Stocks traded mostly flat yesterday as investors geared up for a hectic week of economic data. The PPI report will be released soon, followed by the CPI report on Wednesday and retail sales on Thursday. Jay Powell will also speak later today.

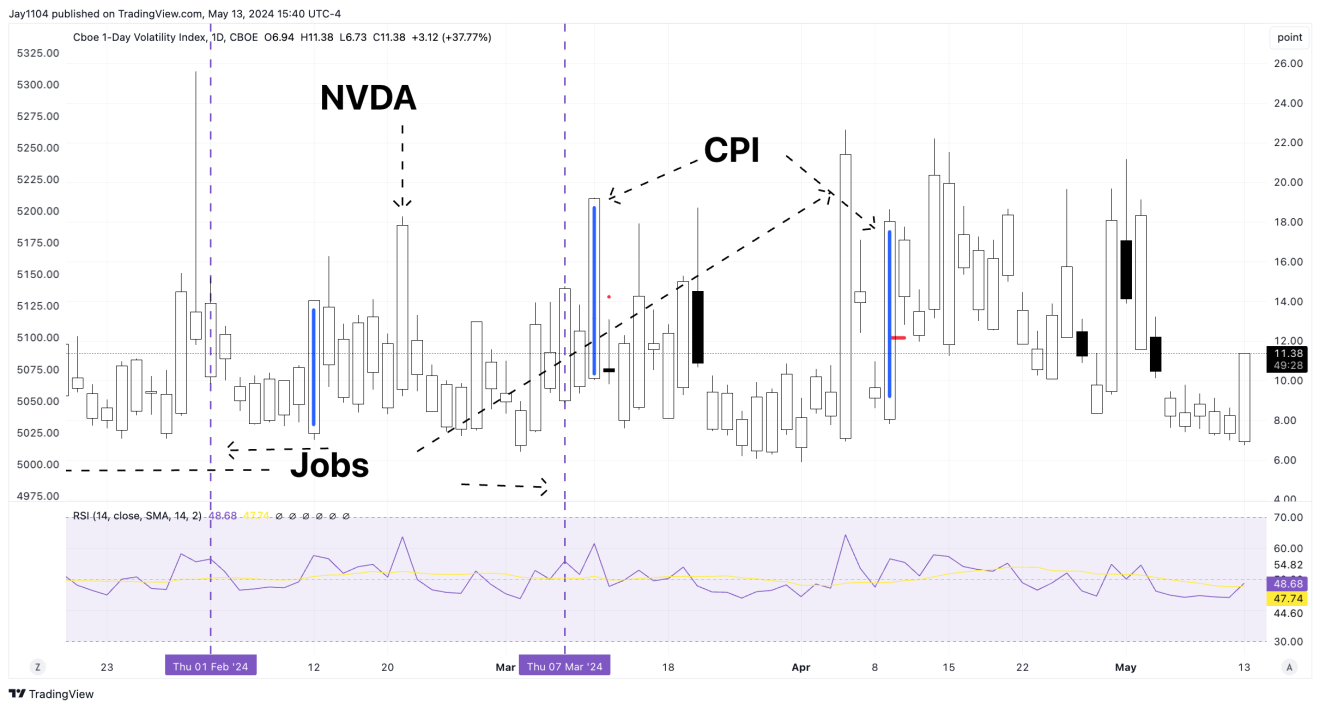

The one thing that is very clear today is that implied volatility levels seem too low, given where they have typically been over the past 2 CPI reports.

The VIX 1-day is around 11.80, up from Friday by 3.5 points. However, the last CPI report saw the VIX 1-day climb to around 19; even in February, it was around 14. So, by that measure, I would be surprised not to see it closer to 18 or 19 by the end of the day tomorrow.

This implies that we can see some crazy moves in the market intraday as IV ramps and traders put on hedges. For example, on April 9, when the VIX 1 Day started to move quickly in the morning, it led to a pretty quick drop in the S&P 500. The IV reset after the CPI report can also give one of these “the market doesn’t care” moments or even days.

