By Barani Krishnan

Investing.com -- Oil prices fell on Wednesday ahead of a widely-expected rate hike by the Federal Reserve as fears grew that the central bank will eventually push the U.S. economy into a recession in its bid to fight the worst inflation in 40 years.

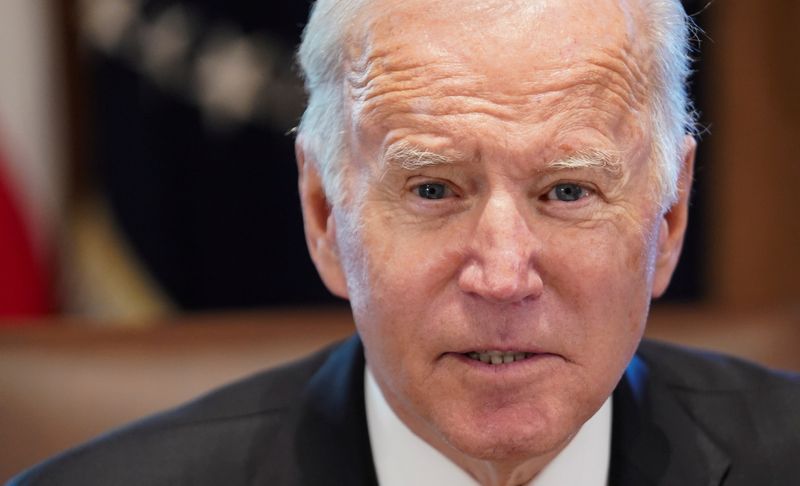

President Joe Biden, meanwhile, added to oil market jitters by calling on U.S. refining companies to produce more fuels, saying they were duty-bound to help alleviate the burden of record high gasoline and diesel prices on Americans.

“At a time of war – historically high refinery profit margins being passed directly onto American families are not acceptable,” Biden said, referring to the Russia-Ukraine crisis, in his letter to refiners, including those belonging to oil majors such as Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX).

″[C]ompanies must take immediate actions to increase the supply of gasoline, diesel, and other refined product,” the letter, reproduced by CNBC, said.

Biden’s call to refiners came as sky-high energy costs add to inflationary concerns across the economy. The president has indicated lately that a “windfall profits tax” might be levied on refiners after the national average for a gallon of gasoline crossed $5 over the weekend for the first time ever, according to the American Automobile Association.

The national average now stands at $5.014 a gallon, some 54 cents more than a month ago, and $1.94 above a year ago.

Adding to the weight on oil was U.S. crude production, which hit 12 million barrels per day last week, for the first time since April 2020, the Energy Information Administration said in its weekly industry report on Wednesday. It was a sign that oil at $120 a barrel was finally spurring higher output, although at a slower pace than needed to tamp down record high fuel prices.

Responding to all these, New York-traded West Texas Intermediate, the benchmark for U.S. crude, fell $1.51, or 1.3%, to $117.43 per barrel by 12:54 PM ET (16:54 GMT).

London-traded Brent crude, the global oil benchmark, was down 91 cents, or 0.8%, to $120.26 a barrel.

Crude prices hit 14-week highs on Tuesday, with WTI soaring to almost $124 a barrel and Brent breaching $125 after the Organization of the Petroleum Exporting Countries stuck with its forecast that world oil demand will exceed pre-pandemic levels in 2022. This was in spite of OPEC admitting that Russia's invasion of Ukraine and developments around the coronavirus pandemic pose a considerable risk.

From then, prices have been in the red as concerns grew about U.S. inflation ripping at its highest since 1981 and the likelihood that the Fed might impose a rate hike as high as three quarters of a percentage point, versus initial speculation for a half-percentage point hike, at the conclusion of its monthly policy meeting Wednesday.

The US economy expanded by 5.7% in 2021, also growing at its fastest pace in four decades after a 3.5% tumble in 2020 due to complications caused by the coronavirus pandemic.

Since the start of this year though, the economy has been on a weaker trajectory, posting a negative growth of 1.4% for the first quarter. That slowdown has reinforced fears that the United States may be headed for a recession, especially with aggressive rate hikes planned by the Fed. Technically, the economy needs just two straight quarters of negative growth to be in recession, with the first quarter already being in the red.