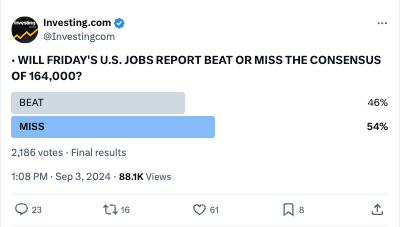

Investing.com -- According to a survey on X (formerly Twitter), 54% of Investing.com users see U.S. jobs data missing expectations on Friday.

2,186 people voted in the poll, with the results showing that when asked if Friday's jobs report will beat or miss the consensus of 164,000, 54% said they expect a miss, and 46% said they expect a beat.

A miss could give the Federal Reserve cover to lower rates by 50 basis points instead of 25bps.

According to data from the CME Group (NASDAQ:CME) 30-Day Fed Fund futures, the likelihood of a larger 50bps rate cut from the U.S. Federal Reserve in September has seen a notable increase in recent days.

The latest Sevens Report said on Thursday that "for the first time in nearly three years, a 'Too Cold' jobs report poses the bigger risk to stocks as the growth implications of Friday's jobs report are more important to investors than whether the jobs report makes the Fed cut 25 bps or 50 bps."

"The market would prefer gradual but consistent rate cuts and stable economic growth over dramatic rate cuts and collapsing growth. Put differently, investors are worried the Fed is behind the curve on rate cuts and Friday's jobs report will either 1) Calm or 2) Exacerbate those fears," adds the firm.

Meanwhile, BofA said in its preview note that it forecasts solid jobs growth in August, expecting nonfarm payrolls to rise by 200k after coming in at 114k in July.

"Public sector hiring should rise 30k on the back of local employment. Hence, we see private payrolls rising by 170k. Education & healthcare hiring should remain robust," they wrote.

"We look for the unemployment rate and labor force participation rate to decline a tenth each, to 4.2% and 62.6%, respectively. We think average hourly earnings and average weekly hours will both rise by a tenth to 0.3% m/m and 34.3, respectively," added the bank.