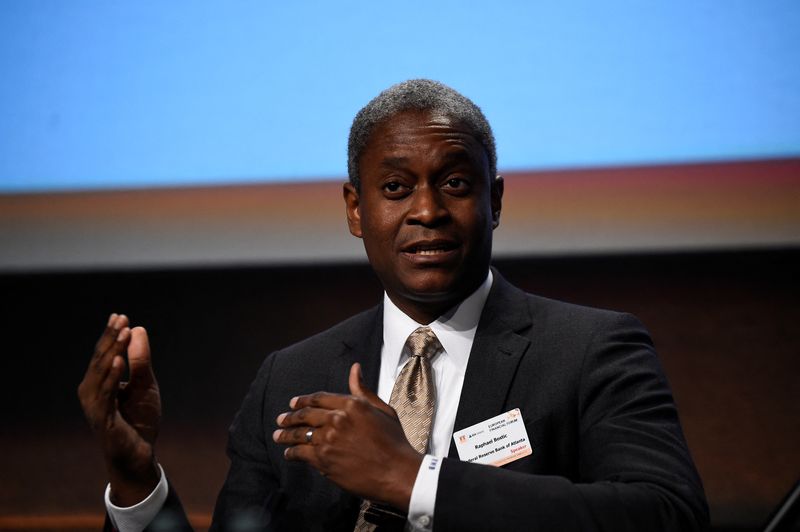

Investing.com - The Federal Reserve should not cut its benchmark interest rate until the end of this year, Atlanta Fed President Raphael Bostic said on Wednesday, confirming his stance as one of the more hawkish members of the Federal Open Market Committee.

Uncertainty has gripped U.S. markets over the extent of the interest rate cuts the Federal Reserve will authorize in 2024 as inflation has remained elevated and the country’s labor market is still robust.

Projections published at the Fed's March meeting showed the typical policymaker expected to deliver three quarter-point interest rate cuts this year. However, nearly half of officials - nine of the 19 - see two or less this year, according to forecasts issued last month.

Atlanta Fed President Raphael Bostic added to uncertainty Wednesday, expressing concern about the pace of inflation and indicated that interest rate cuts could be limited to just a single cut in 2024.

“If the economy evolves as I expect, and that’s going to be seeing continued robustness in GDP, unemployment and a slow decline of inflation through the course of the year, I think it would be appropriate for us to do start moving down at the end of this year, the fourth quarter,” Bostic said in a CNBC interview. “We’ll just have to see where the data come in.”

Data released earlier Wednesday showed that the U.S. private sector added far more jobs than expected in March, ahead of Friday’s official monthly jobs report.

Two other Fed policymakers in separate appearances yesterday maintained their forecasts for three rate cuts. Fed Chair Jerome Powell is set to speak later on Wednesday.