- Big investors Warren Buffett, Carlos Slim, and Nancy Pelosi made significant stock purchases in June.

- While these don't guarantee success, they're certainly an indication of potential for the acquired stocks.

- Using InvestingPro, we delve into the financial health and potential upside for these companies to see if they're good to you as well.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

While big investors and influential people are not immune to making mistakes or suffering losses, they are certainly better informed than most retail investors.

Today, we are going to look at three stocks just bought in the month of June by three relevant people, i.e., legendary Oracle of Omaha Warren Buffett, Carlos Slim (successful businessman and billionaire), and US Congresswomen Nancy Pelosi - one each.

To provide comprehensive insights on these companies, let's use the InvestingPro tool to gather important data and information about these companies and understand whether these stocks are really worth the punt.

1. PBF Energy

Based in New Jersey, PBF Energy (NYSE:PBF) was founded in 2008 and is one of the largest oil refineries and suppliers in the United States.

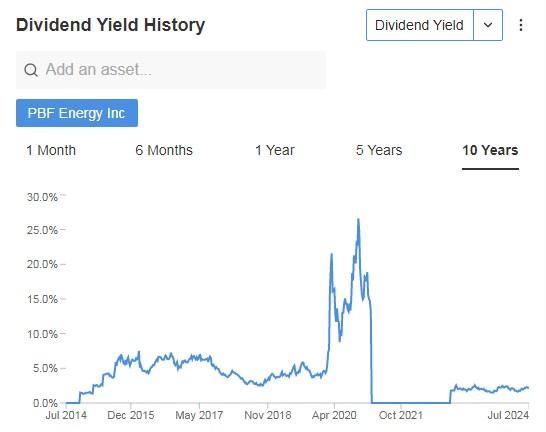

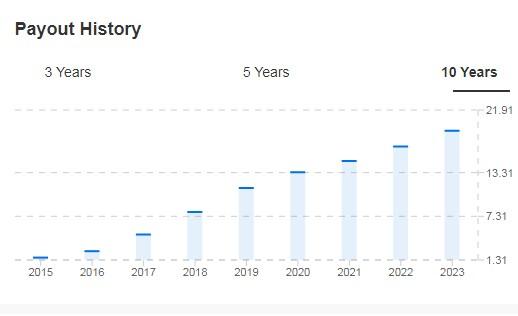

It offers an annualized dividend of $1 per share, resulting in a dividend yield of 2.11%. On May 30, it paid shareholders a quarterly dividend of $0.25 per share and repurchased $125 million in shares.

Source: InvestingPro

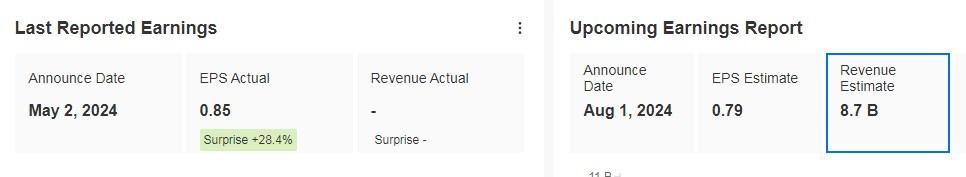

In May, the company announced its PBF Energy Inc (NYSE:PBF), surpassing Wall Street forecasts. Total revenue reached $8.7 billion, exceeding expectations by 3.8%, while earnings per share (EPS) outperformed by 28.4%.

The next earnings report is scheduled for August 1, with expected earnings of $5.67 per share in fiscal 2024.

Source: InvestingPro

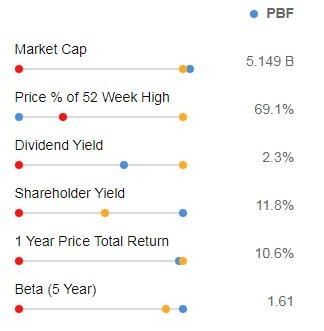

Trading at 7.35 times forward earnings and 0.14 times sales, the stock is priced at a discount compared to its sector peers. At the end of the quarter, the company held approximately $1.4 billion in cash and $1.2 billion in total debt.

Geopolitical tensions abroad could act as a significant catalyst. Any disruptions in refining operations or shipping could advantageously position PBF Energy and other U.S.-based refiners to benefit from increased demand.

Additionally, Carlos Slim's investment firm, Control Empresarial de Capitales, recently invested in PBF Energy, demonstrating confidence in the company. The firm believes that with the AI industry's growing electricity needs, energy companies are poised to benefit. Specifically, Slim increased his stake in the company with purchases totaling over $14 million on June 27 and 28, acquiring shares at prices ranging from $45.066 to $45.7394.

With a beta of 1.61, the stock exhibits higher volatility compared to the market.

Source: InvestingPro

PBF's financial health is also quite strong, with an overall score of 4 out of 5.

Source: InvestingPro

The company has received 12 ratings, of which 3 are "buy," 9 are "hold," and none are "sell." The average price target set by the market is $51.50.

