- Political turmoil in Japan is not conducive to further interest rate hikes, weighing on the yen.

- Meanwhile, US labor market remains strong, and Fed may be mulling a smaller hike.

- With this backdrop, USD/JPY is approaching the 150 yen per dollar barrier.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

The political reshuffle in Japan has triggered a notable weakening of the yen against the US dollar, offering traders fresh insights into the USD/JPY outlook.

Prime Minister Shigeru Ishiba's surprising shift in economic policy—particularly his suggestion that Japan's economy isn’t ready for further interest rate hikes—sent ripples through the market, pushing the yen lower.

Meanwhile, robust U.S. labor market data gave the dollar an extra boost, propelling USD/JPY back into an uptrend after a period of correction.

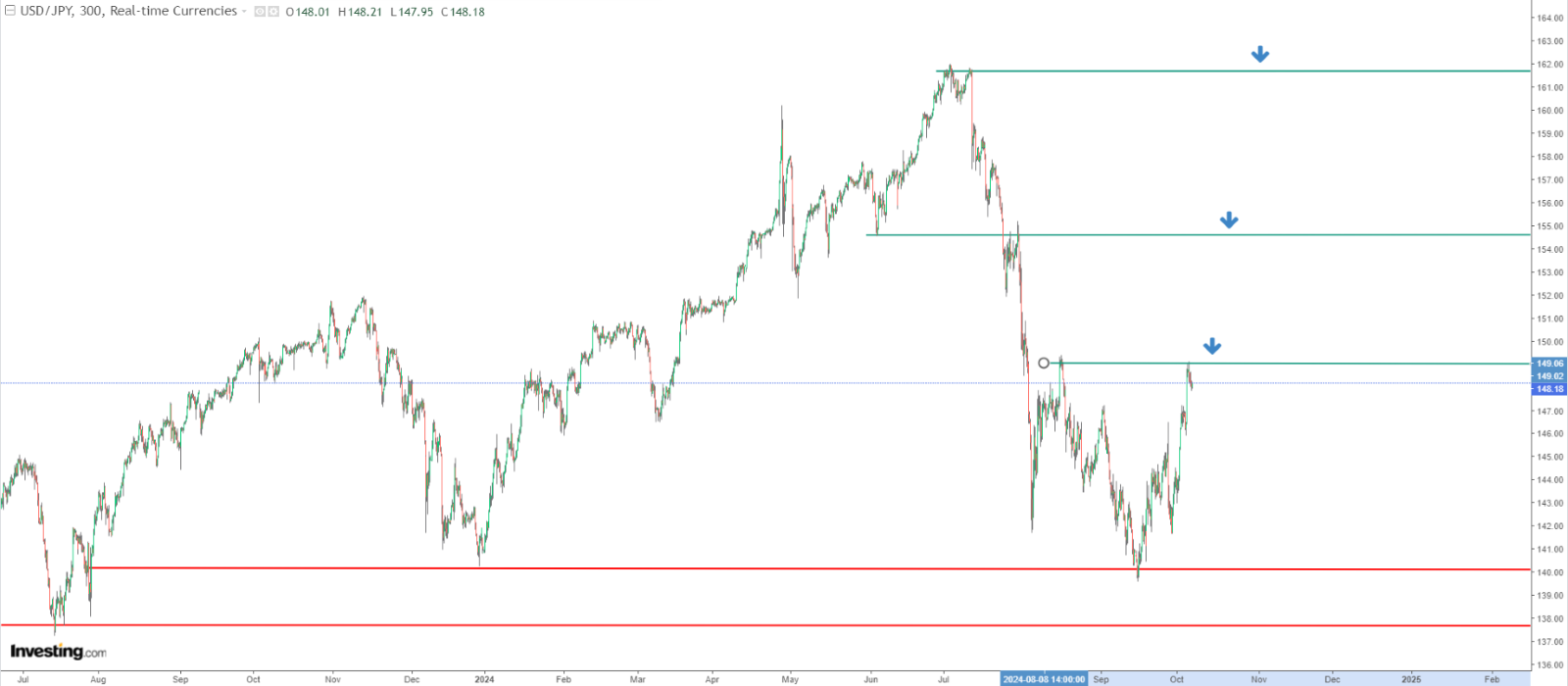

With the pair now testing the critical 150 yen resistance level, traders are eyeing a potential breakout that could set the stage for further gains.

