- There is little sign that consumers are spending less on ride-sharing and delivery services

- Uber is making more money from delivery than ever, primarily because of its higher-margin advertising business contributions

- Earnings from Airbnb showed that travel demand remains robust after the pandemic-related restrictions

Shares of gig economy companies are roaring back after a sharp downturn in the first half of this year. Uber Technologies (NYSE:UBER) surged 36% last week, while LYFT (NASDAQ:LYFT) gained 46% for the same period—the best ever 7-day performance for both stocks.

Meanwhile, Airbnb (NASDAQ:ABNB) rose for a third straight week, amounting to a 20% gain during the past month.

Despite current macroeconomic headwinds, the industry's earnings showed that there is little sign that consumers are spending less on ride-sharing, shared accommodation, and delivery services. The latest evidence of this strength came in the second-quarter earnings reports from Uber, Lyft, and Airbnb.

Uber Chief Executive Officer Dara Khosrowshahi told Bloomberg TV that his business is firing on all cylinders, with no sign that people are spending less. During the second quarter, the ride-hailing giant reported record gross bookings and revenue, which more than doubled to $8.1 billion.

Uber's much smaller rival, Lyft, reported its best-ever earnings, with revenue surging 30% from a year earlier amid a broad-based rebound in ride hailing that showed that the worst, perhaps, is over for this stock which is still down more than 50% year-to-date.

More Upside

I see more upside in Uber and Airbnb as both companies should benefit from resilient consumer demand of spending more on services and experiences after a prolonged period of COVID-related restrictions.

Furthermore, both companies have used the pandemic to invest in innovation and streamline their cost structures, making their business models more resilient to any potential economic downturn.

The global platform for vacation home rentals earnings from Airbnb also showed that travel demand remains robust after the pandemic restrictions, justifying the jump in its stock in the past month. The San Francisco-based company reported record revenue in the second quarter and said the current period would produce another all-time high.

Uber's delivery business, for example, has proven to be great diversification during the pandemic and has become a solid source of revenue in normal times. Uber Eats revenue grew 25% from a year ago. Uber's delivery arm, including restaurants, grocery items, and alcohol, saw bookings increase 7% from a year ago to $13.9 billion. The company is making more money from delivery than ever, partly because of its higher-margin advertising business contributions.

As rides come back and UberEats business thrives, the company is also attracting drivers who were in short supply in the post-pandemic environment. An economic argument to support this bull case is that the job market is still resilient due to the workers' shortage. That situation will likely persist, giving people strong spending power to travel.

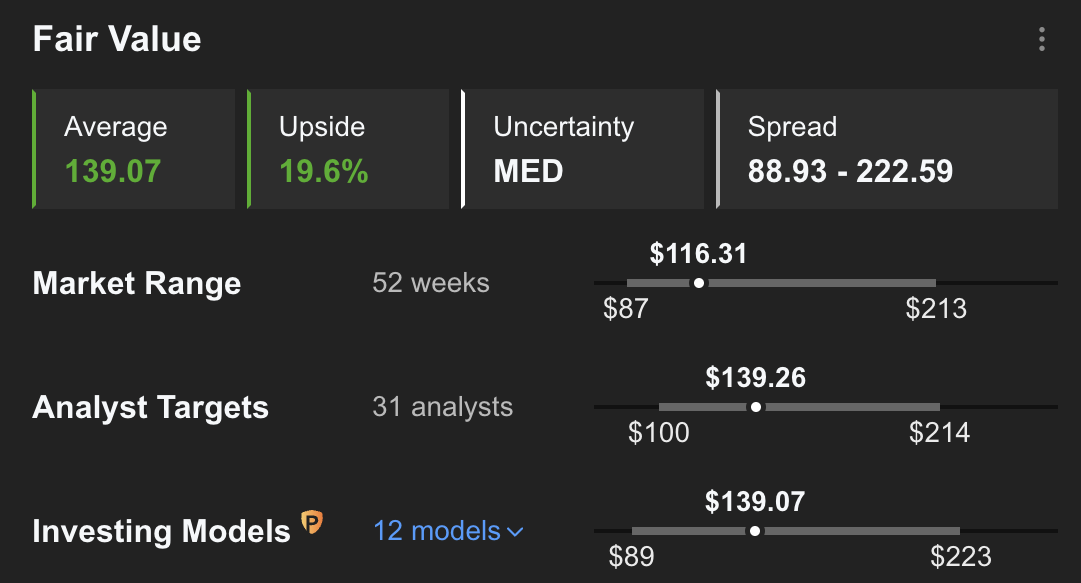

On the other hand, Airbnb will continue to gain from pent-up demand for travel even if we enter a mild or short recession. The InvestingPro fair value model shows a 19.6% upside potential for the stock.

Source: InvestingPro

IATA Director General Willie Walsh told a gathering of airline CEOs in June that experience suggests the impact of an economic slowdown won't be so harmful to the travel industry. He pointed to the global financial collapse of 2008, after which passenger numbers held steady in 2009 and showed strong growth in 2010.

Airbnb said in a letter to shareholders:

"During the height of the pandemic, we made many difficult choices to reduce our spending, making us a leaner and more focused company.

We've kept this discipline ever since, allowing our hiring and investment plans to remain unchanged since the beginning of the year. Airbnb is well positioned for whatever lies ahead."

Bottom Line

Uber and Airbnb remain my two favorite gig economy stocks in the current bear market. Despite their recent gains, they are still offering an attractive opportunity for long-term investors to benefit from their global growth, which still has more room to run.

Disclosure: The writer doesn't own shares of the companies mentioned in this report.