As the market reacts to recession signals, the CBOE Volatility Index (VIX) briefly broke above 60 on Monday, climbing 163% over 5 days. Otherwise known as the “fear index,” based on S&P 500 weighted 30-day call and put options, VIX reflected the level of anxiety last seen in March 2020 following the lockdown-related concerns.

This time around, the market anxiety follows Friday’s weak jobs report and Berkshire Hathaway B (NYSE:BRKb)’s 37.8% reduction of Apple (NASDAQ:AAPL) stake in the Q2 earnings report. Serving as a market signal, Warren Buffett’s portfolio reshuffling has even gone viral.

Likewise, the Japanese Nikkei 225 index experienced the biggest drain in history, having closed more than 12% down. The loss of Nikkei’s 4,451 points was greater than during the “Black Monday” of October 1987, having lost 3,836 points then.

With the S&P 500 (SPX) in the red for the week, the market benchmark reverted to the early May 2024 level. On the upside, the markets are pricing in 118 bp worth of interest rate cuts by December’s FOMC meeting, according to BofA Global Research.

But during this major market correction, is it time to double down on AI stocks ahead of the inevitable recovery? Let’s take a look at Nvidia (NASDAQ:NVDA) first as the weathervane for the AI sector.

1. Nvidia

Over the last 30 days, Nvidia stock has been down 21%, wiping out $651 billion worth of market cap. Now at $2.5 trillion from a $3.15 trillion valuation, Nvidia’s much-anticipated Blackwell B200 AI chips appear to be delayed. According to an insider Microsoft (NASDAQ:MSFT) source exclusively relayed to The Information, a design flaw in the chip’s architecture was discovered “unusually late in the production process.”

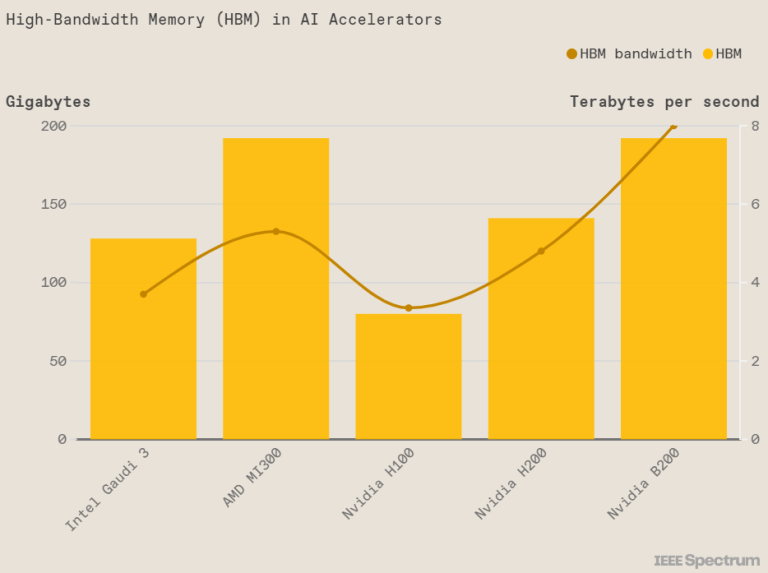

Just as H100 chips carried Nvidia over the $1 trillion market cap milestone, as they trained most large language models (LLMs), B200 is supposed to push the envelope further. The second-generation chips are purportedly 30x faster in inference performance while having 4x the training performance of H100s.

Moreover, with a 2.4x greater memory bandwidth for large datasets, B200s are supposed to reduce power consumption by 25x while handling equivalent AI workloads. Given the fact that Google (NASDAQ:GOOG), Microsoft, Amazon (NASDAQ:AMZN), Meta (NASDAQ:META), Tesla (NASDAQ:TSLA), and Apple rely on Nvidia’s AI chipsets, the delay into 2025 (from expected October) translates to major revenue delay.

According to UBS Group analyst Timothy Arcuri, B200 and GB200 Superchips should account for 7% of Nvidia’s total shipments ending January 2025, at 32,500 and 43,400 units respectively. With the delay, this would account for around $3 billion missing out of the expected $34.5 billion.

That said, Nvidia can still count on a large backlog of Hopper architecture, specifically the H200 chips. Taiwan’s Commercial Times first reported that large-scale H200 shipments are only expected after Q3. At the same time, Taiwan Semiconductor Manufacturing Company reported full production capacity allocation back in June.

In other words, as both fabless companies rely on TSMC (NYSE:TSM), Nvidia’s competitor, AMD (NASDAQ:AMD), cannot exploit Nvidia’s delay. This still puts Nvidia as the main source of capital for post-market correction.

2. Intel

Following last week’s matchup between Intel, Nvidia and AMD, the market correction could make Intel (NASDAQ:INTC) even more enticing. Now down 57% year-to-date, INTC is priced at $20.24, which is nearly half its 52-week average of $37.97 per share. It still remains a fact that Intel is building itself as a major chip foundry, with a plan to rank second behind TSMC and ahead of Samsung (KS:005930) by 2030.

Moreover, Databricks’ January research found that Intel’s Gaudi 2 AI chip matches the performance of Nvidia’s H100 with even higher memory bandwidth utilization, making Gaudi 2 the top dollar-per-performance investment against H100/A100.

At Intel Vision 2024 conference in April, Intel revealed Gaudi 3 as having up to 50% memory bandwidth boost, purportedly on par with Nvidia’s H200.

Although lower in performance than Nvidia’s delayed Blackwell series, it is expected that Gaudi 3 will also be a cheaper alternative, around half the cost of B200’s rumored $30k – $40k price range.

Image credit: IEEE Spectrum

At the time, Intel gave a $500 million revenue inflow outlook from Gaudi 3 shipments for 2024. For comparison, AMD’s MI300 series is expected to bring in $3.5 billion. However, with Nvidia’s design flow to be sorted out, this provides Intel space to accelerate its market position during 2025.

In the meantime, the predictable class action lawsuit, resulting from Intel’s 13th and 14th generation CPU instability issues, is having a suppressing effect on INTC price stock. But given Intel’s market dominance in the integrated GPU and CPU market, the current low point should be seen as an opportunity.

3. Taiwan Semiconductor Manufacturing Company

TSMC has been in an awkward position. On one hand, the company is the world’s top semiconductor foundry with the cutting edge chip node processes. On the other hand, its location in Taiwan, contested by China, makes it a risk-on investment exposure.

After Friday’s anxiety-inducing jobs report in the US, Taiwan’s weighted index Taiex dropped 8.3%, with TSM down 8.8%. Yet, with TSMC’s foundry capacities in full swing, the company’s wide moat remains fortified. After all, this is the world’s chipmaking chokepoint.

TSMC still expects Q3 revenue at $23.2 billion to beat expectations, having increased its Q2 revenue 32% year-over-year at $20.82 billion. To make the case that TSM decline is terminal is to make the case that the Big Tech sector will lose its competitive drive for generative AI.

But considering that the Big Tech views generative AI as a Darwinian filter for the next stage of the digital age, that scenario is not likely. Moreover, China’s military engagement with Taiwan is exceedingly unlikely given its high economic instability potential for China.

Taking these factors into account, TSM’s price drop to $147.90 from $182.49 a month ago seems a solid buy-the-dip opportunity.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.