Call it the curse of the 'unwintry' winter.

A cold season that’s lately been anything but freezing is spelling doom to prices of natural gas, the chief commodity for heating in the United States.

Until the semblance of recovery that crept up in the past three sessions, the spot gas contract on New York’s Henry Hub had lost an epic 30% plus over the past two weeks, falling from a November peak of $5.56 per million metric British thermal units to this week’s five-month low of $3.63 per mmBtu.

Without an appreciable drop in temperature, the market’s needle could be stuck below the key $4 mark for a while, and edge closer to the $3 support if gas stockpiles build more materially than the weather.

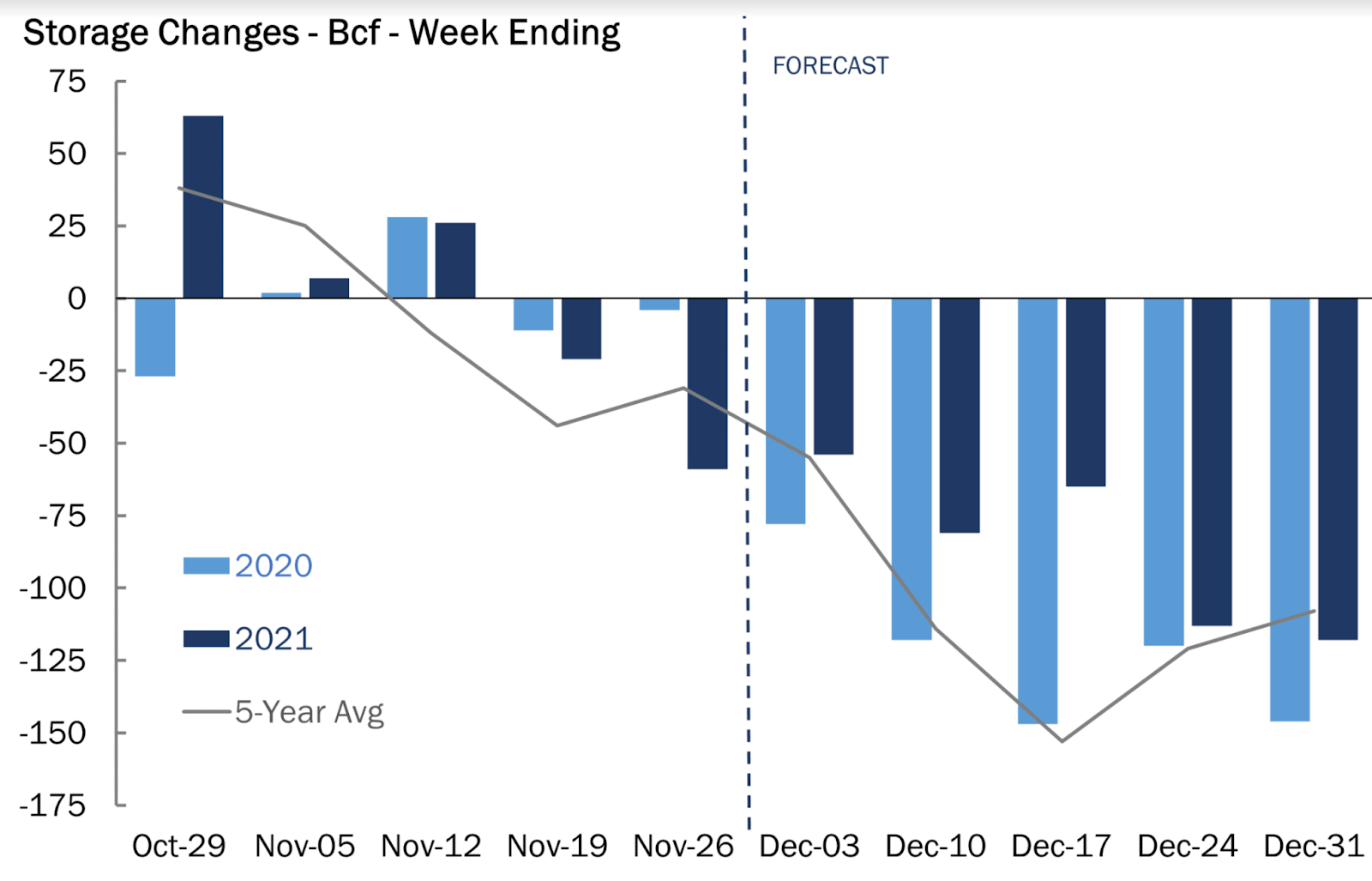

As market participants await another weekly update on US gas inventories from the Energy Information Administration, the consensus is that last week utilities burned close to the five-year average of gas required for heating and power generation, though this was still sharply lower from year-ago levels.

All charts courtesy of Gelber & Associates

According to analysts tracked by Investing.com, US utilities likely pulled 54 billion cubic feet (bcf) of gas from storage last week, helped by near record-high exports that propped up consumption amid warmer-than-usual weather.

That compared with a withdrawal of 78 bcf during the same week a year ago and a five-year (2016-2020) average withdrawal of 55 bcf.

In the prior week to Nov. 26, utilities withdrew 59 bcf of gas from storage.

