Recent US recession forecasts look set to fail again for the first-quarter economic profile, based on the current lineup of Q1 GDP nowcasts.

Output remains on track to slow in the first three months of 2024, but not enough to revive the warnings from some analysts that a new downturn is near as a highly plausible scenario.

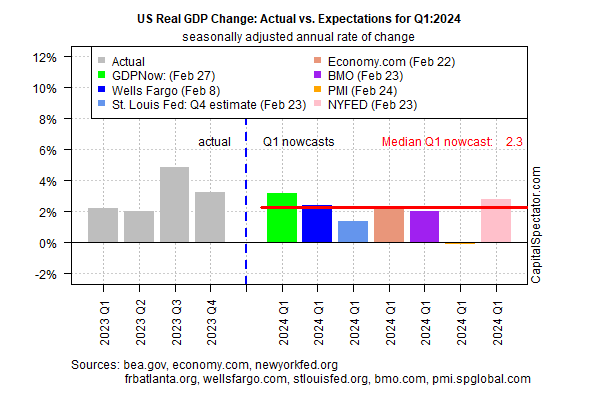

Q1 growth is projected to rise 2.3% (real seasonally adjusted annual rate), based on the median GDP nowcast for a set of estimates compiled by CapitalSpectator.com.

The nowcast reflects a substantially softer rise vs. Q4’s strong 3.3% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to data published by the Bureau of Economic Analysis. (Note: BEA is scheduled to publish revised Q4 GDP today.)

Today’s revised Q1 estimate ticked down slightly from the previous estimate, but for now there’s still no sign that economic activity is slowing to an extent that raises warning flags that the expansion is threatened.

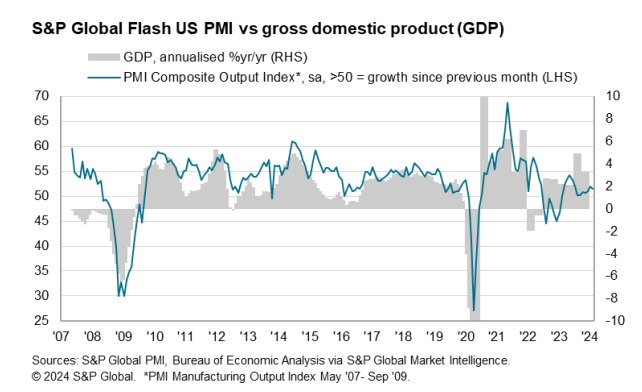

Survey data for this month paint a relatively upbeat profile for US economic activity.

“The early PMI data for February indicate that the US economy continued to expand midway through the first quarter, pointing to annualized GDP growth in the region of 2%,” says Chris Williamson, chief business economist at S&P Global Market Intelligence.

“Although service sector growth cooled slightly, manufacturing staged a welcome return to growth, with factory output growing at the fastest rate for ten months.”

Another survey also indicates that recession risk is low, according to the National Association for Business Economics. A new poll of the group’s members projects that the US will expand 2.2% in real terms this year – up from November’s 1.3% forecast.

For some economists, economic risk has only been postponed rather than sidestepped. Economist David Rosenberg, who runs Rosenberg Research, says:

“Not everything is coming up smelling like roses, as the consensus narrative and Fed commentary would have you believe.” He cites several red flags that could bring trouble later in the year, including soft residential construction, industrial production and retail spending data via recent updates.

A further slowing of the economy, or worse, can’t be ruled out, but at the moment the odds remain favorable for expecting that the next NBER-defined recession for the US won’t start in the first quarter.

“The big question is: what’s the chance of a really nasty landing? So maybe growth tips a little below zero, does it go deeply negative?” Michael Schumacher, Wells Fargo head of macro strategy, tells CNBC. “We at Wells Fargo think that chance is vanishingly low at this point.”