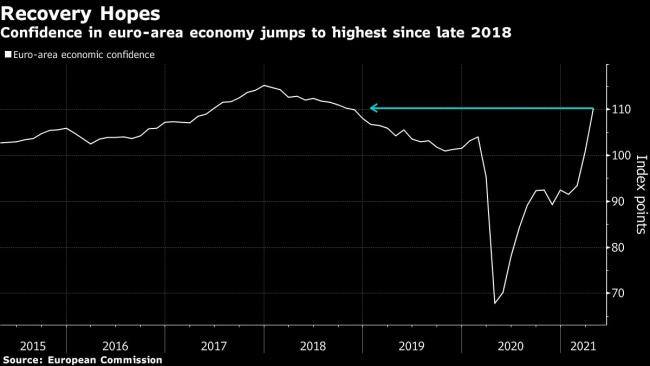

(Bloomberg) -- Confidence in the euro-area economy improved sharply in April as the region’s vaccination campaign picked up speed, paving the way for a lifting of coronavirus restrictions in the coming months.

A European Commission sentiment index increased to 110.3, exceeding all estimates in a Bloomberg survey. The highest reading since 2018 reflects improvements across all parts of the economy and the European Union’s six largest members.

The data add to signs that the region is starting to recover from the pandemic even as infection rates in some countries remain high. Immunizations have accelerated after early stumbles, allowing governments to plot an exit from restrictions that almost certainly tipped the bloc into a double-dip recession in the first three months of the year.

The German government this week raised its growth forecast for the year to 3.5% and expressed confidence that consumer spending will take off once the pandemic is under control. Manufacturing has also held up well, though the sector is now facing supply shortages that are threatening to hold back the recovery.

Industrial confidence hit a record high in April, with production expectations reaching unprecedented levels while stocks were scarcer than ever. The mood in services improved for a second consecutive month, driven by optimism about future demand.

Consumers assessed both the general economic situation and their personal conditions as more positive. Employment plans rose in all surveyed business areas.

A separate report on Thursday showed unemployment in Germany unexpectedly increased this month after nearly six months of lockdowns -- despite generous government subsidies enabling businesses to retain workers.

The European Central Bank has repeatedly pointed to downside risks for the economy in the short term, arguing that prospects will improve in the second half.

By then, countries are set to see the first disbursements from the EU’s 800 billion-euro ($969 billion) recovery fund. Plans for how to use the money are being submitted to the European Commission this week.

©2021 Bloomberg L.P.