- The key to a stock's surge is exceeding market expectations on earnings day.

- Today we will look at some companies that are expected to report good results with decent upside potential.

- We will harness the power of InvestingPro to gain insights into the stocks' current fundamentals.

- Want to invest by taking advantage of market opportunities? Don't hesitate to try InvestingPro. Sign up HERE and get almost 40% off for a limited time on your 1-year plan!

Nvidia (NASDAQ:NVDA) continued its bull run last week, beating market expectations and sending its stock even higher. This stellar performance highlights a key driver of stock prices: exceeding expectations.

It doesn't matter if a company is trading at all-time highs or languishing near lows – the ultimate factor influencing stock price is whether results surpass market forecasts. When companies consistently beat expectations, their shares tend to climb.

Now, let's turn our attention to other potentially exciting companies that have caught the market's eye. Using the powerful InvestingPro tool, we'll delve into the fundamental data of these businesses to help you gauge their investment potential.

1. Super Micro Computer (SMCI)

Super Micro Computer Inc (NASDAQ:SMCI) develops and manufactures high-performance storage and server solutions based on a modular architecture, mainly in the United States, Europe, and Asia. The company was incorporated in 1993 and is headquartered in San Jose, California.

In January it surprised with revenues of $3.6 billion, which exceeded the previous forecast of $2.7 billion. It reports its results on August 6 and is expected to report EPS up 164.66% and revenue up 147.37%.

Source: InvestingPro

As the demand for GPUs increases, so does the construction of data centers and this fact works in its favor.

In addition, companies involved in computer components, such as Super Micro Computer (and others such as Dell (NYSE:DELL) Technologies, HP (NYSE:HPQ) Enterprise, Coherent (NYSE:COHR), Fabrinet (NYSE:FN) and Lumentum Holdings (NASDAQ:LITE)) will benefit from Nvidia's momentum.

And it is that the expected boost in AI infrastructure investments underscores a growing demand for advanced computing solutions and components, positioning these companies for potential growth.

Market consensus gives it a median potential of $1032.

Source: InvestingPro

2. Western Digital (WDC)

Western Digital Corporation (NASDAQ:WDC) is a global manufacturer of hard drives, integrated circuits and storage products. It was founded on April 23, 1970 as General Digital.

It became a semiconductor manufacturer, with capital provided by individual investors and industrial giant Emerson Electric (NYSE:EMR).

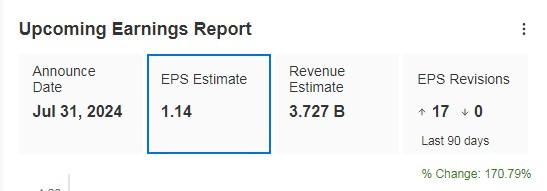

On July 31 it will present its results and forecasts for an increase in EPS (earnings per share) of 170.79%.

Source: InvestingPro

Total revenues for the storage media industry are expected to grow at a compound annual growth rate of approximately 25% over the next three years.

The vice president and chief accounting officer recently sold a portion of his shares in the company, according to recent filings with the Securities and Exchange Commission (SEC).

Specifically, on May 21, he sold 416 shares for $71.88 per share, no big deal. After this transaction, he still owns a substantial amount of Western Digital shares, with 30,321 shares remaining in his possession.

The market consensus gives it an average potential of $83.95.

Source: InvestingPro

3. Hasbro (HAS)

Hasbro (NASDAQ:HAS) is a toy company with a presence in the United States, Europe, Canada, Latin America, Australia, China, and Hong Kong. It was founded in 1923 and is headquartered in Pawtucket, Rhode Island.

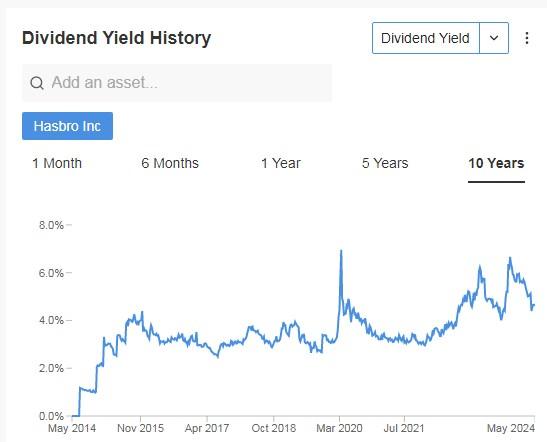

Its dividend yield is 4.62%.

Source: InvestingPro

Source: InvestingPro

We will know its numbers on July 23, expecting an EPS increase of 8.13% in the total computation of 2024 of 42.9%.

Source: InvestingPro

It has 14 ratings, of which 10 are buy, 4 are hold and none are sell.

The market's advisory sees it reaching, on average, $71.77.

Source: InvestingPro

4. Progressive (PGR)

Progressive (NYSE:PGR) is an insurance company specializing primarily in auto, property, business and casualty insurance. It was founded in 1937 and is headquartered in Mayfield Village, Ohio.

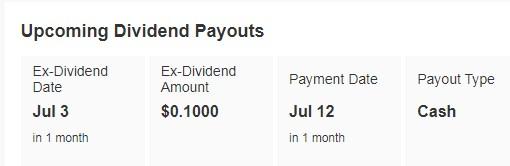

It will pay a dividend of $0.10 per share on July 12. Of note, it has maintained dividend payments for 15 consecutive years.

Source: InvestingPro

We will have its earnings report on July 11, with EPS expected to increase by 51.17% and for the 2024 computation by 86%.

Source: InvestingPro

The company's revenue growth has been very interesting, up 24.93% in the last twelve months through Q1 2024, indicating a strong ability to expand its financial income.

The company enters what is traditionally a slower growth period for auto policies. Based on historical data, Progressive typically adds about 3.5% of its auto policies in May.

Despite this, current market dynamics could alter this trend, as there is increased buying activity and Progressive is actively investing in advertising.

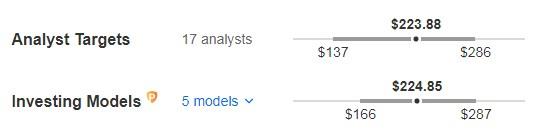

Its fair value based on its fundamentals would be at $224.85, virtually where the market consensus sees it rising on average ($223.88).

Source: InvestingPro

5. Wynn Resorts (WYNN)

Wynn Resorts (NASDAQ:WYNN) builds and operates high-end hotels and casinos. It was founded in 2002 by former Mirage Resorts Chairman and CEO Steve Wynn and is based in Las Vegas, Nevada.

Its dividend yield is 1.06% and the payout (percentage of earnings that goes as a dividend) is slowly rebounding.

Source: InvestingPro

On August 6, we will know its accounts. EPS is estimated to increase by 13.61% and by 2024 by 40.4%.

Source: InvestingPro

The company's hotels have been nearly full and it is going to benefit from the return of convention groups to Las Vegas. In addition, the expansion of its online sports betting business will be a positive driver for the company's growth.

It has 17 ratings, of which 11 are buy, 6 are hold and none are sell.

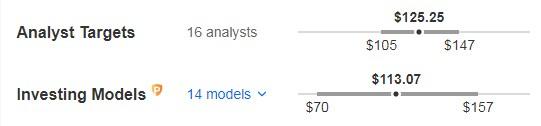

Its fundamental fair value would be $113.07, and the market gives it an average price target of $125.25.

Source: InvestingPro

***

How do you continue to take advantage of market opportunities? Take the opportunity HERE AND NOW to get InvestingPro's annual plan. Use the code INVESTINGPRO1 and get 40% off your 1-year subscription. With it, you will get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.