If analysts are on target, the withdrawal during the week ended Dec. 3 would cut inventories to 3.510 trillion cubic feet, 2.4% below the five-year average and 9.1% below the same week a year ago.

The storage report for the week ended Dec. 3 will be released at 10:30 AM (15:30 GMT) today.

“Looking ahead at future withdrawals, mild weather is expected to continue to impact the storage reports on Dec. 10 and 17 as well,” said Dan Myers, analyst at Houston-based gas market consultancy Gelber & Associates.

He said today’s report as well as the following two were not expected to show remarkably higher consumption compared to five-year averages.

“As a result, it is likely that total storage inventories will drive closer and eventually surpass the five-year average of total storage in the near future,” said Myers.

He added:

“Risk of undersupply, which materialized late in the injection season, has largely been eradicated, and it will take a severe bout of cold weather to reverse the decline of the winter risk premium.”

The weather last week was milder than normal with 122 heating degree days (HDDs), compared with a 30-year normal of 148 HDDs for the period, according to data provider Refinitiv.

HDDs, used to estimate demand to heat homes and businesses, measure the number of degrees a day's average temperature is below 65 degrees Fahrenheit (18 degrees Celsius).

Helping consumption were exports of liquefied natural gas.

The amount of gas flowing to US LNG export plants has averaged 11.8 bcf per day so far in December, with the sixth train of Cheniere Energy's (NYSE:LNG) Sabine Pass plant in Louisiana in production. In November, daily flows for LNG were at 11.4 bcf.

