(Bloomberg) -- Europe’s job market is giving some hope to the region’s economic story, which has been dominated by a deepening slump in manufacturing that’s tipped Germany close to recession.

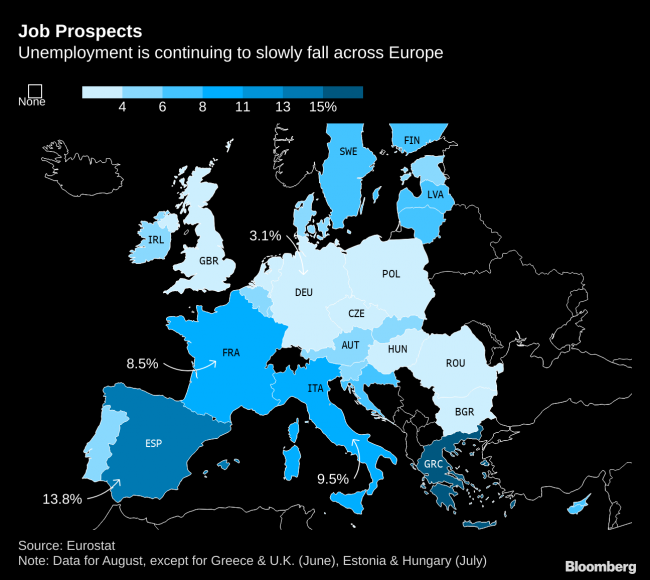

Figures Monday showed the euro-area unemployment rate fell to 7.4% in August, the lowest in over 11 years. Italy also reported an unexpected drop in its rate to 9.5% and Germany saw the number of people out of work decline for the first time since April. However, Germany also saw a decline in vacancies, a sign of caution among companies about hiring.

While the labor market is a lagging indicator, the figures show it’s so far resisting weaker global demand and a contraction in industry. That’s good news for consumer spending and the services sector, which continues to show growth.

“As one of the main drivers of service sector growth, the labor market has taken center stage in predictions about a looming recession,” ING economist Bert Colijn said. “If unemployment continues to come down at a decent pace, this will boost household incomes and in turn fuel domestic demand.”

The relative buoyancy of the job market may reinforce the view among some that the economic situation isn’t as bad as feared. European Central Bank policy makers are already in disagreement over their response to the threat of a deep downturn.

The ECB unveiled a broad stimulus program earlier in September and called on governments to follow suit with a fiscal program. But the inclusion of quantitative easing in the ECB measures stimulus sparked dissent in the ranks of officials.

Pointing to job numbers may not be enough to allay concerns about the outlook. Reports on Tuesday will probably confirm a worsening situation for manufacturing across the bloc and little change in inflation from the low levels that have motivated the ECB’s action. The euro-area rate is forecast to remain stuck around 1% in September.

What Bloomberg’s Economists Say...

“The euro area’s fragile recovery is being blown off course by headwinds from abroad. Bloomberg Economics expects the bloc to avoid recession, but the risks of a contraction are elevated -- a trade spat with the U.S. would cause some serious damage.”--David Powell, Maeva CousinRead the full INSIGHT

French Finance Minister Bruno Le Maire will travel to Berlin Tuesday to implore the German government to act now to invest its surpluses and give the economy a shot in the arm. So far, Germany has said it sees no reason to act.