- Markets closed positively after the release of a U.S. inflation reading for the first time since December 2021

- Better-than-expected CPI figures imply lower discount rates for stock valuations

- Despite a broad-based rebound, we are still within a bear market

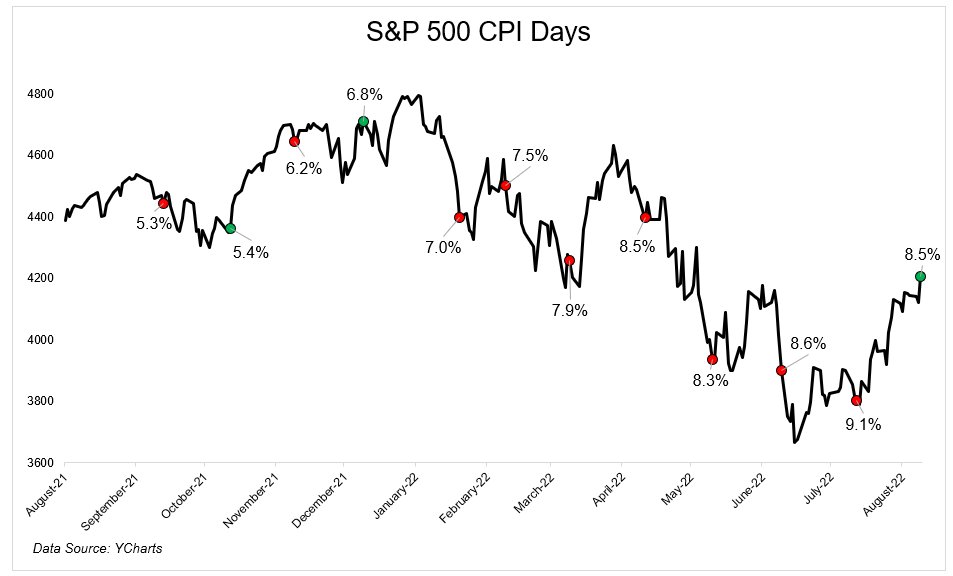

We've all witnessed yesterday's broad-based stock market rebound after the release of the U.S. inflation data (CPI at +8.5% year-on-year against expectations of 8.7% and the previous figure at 9.1%).

Risk assets worldwide have reacted positively to the report because (possibly) peaking U.S. inflation could mean more accommodative central banks and less aggressive rate hikes. This trend impacts equity valuations because the discount rate decreases in such a scenario, pushing valuations upward.

But, in reality, markets have been trending up way before this report—since June 16, to be exact (see chart below).

Why? There can be two reasons for that:

Technical Rebound Within The Bear Market

We must always know the story and the numbers involved. Below I have put historical bounces in major bear markets, and we see how there have been upward movements of up to 80% before starting to fall again. The fact that markets do +20% from the lows means nothing because, in bear markets, similar bounces are entirely customary.

Source: Bloomberg

I want to emphasize that we are not necessarily out of the bear market yet. Personally, I will consider the bear market broken only upon recovery of previous highs.

Resumption Of The Bullish Trend

I wrote extensively about this when everything went down in the year's first half. My point was that if you have a plan, a well-diversified portfolio, and the proper time horizon, you will use such downturns as a buying opportunity.

2022 had the fourth-worst H1 in history, after 1932, 1940, and 1970. In those past cases, what happened in the second half? (Here is my latest analysis on that)

Another positive sign for the bulls was that yesterday, for the first time since December (the beginning of the bear market), the markets closed positive after the release of the U.S. inflation figure.

Source: Ycharts

I also talked about tech stocks and how they went from being in everyone's portfolios to being heavily sold, with declines of up to 70-80% in the year's first six months.

Well, I bought some of those declines--and even closed some of those trades already, i.e., Netflix, Inc. (NASDAQ:NFLX) and Semler Scientific, Inc. (NASDAQ:SMLR), with gains of 12.2% and 16.7%, respectively.

I still maintain positions on Meta Platforms (NASDAQ:META), PayPal Holdings (NASDAQ:PYPL), and UiPath (NYSE:PATH) not only because they provided good entry points, but because they represent good companies not only in the short term but also in the medium term.

Moreover, the drop generally brought valuations on tech back to excellent levels—just when all investors were running away with accumulated losses. As I have often said, you can do anything with a good money management strategy (perhaps split entry to buy on declines or via an accumulation plan).

The point is always to know what you are buying and to do it smartly. Many will get back on the merry-go-round these days, perhaps those who have lost so much but not yet everything. The truth, however, is that from markets in general, one should never get out entirely.

Disclosure: The author owns stocks of Meta Platforms, PayPal Holdings, UiPath, and the S&P 500.