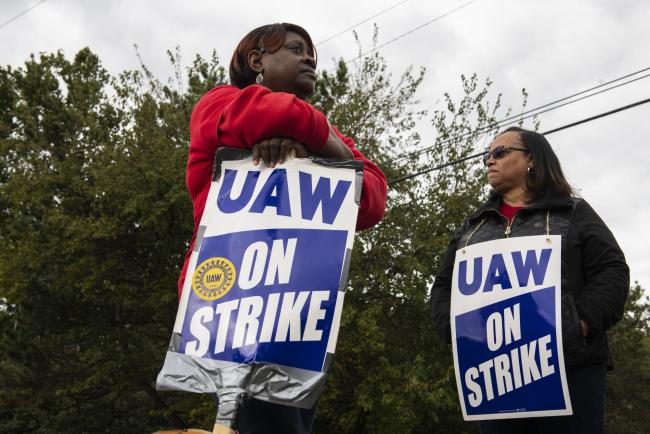

(Bloomberg) -- The strike at General Motors Co (NYSE:GM). entered its fourth week with the United Auto Workers union and the carmaker at an impasse over investment in U.S. factories, overshadowing progress made in recent days on other key issues.

The union made an offer to GM on Saturday evening, and the company’s response Sunday morning didn’t address some issues, especially job security, Terry Dittes, a UAW vice president, wrote in a letter to members. “Negotiations have taken a turn for the worse,” he wrote.

GM shares were little changed at $34.89 as of 1:15 p.m. Monday in New York. The stock has dropped about 10% since the walkout began.

“They reverted back to their last rejected proposal and made little change,” Dittes wrote, in reference to GM. “It did nothing to provide job security during the term of this agreement.”

A spokesman for GM said the automaker is continuing to negotiate in good faith. The company is “committed to continuing discussions around the clock to reach a resolution,” the spokesman said in an email. The two sides resumed negotiations Monday morning.

The strike that took effect Sept. 16 has cut GM production by more than 8,000 vehicles a day, according to calculations by analysts at Credit Suisse (SIX:CSGN) and IHS Markit. The cost to the automaker has exceeded $1 billion, with GM losing about $82 million of potential profit in North America every day of the strike, JPMorgan (NYSE:JPM) analyst Ryan Brinkman wrote last week.

Fallout from the strike widened on Monday, with GM temporarily halting production of a V-8 engine and a transmission at its plant in Ramos Arizpe, Mexico, due to the lack of components coming from an idled U.S. factory.

The walkout has the attention of the Trump administration. Larry Kudlow, the White House economic adviser, told Fox News on Monday he’s concerned about the slowdown in U.S. manufacturing and said the GM strike is “not helping.”

Tense Talks

In a sign of how tense the talks got on Sunday, Dittes sent a letter to Scott Sandefur, vice president of labor relations for GM North America, to scold him for a lack of response to the union’s offer.

In a letter, he criticized Sandefur for not having the “professional courtesy to explain why you could not accept or why you rejected our package proposal for each item we addressed.”

“We expect the company to respond and discuss the package proposal we presented yesterday,” he wrote.

In the past week, the two sides have agreed on health care, which will remain mostly untouched from from the current plan, people familiar with the matter said on Saturday. They’ve also agreed on one of the biggest outstanding issues: how to give temporary workers a path to full-time employment, the people said.

Job Security

Progress toward a deal broke down over investment in U.S. plants. GM has offered to build its electric trucks in a plant that straddles the line between Detroit and the town of Hamtramck, which is scheduled to be idle in January when the sedans it builds go away. But there is no promise for GM’s idled compact car plant in Lordstown, Ohio.

The UAW wants GM to allocate new work for those factories, even if it means moving the assembly of the Chevrolet Equinox and Blazer and GMC Terrain sport utility vehicles from a plant in Mexico, one of the people said.

The pressure for a deal has been increasing, on both sides, and the issues are complex. They include corruption investigations of union leaders; the shift from traditional engines to electric powertrains; and the possibility that the economy could flip into recession with damage of a longer strike at a company like GM.

The fight won’t be over once an agreement is reached, since the deal must be ratified by all members. After four years of record profits for the company, workers want a share of the spoils, said Kristin Dziczek, vice president of the labor and economics group and the Center for Automotive Research. “They will have to sell it,” she said.

If a tentative deal is signed, union workers may stay on strike until they vote to ratify the four-year deal. UAW local leaders nationwide will convene in Detroit to decide whether to remain out of work until that ratification vote is completed.

Outstanding Issues

GM and the UAW continue to debate over a boost to retirement accounts for older workers with pensions and newer hires with 401(k) plans. Another outstanding issue is pay progression for temporary workers.

The people didn’t say how much of a raise workers will get. GM originally wanted to give workers 2% raises in two of the contract’s four years, interspersed with 2% lump sum payments in the other two years. UAW leaders want 4% raises in two years and 4% lump sums.

For temporary workers, negotiators have discussed a path to full-time employment after three years. The two sides debated whether a temp who was laid off could claim the accumulated time once called back, one of the people said. The union also wants more vacation time and better health care for temps.

(Updates with Mexico plant shutdown in seventh paragraph)