It is tough to predict how the market will respond to the CPI report, but one thing that seems clear is that the higher implied volatility climbs into the news, the more likely it is that the S&P 500 will rally following the report. So, it is not that the market doesn’t care; the mechanical forces are in charge. The higher the IV goes into the event, the more I argue that the market cares greatly.

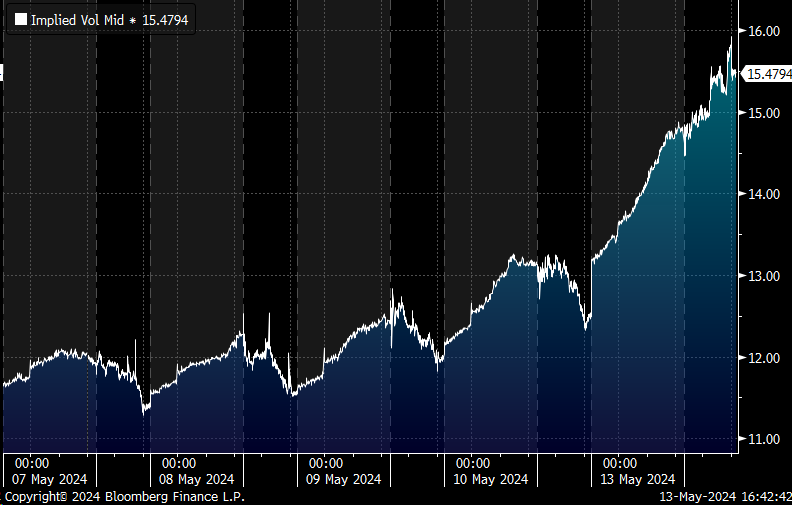

The most actively traded options in the S&P 500 for Wed OPEX were all puts.

The IV for the 5,190 puts for Wednesday was up sharply today and is likely to continue to increase tomorrow.

