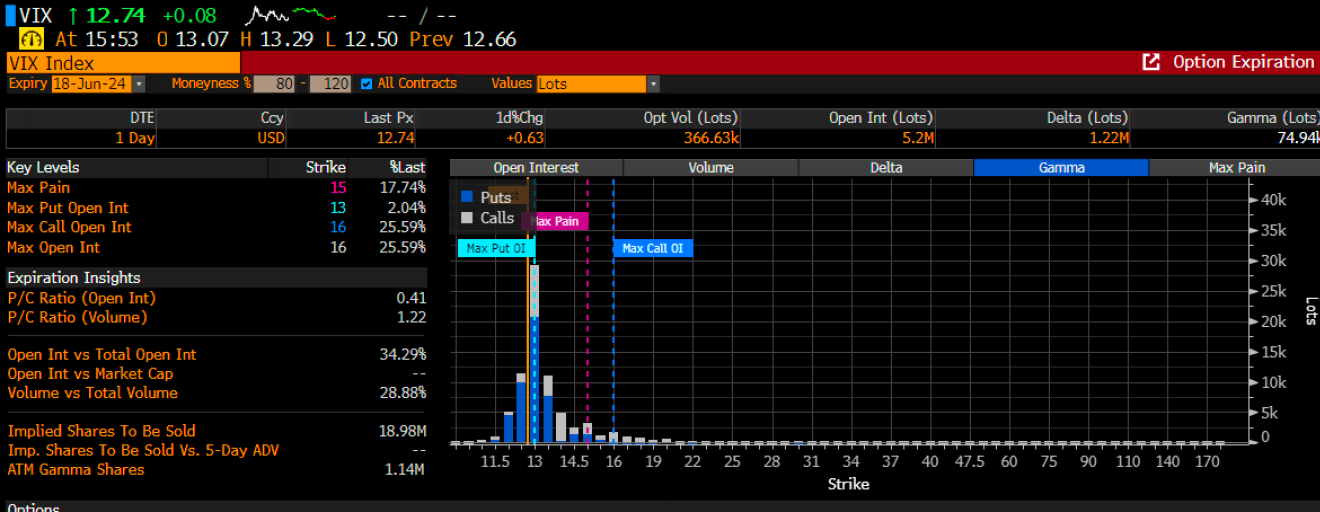

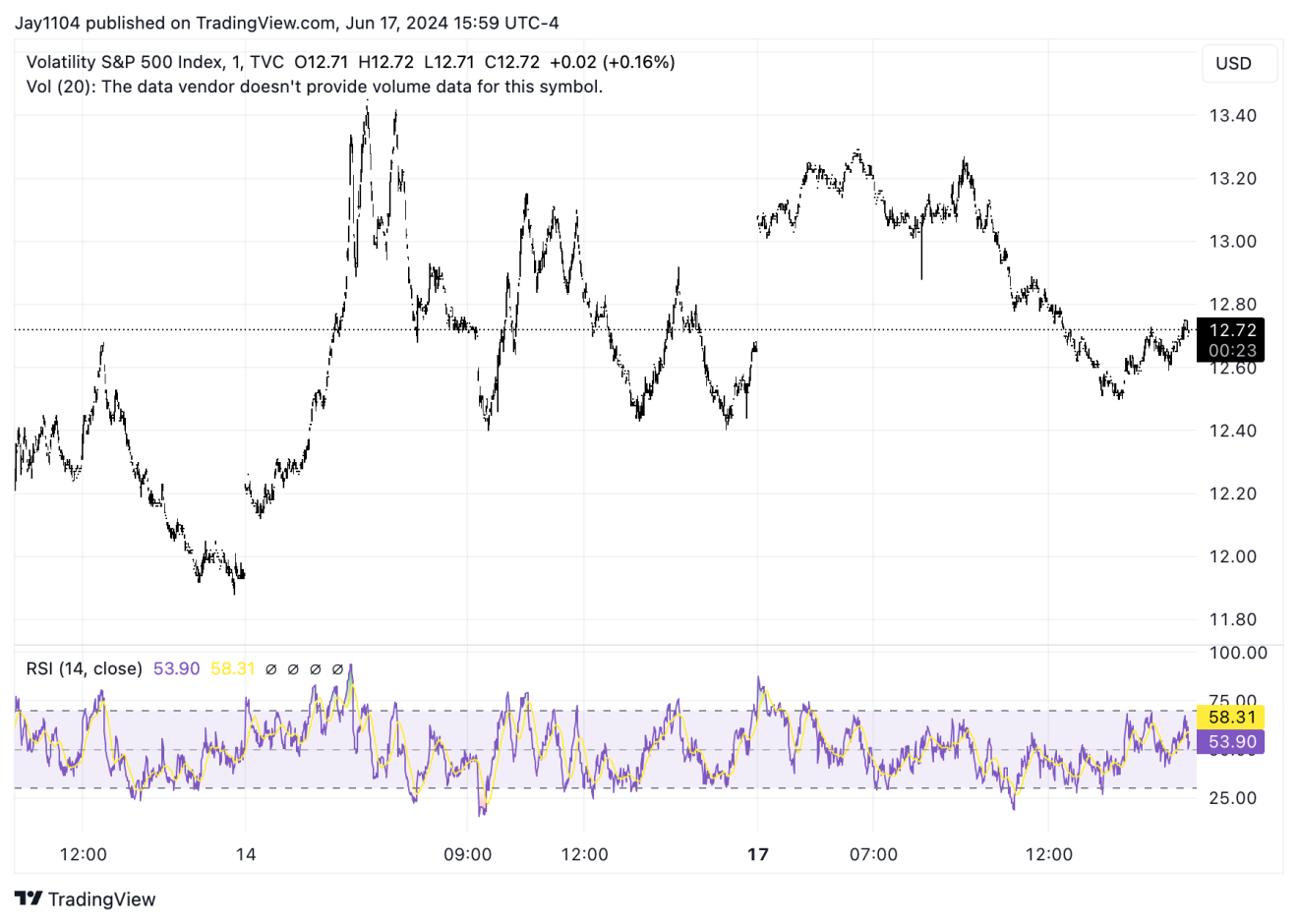

I wasn’t planning on writing today, but I saw that the equity market was higher, and I figured I’d weigh in and mention that today seems like a pre-VIX opex type of day. The S&P 500 traded higher, while the VIX was basically flat to up. Odd. With today being VIX opex, it looked a lot like VIX opex games, with the big gamma level clearly at 13 and that giant amount of put gamma at 13 clearly serving as resistance.

