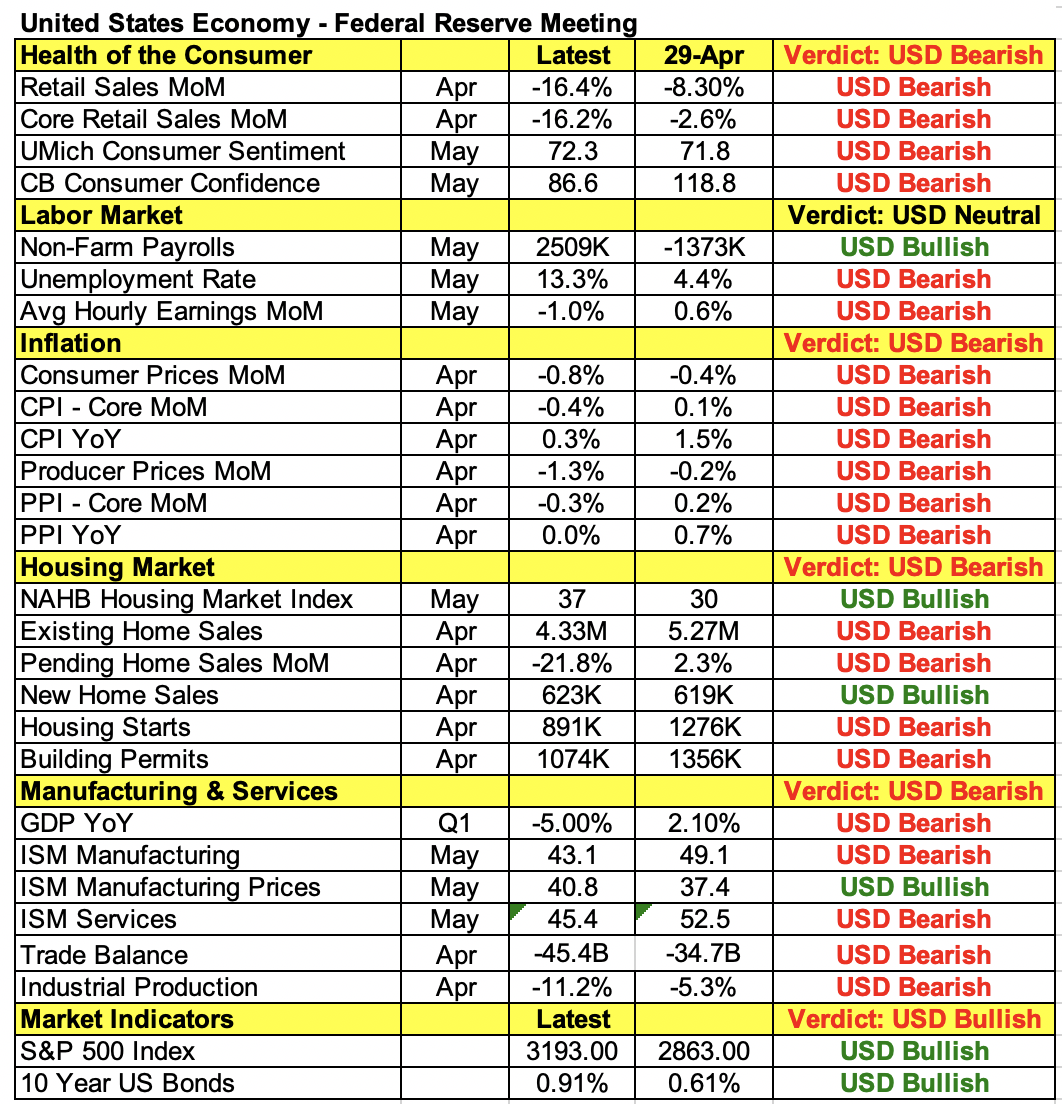

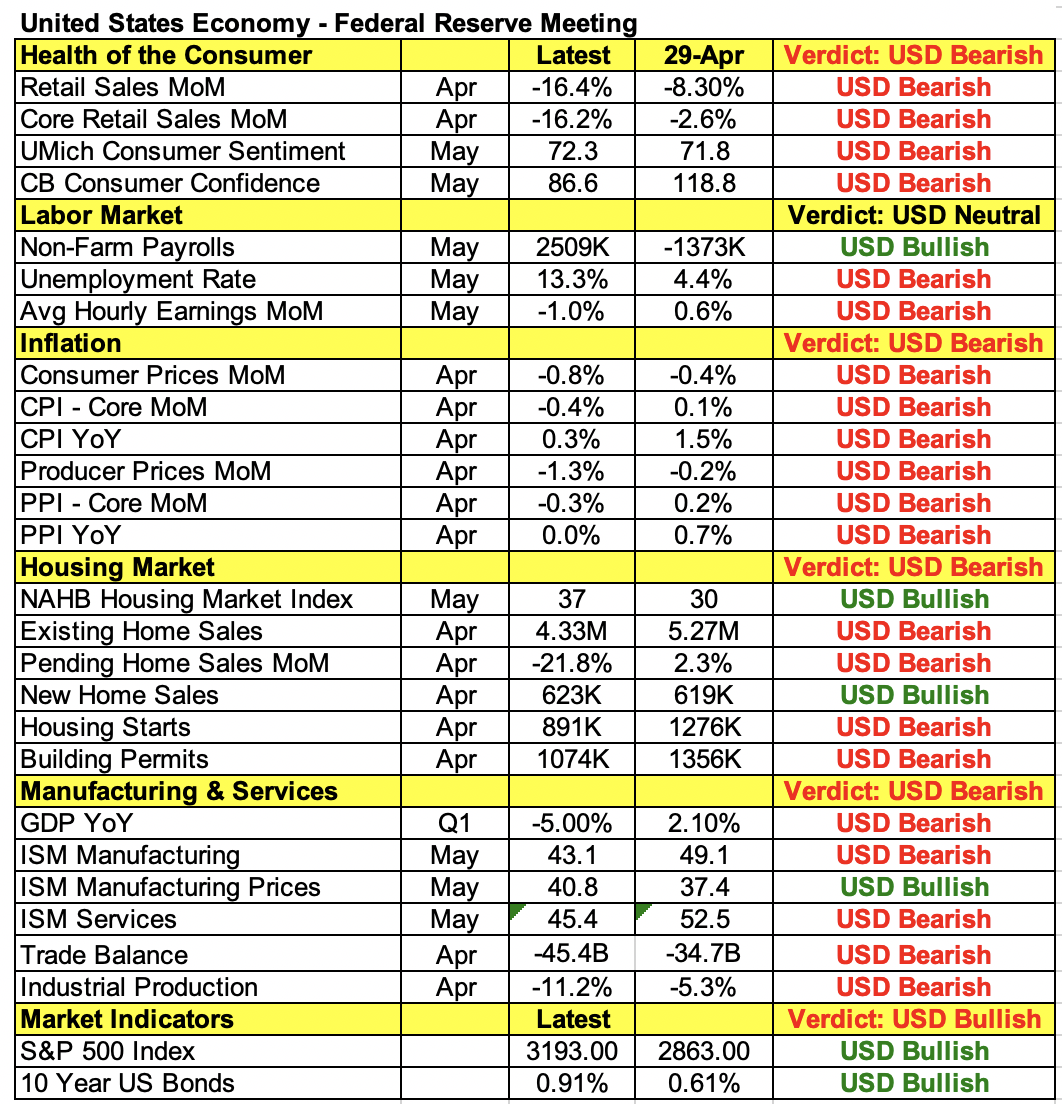

Investors drove U.S. dollars to fresh lows after the Federal Reserve made it clear that zero interest rates are here to stay, at least for the next year and a half. According to the updated dot plot of interest rate projections in June, U.S. policy-makers do not see a rate hike before the end of 2022. They also felt that continued purchases of Treasury- and mortgage-backed securities “at least at the current place” is necessary, leaving the door open to further bond purchases.

The prospect of cheap and easy money for another 18 months is negative for the U.S. dollar because it eliminates the hope for any meaningful increase in yields and discourages safe-haven trades. A central bank’s reluctance to rate hikes hurts the market in a backdrop of deteriorating growth, but when markets and economies are in recovery mode like now, keeping interest rates low to support a stronger recovery encourages risk-taking. For all these reasons, the euro, sterling, the Australian, Canadian and New Zealand dollars climbed to multi-month highs versus the greenback. The biggest beneficiary was the Australian dollar, which rose more than 1% to its strongest level since July 2019. EUR/USD broke through 1.14 to a nearly 3-month high.

The need for accommodative policy was made clear in the Fed’s view that the virus poses considerable risks and, in Fed Chairman Jerome Powell’s comment today, the central bank is not even thinking about raising interest rates. The May jobs report was good, but the BLS jobless rate likely understates unemployment and