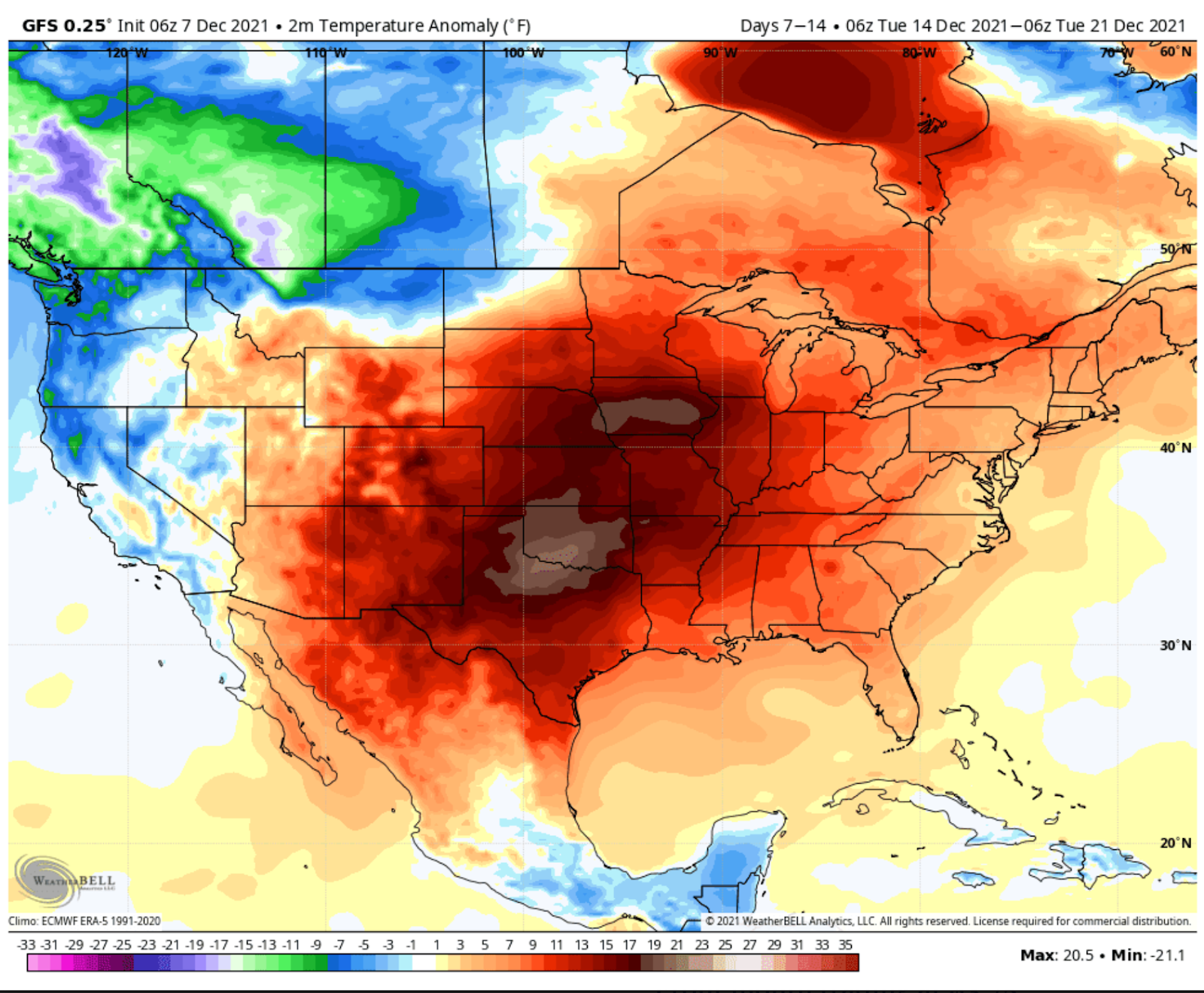

Although the weather models did not add much demand to the 15-day outlook, Bespoke Weather Services said in a forecast carried by naturalgasintel.com that there were some bullish changes in the upper-level pattern around Dec. 20, as both the American and European weather models pushed more ridging into Alaska.

This could pose more of a threat for cold air intrusions into the western and central United States during the holiday season, the forecaster said.

“This is tied into the changes in tropical forcing we have discussed this week, and why we have talked about at least the potential for material changes in the pattern down the road,” Bespoke said.

It added, however, that “we need to see consistency in the modeling and progression forward in the forecast.”

“Also, it remains to be seen if such a change would simply take us from super warm to variable, or perhaps something more,” Bespoke said.

“For now, we would lean toward just some variability, nationally, with best cold chances central/west.”

NatGasWeather was also cited by naturalgasintel.com as saying that the midday Global Forecast System data maintained the small increase in projected demand for later this month, but was still “exceptionally bearish overall.”

There are expected to be chilly weather systems into the US Western regions over the next 15 days, which at times may leak across the Midwest, according to NatGasWeather. However, with warmer-than-normal conditions over the important southern and eastern United States on most days, “national demand just won’t be nearly as strong as needed,” the forecaster added.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.