Bloomberg

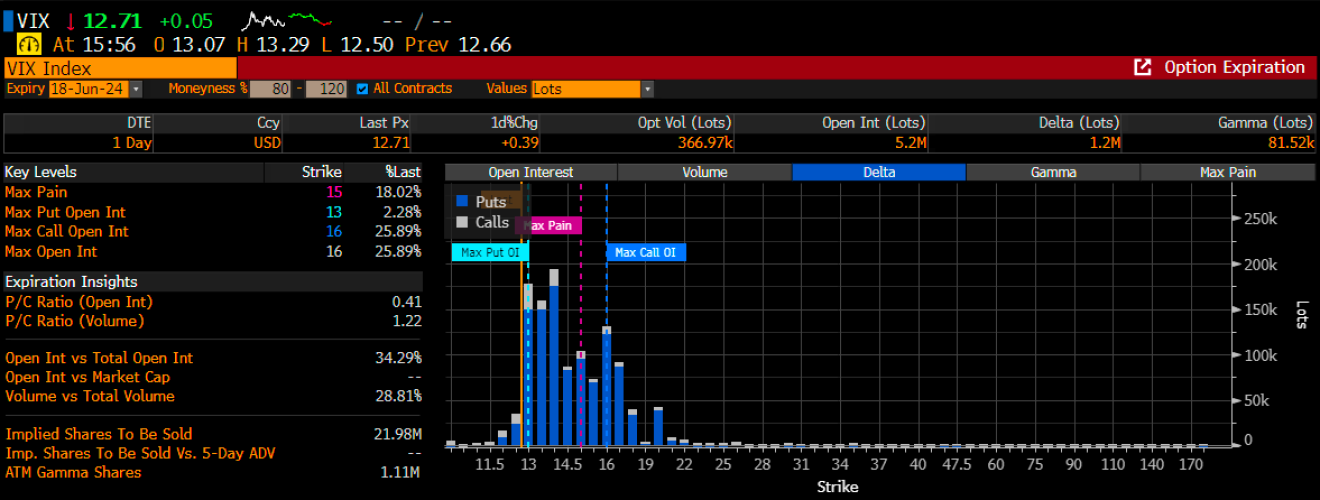

Just a lot of negative delta also built up above 13, which was likely suppressing the VIX today and probably keeping it from going higher.

Bloomberg

So I think that today was mostly a reflection of trying to keep the VIX pegged and below at 13 or low. The VIX opened above 13 and really held above 13 for most of the morning until about 10:30 AM when the volatility selling seemed to come. When implied volatility is being sold, it is usually hedged by going long S&P 500 futures.

It is possible that my theory is entirely wrong. But it makes sense to me, given that today is VIX opex instead of Wednesday due to the holiday and the market being closed. The only way we will know is if today we see the VIX move higher and the S&P 500 give back the day’s gains.

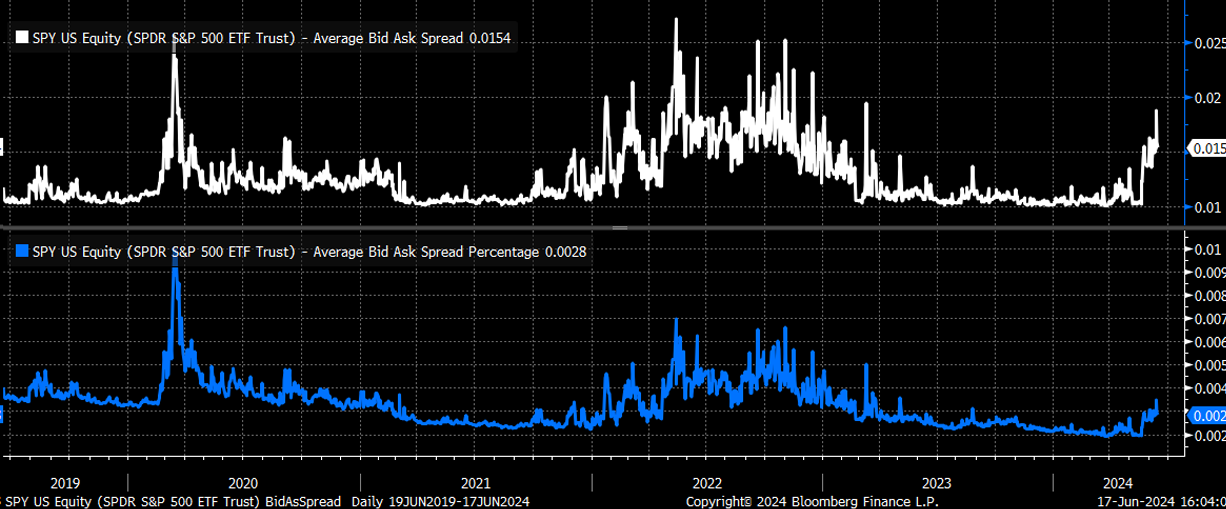

The other tidbit I noticed today is that the average bid-ask spread in the SPY has blown out since the beginning of May, in fact, to levels that you typically see during periods of heightened volatility and stock moving lower. The move higher in the S&P 500 appears to be getting treated with the same type of reaction function, which could be an indication that liquidity is just not that ample in the market.

We will at this some more in the coming days. There will be no write-up today.