The U.S. dollar traded higher against all of the major currencies on Tuesday on the back of relatively neutral comments from Federal Reserve Chairman Jerome Powell. Although Powell described the outlook as highly uncertain and said “the path forward will depend on keeping the virus under control and on policy actions taken at all levels of the government,” none of these remarks were surprising. Powell is speaking a few times this week on the coronavirus and the economy but, with monetary policy set, comments from his peers could be more market-moving. In fact, we were surprised when Fed President Charles Evans said the economy returned to 90% of pre-pandemic levels (because it certainly doesn’t feel that way) and the Fed could raise interest rates before 2% average inflation is reached. Fed President Thomas Barkin agreed with Powell that the path of the economy is “critically dependent” on the virus path, but he also noted that “spending is coming back faster than employment.” These notes of optimism played a key role in sparking demand for U.S. dollars. Manufacturing activity in the Richmond region was also better than expected, while existing home sales rose 2.4%, right in line with expectations. With no major U.S. economic reports scheduled for release on Wednesday, the focus will be on Fed speak and Washington headlines.

The rally in the dollar drove sterling, the Australian and Canadian dollars to one-month lows and the euro to a two-month low. On a percentage basis, the Australian dollar was the biggest loser, but the milestone in the euro was more significant. With the second virus wave intensifying in Europe and ECB President Christine Lagarde shifting her stance on the euro’s appreciation, losses were inevitable. In yesterday’s note we wrote that the pair could slide as far as 1.15, and how quickly this happens will hinge on tomorrow’s Eurozone PMI report. If manufacturing and service sector activity slows in the month of September, it could be the nail in the coffin for the euro.

Virus woes hit sterling hard today after Prime Minister Boris Johnson announced new restrictions that could last up to six months. This includes office workers working from home if possible, penalties for not wearing a mask or gathering in groups of more than six. All pubs and hospitality venues must close by 10 p.m. and there is no planned return of spectator sports. Many small businesses have suffered during the pandemic, and the prospect of these restrictions being in place for the next six months could force more into closure. Between coronavirus pains and the increasing likelihood of a no-deal Brexit, sterling is destined for more losses. Like the Eurozone, UK PMI numbers are scheduled for release next week and softer numbers will also compound the losses for the currency.

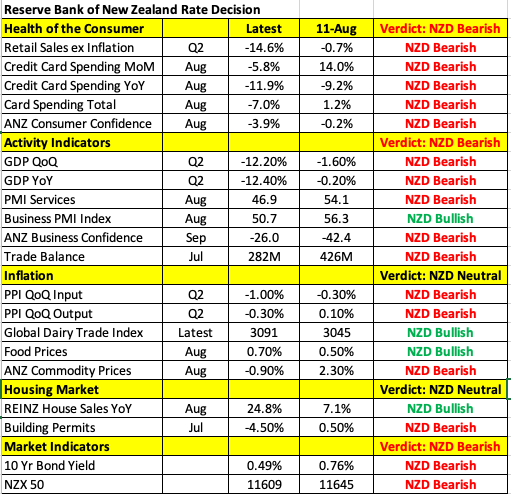

All three of the commodity currencies extended their losses with the Australian dollar leading the slide. No economic reports were released from Australia, Canada or New Zealand, but ongoing tensions between China and Australia makes the Australian dollar less attractive. The Reserve Bank of New Zealand meets tonight. While New Zealand is one of the most successful countries in beating COVID-19, economic data deteriorated between August and September. Consumer spending declined, consumer confidence fell as service and manufacturing activity slowed. The good news is that business confidence improved but that’s the extent of it. When the RBNZ last met, it talked about the effectiveness of negative interest rates, but said the most immediately available tool is expanded large scale asset purchases. While no changes in monetary policy is expected tonight, domestic data and the global outlook warrant an easing bias by the central bank.