Turmoil in the bank industry and renewed concerns of economic headwinds are driving expectations that Federal Reserve's interest-rate hiking is at or near an end. In turn, the outlook has sparked a rally in the US bond market.

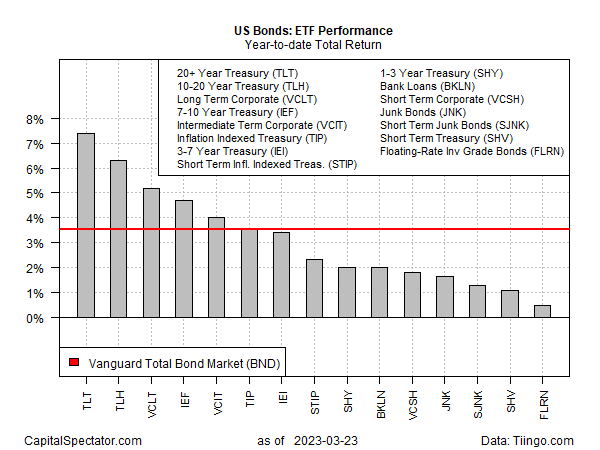

Year to date, through Thursday’s close, all the major components of US fixed income are posting gains based on a set of ETFs. The 2023 rally is led by long Treasuries: iShares 20+ Year Treasury Bond (NASDAQ:TLT) is up 7.4% this year. Most of the gain has unfolded over the past two weeks as news of bank turmoil lifted demand for safe havens.

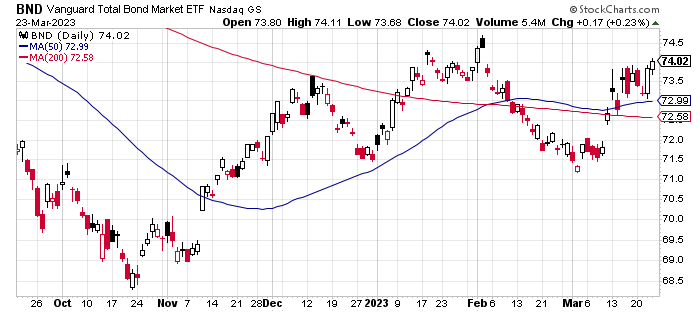

Fixed income generally is enjoying higher prices lately, based on a broad measure of US investment grade bonds. Vanguard Total Bond Market ETF (NASDAQ:BND) is up 3.5% so far in 2023.

Bloomberg earlier this week noted that Federal Reserve Chair Jerome Powell’s preferred measure of US recession risk is flashing a warning. In March 2022, he cited the spread between the current yield on United States 3-Month Treasury bills and their expected yield 18 months forward — a spread that’s now clearly signaling a recession at some point in the near term.

The combination of a banking crisis (albeit one that appears contained so far) and expectations for stronger economic headwinds, if not a recession, are inspiring revised forecasts for monetary policy decisions. After the Federal Reserve lifted its target interest rate by ¼ point to a 4.75%-5.0% range on Wednesday, analysts and investors wondered if that increase would be the last, at least temporarily. The change in sentiment has fueled demand for the relative safety of bonds in the second half of March.

The Fed funds futures market is currently pricing in moderately high odds – roughly 70% in early trading today — that the Fed will leave rates unchanged at the next FOMC meeting on May 3.

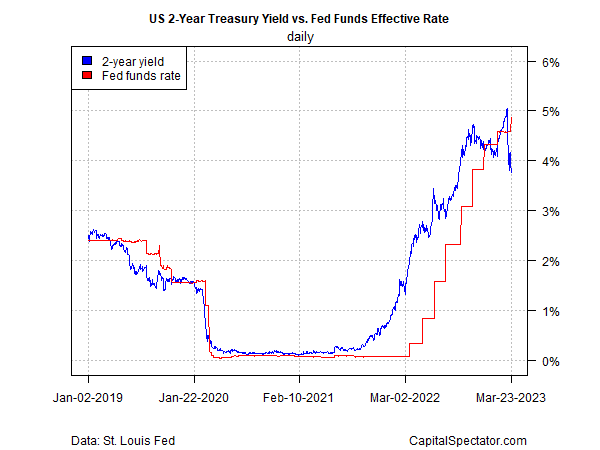

The 2-year Treasury yield is also signaling that the Fed’s target rate has peaked. This yield, widely considered the most sensitive maturity for rate expectations, traded down to 3.76% yesterday (Mar. 23), the lowest since September.

The key takeaway: the wide gap between the lesser 2-year rate and the 4.75%-5.0% range for Fed funds reflects a market sentiment that anticipates a pause and perhaps a cut in central bank monetary policy.

Keep in mind that elevated worries linked to bank turmoil and economic headwinds are driving bond prices higher and yields lower. Michael Gapen, an economist at Bank of America) Securities, noted,

“Should the stresses in the financial system be reduced in short order, we cannot rule out that stronger macro data will lead the Fed to put in additional rate hikes beyond May. But for now, we think that risks are in the direction of an earlier end to the tightening cycle.”

Timothy Duy, the chief US economist at SGH Macro Advisors, advises that “the game has changed.” Writing in a note to a client on Thursday, he explains,

“The banking sector turmoil has badly shaken the Fed. It has less confidence that it can continue to hike rates without severely impairing the banking sector. Until it can regain its confidence, the Fed will move more cautiously. Watch for the Fed dismissing any strong growth and elevated inflation data as backward-looking as Powell did in [Wednesday’s] presser.”