By Geoffrey Smith

Investing.com -- The presidential election is too close to call, but the anticipated "Blue Wave" has failed to materialize. California voters give Uber (NYSE:UBER) and Lyft (NASDAQ:LYFT) a boost, while pot legalization measures passed in four states. China's markets regain some poise after the shock suspension of Ant Group's IPO, and services PMIs show China thriving and Europe stagnating, with the ISM's survey for the U.S. still to come. Here's what you need to know in financial markets on Wednesday, November 4th.

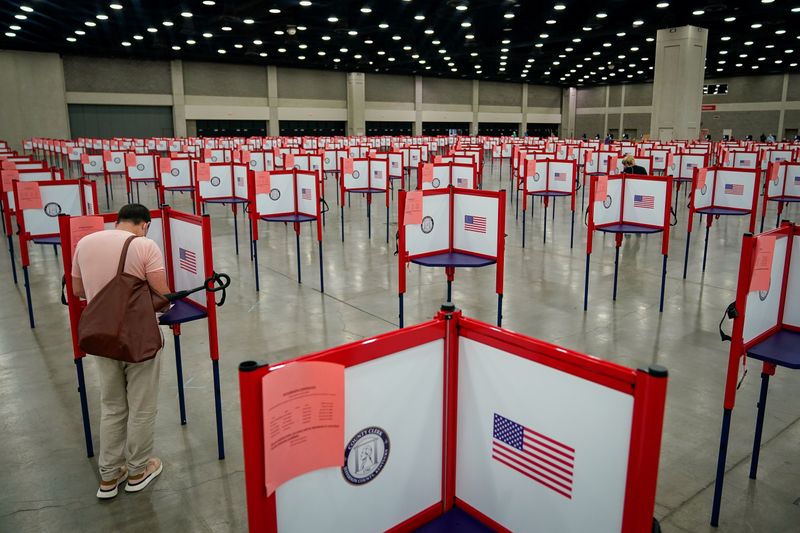

1. White House race too close to call

The U.S. Presidential and Senate elections both remained too close to call, with key vote counts in both races still outstanding.

President Donald Trump performed more strongly across the board than predicted by polls ahead of time, successfully defending Texas, Florida and Ohio, all of which had appeared to be in question.

However, both candidates still have plausible pathways to victory, and over 5 million votes in key states such as Michigan, Pennsylvania, Wisconsin, North Carolina and Georgia remain uncounted.

Trump nonetheless declared victory prematurely, threatening legal action to curtail the counting process. Biden’s campaign called the move “outrageous and illegal”.

Analysts had expected mail-in votes, which are counted later, to skew Democrat, as they have in the past. These expectations were supported when the city of Milwaukee’s results pushed Biden into the lead into Wisconsin, wiping out an early deficit.

2. Uber, Lyft triumph in California ballot; Pot laws passed in 4 states

The clearest winners from election night so far include Uber and Lyft, after California voters approved a ballot freeing them from a requirement to register their drivers as employees, complete with sick pay and vacation rights.

The two ride-hailing companies had said that being forced to absorb such costs would wreck their business model. According to The Wall Street Journal, California accounts for around 9% of Uber’s revenue and 16% of Lyft’s. The so-called Proposition 22 vote is likely to set the tone for regulation of the gig economy elsewhere across the country.

Pot stocks also gained, as measures to legalize either medical or recreational use of marijuana were passed in New Jersey, Arizona, South Dakota and Mississippi.

Other winners from the night included the game of cricket, now that Americans can no longer mock it for going on for days without a clear winner.

3. Stocks set to open mixed; Nasdaq outperforms

U.S. stocks are set to open mostly higher, with sharp gains in Nasdaq futures supported by double-digit gains in the two ride-hailing stocks.

By 6:30 AM ET (1030 GMT), Dow 30 futures were down 22 points, or 0.1%, while the S&P 500 Futures contract was up 0.5% and NASDAQ Futures were up 2.0%.

The positive reaction defies consensus forecasts ahead of time that an uncertain and contested outcome would be negative for stocks, as would a result that left Congress split between the two main parties. Early results in key Senate races suggest that the Democrats’ hopes of regaining control of the upper chamber are set to be disappointed.

Renewable energy stocks underperformed as the Blue Wave failed to materialize, while oil and gas stocks outperformed. Sports betting stocks also gained after various ballots nudged some more states in the direction of liberalization.

4. China markets steady after Ant IPO shock

The Chinese yuan regained most of the losses overnight that it suffered on Tuesday when regulators abruptly suspended the initial public offering of financial services giant Ant Group.

By 6:15 AM ET (1015 GMT), the dollar was up 0.1% against the offshore yuan at 6.6833, broadly in line with its gains against other peers after an election whose first effect was to bolster risk-off trades.

Ant’s shares were due to debut on the Hong Kong and Shanghai stock exchanges on Thursday, before authorities stopped the process, citing “significant changes” in the regulatory environment, without adding any elaboration.

The result has been a severe embarrassment for the Chinese capital market, reminding both local and international investors of its vulnerability to arbitrary political decisions, and of the inherent tension between a ruling Communist Party and an entrepreneurial class of increasing financial power.

5. Services PMIs mixed; ISM and oil inventories due

Business services from China and Europe showed the service sector in slightly better shape than thought in October.

The Caixin services PMI in China rose to 56.8 from 54.8 in September, while in Europe, the final reading for IHS Markit’s services PMI was revised up to 46.9 from 46.2. That left the Composite Eurozone PMI at 50, implying that the Eurozone economy essentially stagnated in a month in which most of its states started to tighten restrictions on economic life again in the face of a second wave of Covid-19.

The Institute of Supply Management will release its non-manufacturing PMI at 10 AM ET, while the oil market will look for corroboration of a strong draw on U.S. crude stockpiles last week when the Energy Information Administration releases its numbers for crude inventories at 10:30 AM ET.

Also, payrolls processor ADP will publish its monthly report on private-sector hiring for the month through mid-October, in a foretaste of Friday's non-farm payrolls report.