Investing.com -- BlackRock acknowledged in its latest weekly market commentary that central banks will hold tight for longer, saying, "sticky inflation looks to compel developed market (DM) central banks to crank policy rates higher – and keep policy tight for longer. The Federal Reserve paused last week but pointed to more hikes on the way. The European Central Bank (ECB) raised rates and made clear it wasn’t done."

United States

Analyzing the U.S. situation, BlackRock notes that "labor shortages are fueling wage growth, keeping core inflation elevated. That has led the Fed to double down on a “whatever it takes” approach to fighting inflation "

They warn, "We think the Fed and ECB appear to be underappreciating the existing damage from hikes. The Fed revised its growth forecast up based on historically low unemployment. The Fed may be relying on a job and growth relationship that has broken, in our view. Labor shortages have made firms reluctant to let workers go, even as demand slows and growth stagnates."

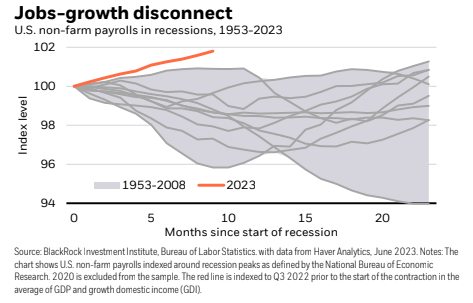

BlackRock adds, "That has made job growth look resilient (orange line in the chart) in recent months compared with weaker jobs data in past recessions (gray lines), even as some data suggest recession may have already arrived."

"We don’t think the Fed can expect to bring inflation back down so quickly and maintain such an optimistic view on growth. CPI data last week confirmed core inflation is not cooling enough yet for inflation to return to 2%."

Europe

Turning to its analysis of the European market, BlackRock warns that "the ECB’s determination to keep hiking has pushed up euro area government bond yields. The market pricing of hikes by the ECB and the Bank of England have become more extreme than our view: Pricing shows rates for both staying higher for much longer than the Fed while inflation stays elevated."

"Bottom line: We think tight policy is likely here to stay as sticky inflation compels major central banks to keep policy tight – and likely tighten even further," BlackRock concludes.