- Walmart’s latest guidance indicates that the situation may be improving for the company

- The world’s largest retailer is successfully working to reduce a massive inventory pile that’s been hurting its margins

- The company also reiterated its outlook for a 3% gain in comparable sales at its U.S. stores during the second half

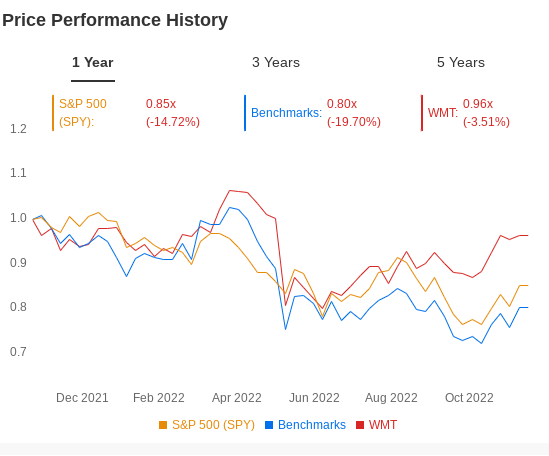

It appears that the worst is over for Walmart (NYSE:WMT). During the past quarter, the world’s largest retailer outperformed the benchmark index by a considerable margin, overcoming its earlier sluggish period.

WMT stock traded on Monday at $140.60, up more than 6% during the past three months. The S&P 500 dropped about 7% during the same period.

Source: InvestingPro

That momentum will be tested when the Bentonville, Arkansas-based giant reports its latest quarterly earnings tomorrow. The biggest good news investors anticipate is that the retailer is on track to cut its inventory levels as it navigates through changing consumer buying habits, cost pressures, and supply-chain hurdles.

After two profit warnings in the past summer, Walmart’s latest results are likely to offer some relief that things haven’t gotten any worse. The sudden change in U.S. consumer behavior in the post-pandemic environment caused inventories to balloon at many large retailers. Amid growing macroeconomic headwinds and inflation running at a four-decade high, consumers spurned big-ticket items like electronics and garden furniture.

WMT and other big-box retailers weren’t prepared to deal with this sudden change. As a result, inventories at WMT surged to $61 billion in the quarter that ended on April 30, up from $46 billion in the same time the previous year.

Due to this accumulation, Walmart was forced to offer discounts on their products throughout the summer, further pressuring margins.

Easing Pressure on Inventories

But the latest guidance from the company shows that things are improving. Walmart told investors in August that it has made progress in reducing the glut of excess products in accumulating sections such as clothing, for example. Furthermore, the company canceled billions of dollars of orders. Inventory during the second quarter rose 25% from a year earlier to $59.9 billion. That was a slower growth rate than the 32% jump in the first quarter.

If the retailer can reduce this issue considerably, it will ease pressure on price reductions, offering a clear signal that earnings will improve from here.

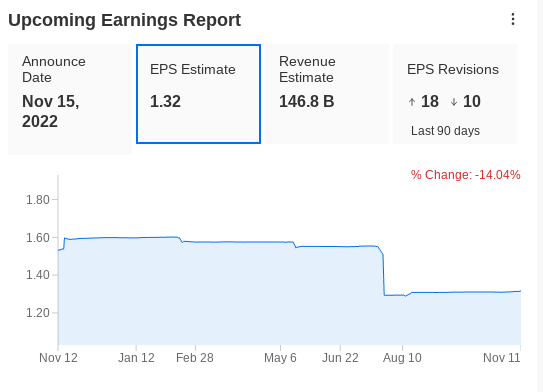

Data from InvestingPro also suggest that Wall Street analysts don’t see a major negative surprise when the company reports tomorrow. The chart below shows that during the past 90 days, there have been more upward earnings revisions than downgrades.

Source: InvestingPro

According to Walmart, earnings per share in this fiscal year will fall no more than 11%, compared with July’s warning of a drop of as much as 13%. The company reiterated its outlook for a 3% gain in comparable sales at its U.S. stores during the second half, excluding fuel. The metric will rise about 4% for the year as a whole.

Despite some strength in the past three months, Walmart stock could remain under pressure if inflationary pressure persists and the U.S. economy slips into a recession. However, long-term investors should take this weakness as a buying opportunity, given the retail giant’s massive moat and ability to recover quickly from the economic weakness.

Cost pressures in the economy also provide Walmart a competitive edge to attract more cost-conscious customers. According to chief executive Doug McMillon, Walmart is in a solid position to win over more consumers, helped by its omnichannel focus, pushing digital penetration to record levels.

During periods of distress, Walmart shares have historically outperformed the S&P 500 by a considerable margin. For instance, during the market crash of 2020, the stock continued to remain in positive territory as the broad market suffered. And during the recessions of 2002 and 2008, Walmart produced positive returns while the S&P 500 tumbled.

Bottom Line

WMT’s earnings tomorrow may show that the retailer is successfully navigating a challenging economic environment and the worst of a slowdown is behind us. If that happens, it could further fuel gains in its shares.

Disclosure: As of the time of writing, the author is long on WMT stock. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.