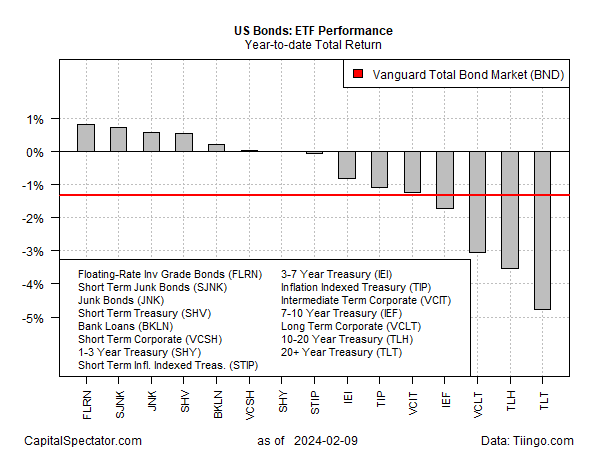

Modest gains in some corners of fixed income contrast with sharp losses elsewhere for year-to-date results with the broadly defined US bond market, based on a set of ETFs through Friday’s close (Feb. 9).

Cherry-picking components of the market offer a modestly upbeat profile, but that’s more than offset by steep declines for longer-term maturities.

The standard benchmark for investment-grade fixed-income securities, however, remains underwater.

Vanguard Total Bond Market Index Fund (NASDAQ:BND), which tracks a benchmark that’s widely followed as a proxy for the broad fixed-income space, has shed 1.3% year to date.

The setback contrasts with BND’s rebound in 2023 following the previous year’s sharp loss.

The leading performing year to date for the bond market components listed above is SPDR Bloomberg Investment Grade Floating Rate ETF (NYSE:FLRN), which is higher by 0.8% so far in 2024.

The fund has benefited from higher resets of interest rates via its portfolio of variable-rate securities.

But with the Federal Reserve expected to start cutting interest rates later this year, floating rate notes may face headwinds in the months ahead after a bull run over the past year and a half.

Headwinds are already blowing hard for long-dated Treasuries

The steepest loss for the bond market year to date is in iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT), which is down 4.8% in 2024.

The decline more than offsets TLT’s modest rebound in 2023, which barely put a dent in deep losses over the previous two years.

A key challenge for Treasuries is the ongoing restrictive policy maintained by the Federal Reserve.

The central bank has stopped raising interest rates and by most accounts will begin cutting at some point this year, but there’s a long way to go before monetary policy shifts to neutral, much less easy.

The current 5.25%-to-5.50% Fed funds rate is far above the recently estimated 0.9%-1.1% range of estimates for the neutral rate, based on a pair of models run by the New York Fed.

Meanwhile, the resilient US economy is raising new doubts about how soon the Fed will start cutting rates.

A cut in March is now off the table, according to Fed funds futures. The May 1 FOMC meeting is now estimated as the earliest start date for easing, although futures are pricing in a modest probability of roughly 63% this morning.

Lower rates by June are more likely, sporting a 90%-plus probability.

Whenever the rate cuts start, it can’t come fast enough for the battered realm of long Treasuries.