- BoJ is set to decide on interest rates tomorrow.

- While the central bank is expected to hold rates steady, a surprise remains in the cards.

- A hawkish move to spark a strong downside breakout below 152 for the USD/JPY pair.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Governor Kazuo Ueda and the Bank of Japan face a formidable challenge this week: navigating an exit from a prolonged period of ultra-loose monetary policy.

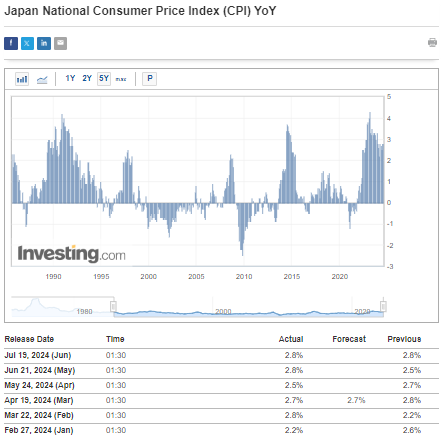

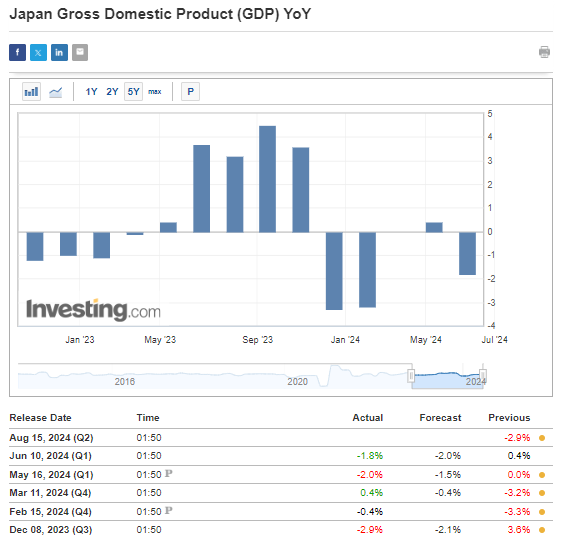

While raising interest rates and scaling back quantitative easing may seem straightforward, the deflationary nature of Japan's economy and its stagnant GDP growth complicates the process.

Adding to the pressure, the Supreme Council of Japan has urged the BOJ to address the negative impacts of a weak yen on the economy and society. The upcoming BOJ meetings are expected to be crucial and closely watched as a result.

Is a Rate Hike in the Cards?

The Bank of Japan faces a delicate balancing act as it strives to achieve a sustainable 2% inflation target while supporting economic growth.

Despite easing inflationary pressures, the central bank is likely to maintain its ultra-loose monetary policy this week.

In March, the BoJ initiated a symbolic interest rate hike, sparking discussions about tightening monetary policy. However, the BoJ has since maintained a passive stance for several reasons.

The central bank remains cautious due to disappointing growth in consumption and real wages, along with GDP readings that suggest Japan's economy teeters between growth and recession.

While a rate hike is unlikely, the central bank could announce a gradual reduction in its bond-buying program.

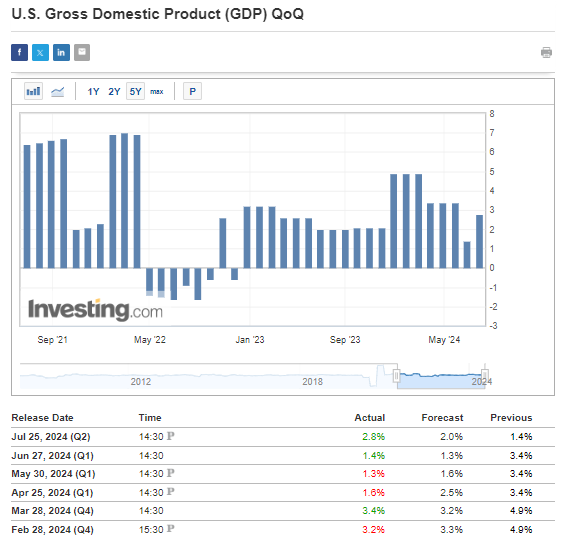

In contrast, positive GDP growth readings have allowed the Federal Reserve to maintain restrictive interest rates in the US.

Upcoming US labor market data, due Friday, is not expected to alter the consensus for a rate cut by the Fed in September. Only a significant deviation from forecasts could trigger substantial volatility in currency pairs involving the US dollar.

USD/JPY Technical View: Correction Halts at 152

In July, the USD/JPY correction slowed near the strong support level of 152 yen per dollar. A move above the local resistance at 155 yen would confirm buyers' intentions to resume the uptrend.

If the Bank of Japan adopts a strong hawkish stance, a downward movement may continue. Should the pair drop below the 152 yen support, the next target for sellers is 147 yen per dollar, where the next confirmed support lies.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.