Ishiba’s Surprise Policy Shift Sends the Yen Tumbling

At the start of the month, Japan swore in a new government, with Shigeru Ishiba taking over as Prime Minister, defeating the incumbent favorite, Sanae Takaichi. Ishiba was initially expected to back the Bank of Japan's (BOJ) stance on continuing interest rate hikes.

However, in a surprising twist, he signaled earlier this week that Japan’s economy may not be prepared for further monetary tightening. Given the close coordination between Japan's government and the BOJ, Ishiba's comments rattled the market, leading to immediate yen weakness.

Adding to the uncertainty, early elections have been called for late October, with no clear outcome in sight. This political unpredictability could cause Japan's monetary authorities to delay any further rate hikes until the December meeting—if the data justifies such a move.

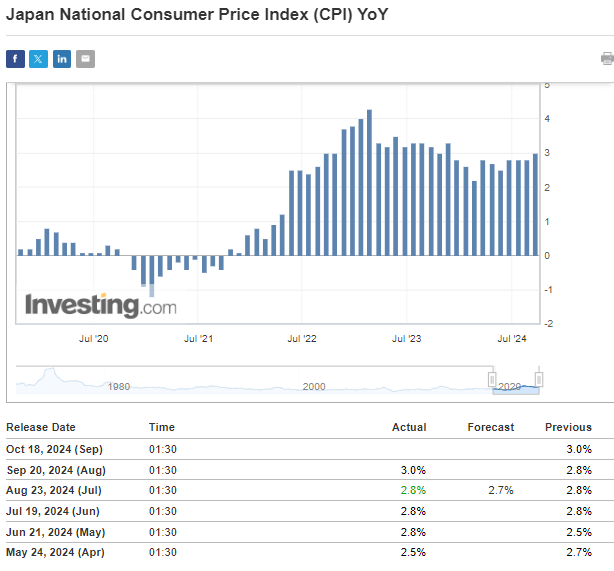

Inflation in Japan Creeps Higher

Japan's inflation dynamics continue to be a key driver of monetary policy decisions. The latest inflation readings showed a rise to 3% for consumer inflation and 2.8% for core inflation, reinforcing the notion that inflation remains on an upward trajectory. This development complicates the BOJ's path forward, as policymakers must weigh inflation risks against economic growth concerns.

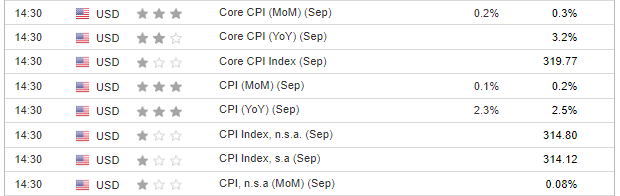

The next major influence on USD/JPY will come from U.S. inflation data, due to be released on Thursday.

A higher-than-expected reading could reignite demand for the dollar, especially if it fuels speculation that the Federal Reserve might slow its rate-cutting cycle.

USD/JPY Battles to Break Above 150 Yen

On the technical front, USD/JPY is currently testing the key resistance zone around 149-150 yen. This level is critical, as a decisive break above it could open the door to a rally toward the next target of 155 yen.

However, failure to breach this zone could lead to a consolidation or even a reversal, with key support resting between 138-140 yen. A break below this level could signal a shift in trend, potentially bringing the pair into a downtrend.

As the market braces for both U.S. inflation data and continued political developments in Japan, USD/JPY traders should remain vigilant.

A breakout above 150 yen could signal strong bullish momentum, while political and inflationary uncertainties may continue to weigh on the yen.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.