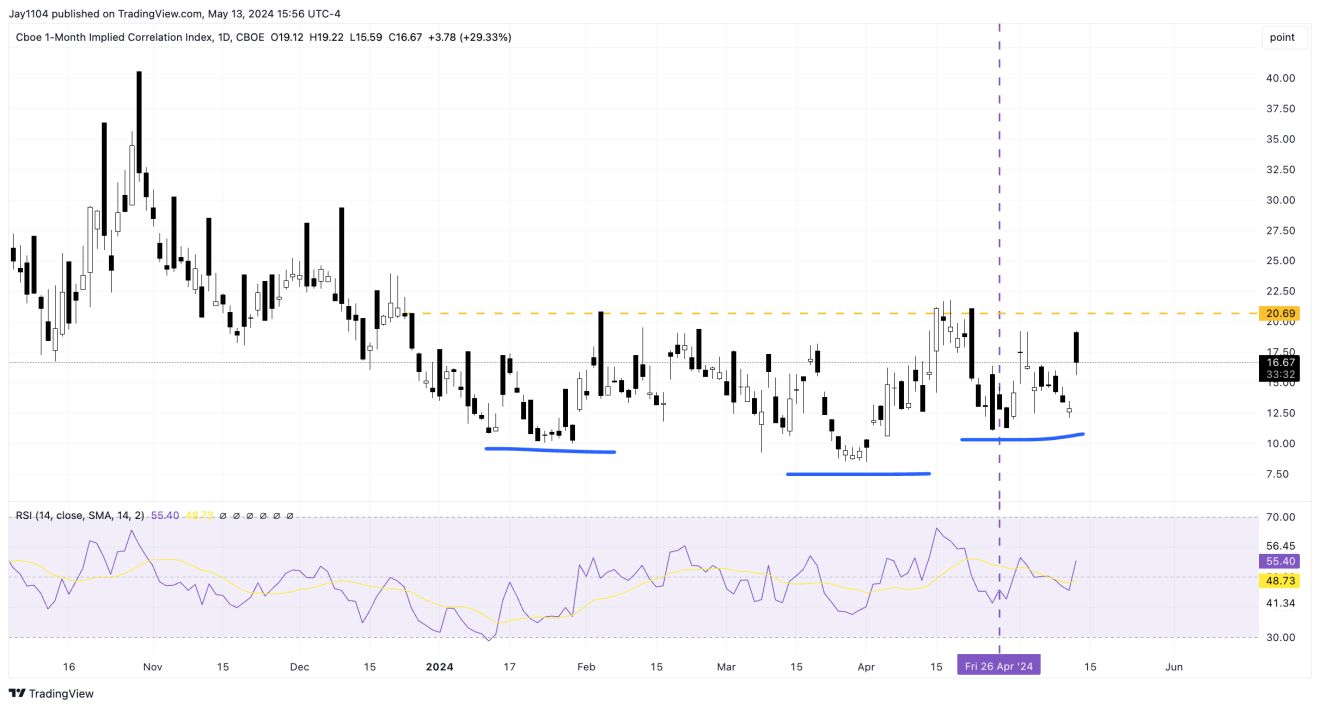

It is probably not the smartest thing to try and do technical analysis on something like the 1-month Implied correlation index. Still, I thought it would be FUN to try, stressing the FUN, with a glaring inverse head and shoulder pattern that appears to be there.

The implied correlation index was up today by around 4 points, and as we have discussed before, it isn’t typical to see the implied correlation index up and the S&P 500 up or flat on the day. Typically, the S&P 500 and implied correlation move in opposite directions.

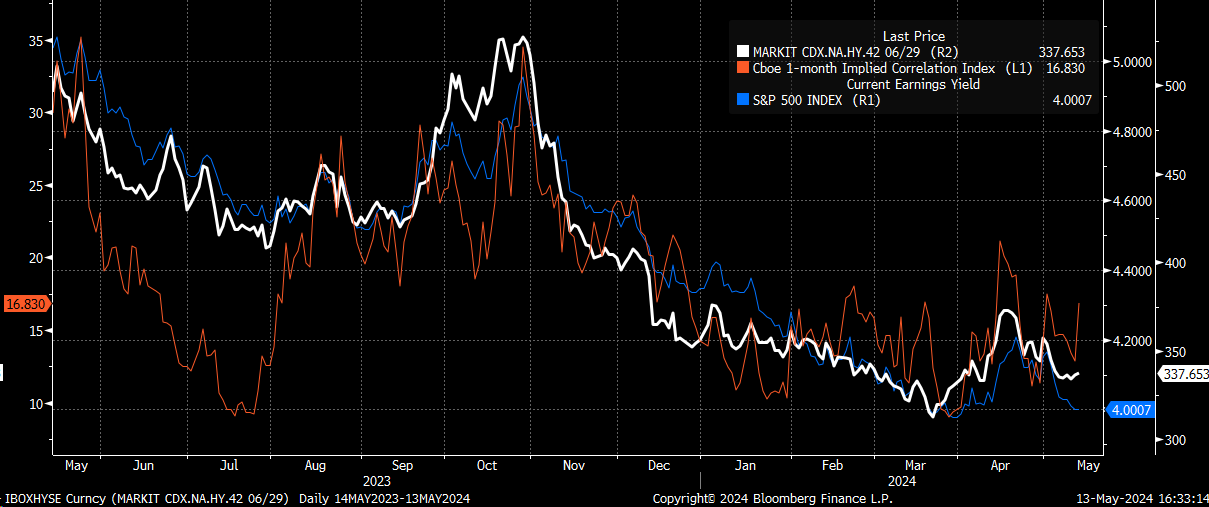

The CDX High Yield credit spread index rose on the day to 337. Typically, the high-yield credit spread index, the implied correlation index, and the S&P 500 earnings yield tend to move together.

The blue line in the chart below shows that the S&P 500 earnings yield is separating from the others. While this signal can persist for a few days, it typically doesn’t persist for long. So, if the data supports financial conditions tightening, then at some point, equity prices will have to reflect the tightening of conditions.

Meanwhile, the USD/MXN was up today, crossing a downtrend on both price and relative strength. Interestingly, the RSI made a higher low despite the USD/MXN making a lower low in mid-April. That could be a reversal signal and needs to be watched. If the USD/MXN starts to move back over 17, things can start to get interesting for the equity market.