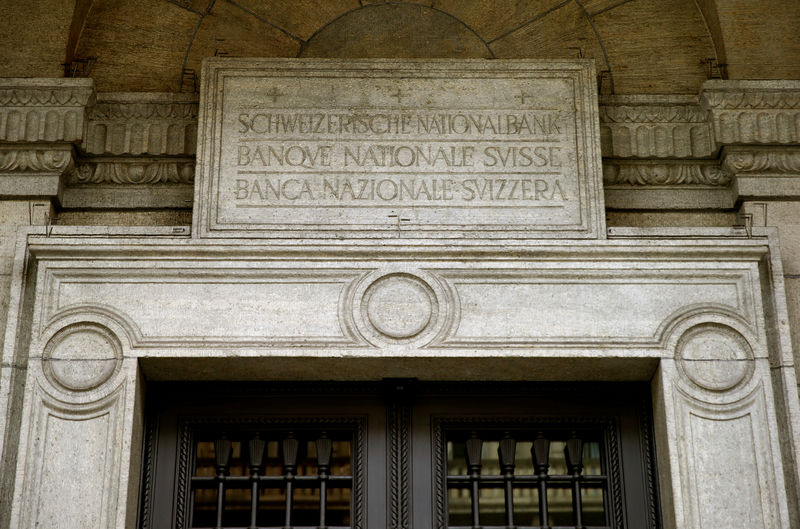

For years, the SNB has sought to tame the franc’s strength by buying foreign currency. The prospect of more euro-area monetary stimulus added to appreciation pressure on the franc last week.

A spokesman for the central bank declined to comment.