Source: InvestingPro

2. Broadcom

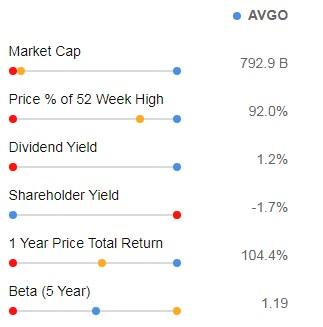

Recently bought by US Congress person Nancy Pelosi, Broadcom (NASDAQ:AVGO) is an American developer and global supplier of a wide range of infrastructure software and semiconductor products, founded in 1961 and headquartered in San Jose, California.

On June 28, it distributed its latest dividend of $5.25 per share, resulting in a dividend yield of 1.23%. The company has increased its dividend for 14 consecutive years, demonstrating a strong commitment to shareholders.

Source: InvestingPro

The company will report its financial results on August 29. Analysts expect it to increase its earnings per share (EPS) by 8.06% and its revenue by 36.53%.

Source: InvestingPro

Broadcom boasts a free cash flow margin of 43%, the second-highest in the semiconductor sector, trailing only NVIDIA (NASDAQ:NVDA).

Despite being the eighth largest company by market capitalization in the S&P 500 index, institutional investor participation in Broadcom is somewhat below the market average.

Recently, Congresswomen Nancy Pelosi purchased options on Broadcom with an exercise price of $800 and an expiration date of June 20, 2025. Additionally, Pelosi bought 10,000 shares of Nvidia stock two days later. Her activity wasn't limited to purchases; she sold 2,500 shares of Tesla (NASDAQ:TSLA) on the same day as the Broadcom transaction and sold 2,000 shares of Visa (NYSE:NYSE:V) on July 1.

Broadcom's beta is 1.19, indicating higher volatility compared to the overall market.

Source: InvestingPro

The company also presents a good financial health status, with a 4 out of 5 score.

Source: InvestingPro

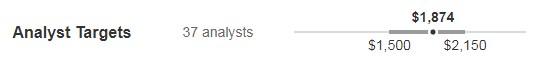

The average target price assigned to it by the market is at $1,874.

Source: InvestingPro

3. Occidental Petroleum

Texas-based Occidental Petroleum Corporation (NYSE:OXY) is an energy company with significant assets in the United States, the Middle East and North Africa.

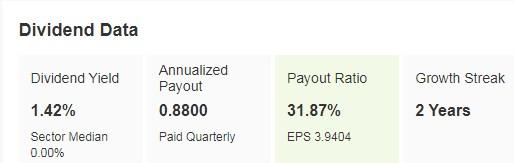

On July 15, it will pay a dividend of $0.22 per share. In annualized terms, the company's dividend is $0.88 per share and yields 1.42%. It has been maintaining dividends for 51 consecutive years.

Source: InvestingPro

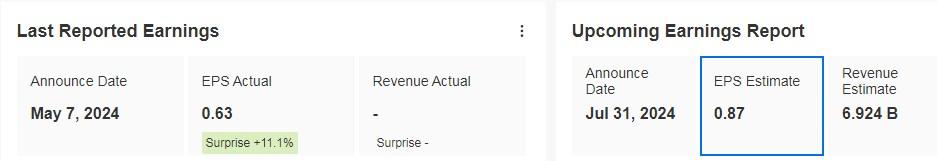

On July 31, the company will report its latest financial results. Previously, it exceeded EPS forecasts by 11.1%. Looking ahead, analysts project earnings to reach $3.88 per share in fiscal 2024, marking a year-over-year increase of 4.9%. Furthermore, earnings are expected to rise by 27.6% to $4.95 per share in fiscal 2025.

Source: InvestingPro

According to his latest 13F filling, Warren Buffett's Berkshire Hathaway (NYSE:BRKb) purchased 1,750,308 shares of the company, totaling $105.5 million over three days (June 10, 11, and 12). This acquisition now represents 4.6% of Buffett's portfolio, increasing his ownership stake in the energy company to nearly 28.5%, making him the largest shareholder by a significant margin.

Recently, OXY strategically expanded its portfolio by acquiring CrownRock, a move expected to enhance free cash flow significantly.

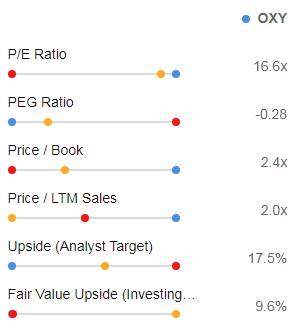

The stock is currently trading at 16.6 times forward earnings, which is below its own five-year average of 31.87 times.

Source: InvestingPro

It features 21 ratings, of which seven are buy, 14 are hold, and none are sell.

The average market price target stands at $72.09.

Source: InvestingPro

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips.

Don't miss this limited-time offer!

Subscribe to InvestingPro today and take your investing game to the next level

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.