it's not clear if the labor market hit a bottom in May, according to Powell. Nonetheless, he sees a second-half recovery that is supported by zero-interest rates. Full recovery, however, is “unlikely to occur until people feel safe.” As a result, they will keep using emergency lending powers forcefully and adjust bond-buying as needed. It needs to continue buying bonds and keep interest rates at zero because there’s a lot of “work to be done” to get 22 million to 24 million back to work, and millions may be out of work for some time. The next few months will be “important in judging the real story,” but it's clear from the Fed’s economic projections and Powell’s cautiously optimistic tone that the central bank’s work has gone from preventing a depression to encouraging a recovery, which is good news for the U.S. economy.

Here are the main takeaways from the Fed announcement:

+ Buying bonds “at least at current pace”

+ Sees rates at zero through 2022

+ No negative rate dots

+ Expects 9.3% unemployment rate end of 2020, 6.5% end of 2021

+ Sees GDP falling 6.5% in 2020, rising 5% in 2021

USD/JPY pulled back post FOMC, but with further improvements expected in U.S. data, the losses should be limited.

Can risk trades carry on? Based on today’s FOMC, the answer is yes, but the overextended moves in currency pairs, such as EUR/USD, AUD/USD, NZD/USD and USD/CAD begs for a correction. For the past few weeks, investors have been driving currencies and equities higher on the premise that the worst is over and Powell’s comments along with the FOMC projections suggests that the central bank shares these views.